From our Ottawa Real estate board:

CONDO NEWS DEC 2019 – OTTAWA, December 4, 2019 – Members of the Ottawa Real Estate Board sold 1,288 residential properties in November through the Board’s Multiple Listing Service® System, compared with 1,161 in November 2018, an increase of 10.9 per cent. November’s sales included 958 in the residential-property class, up 10.5 per cent from a year ago, and 330 in the condominium-property category, an increase of 12.2 per cent from November 2018. The five-year average for November unit sales is 1,133.

“Even with the typical winter slowdown, Ottawa’s home resale market still experienced a relatively brisk pace in November. Our inventory is not having a chance to build as it is being absorbed as quickly as it comes on the market. That’s why there are so many sales every month even though the supply stock is low,” explains Dwight Delahunt, President of the Ottawa Real Estate Board.

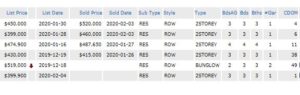

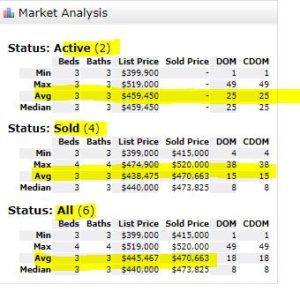

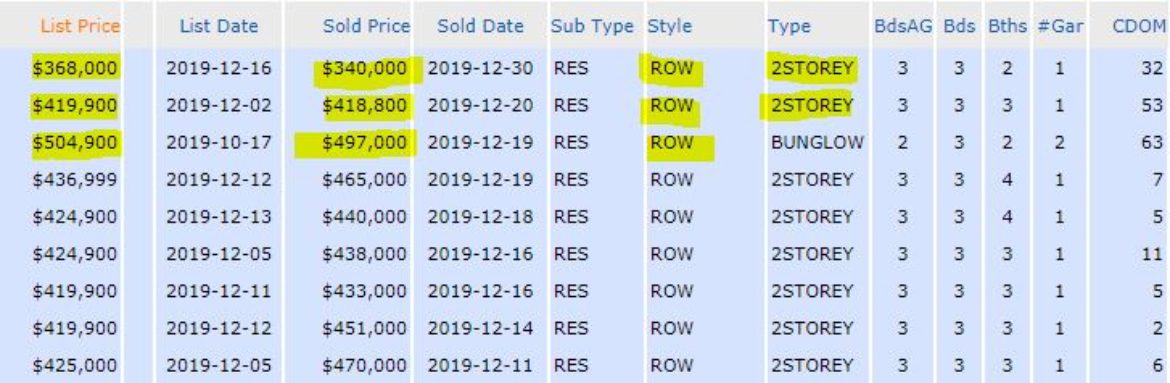

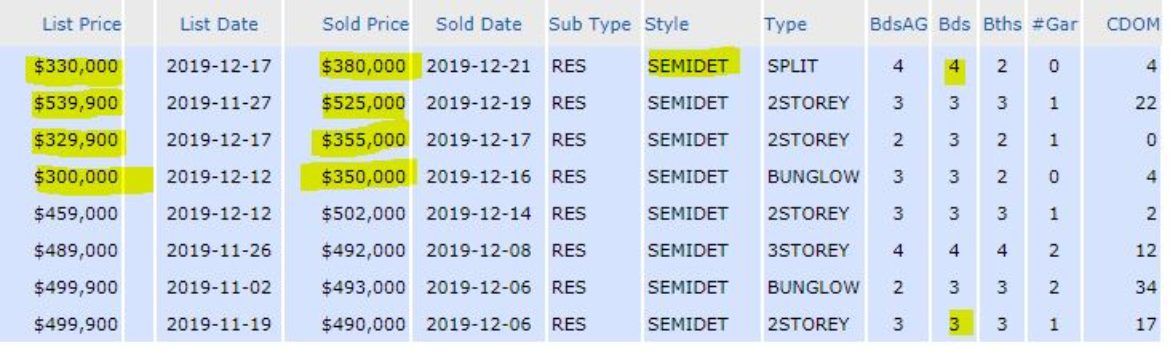

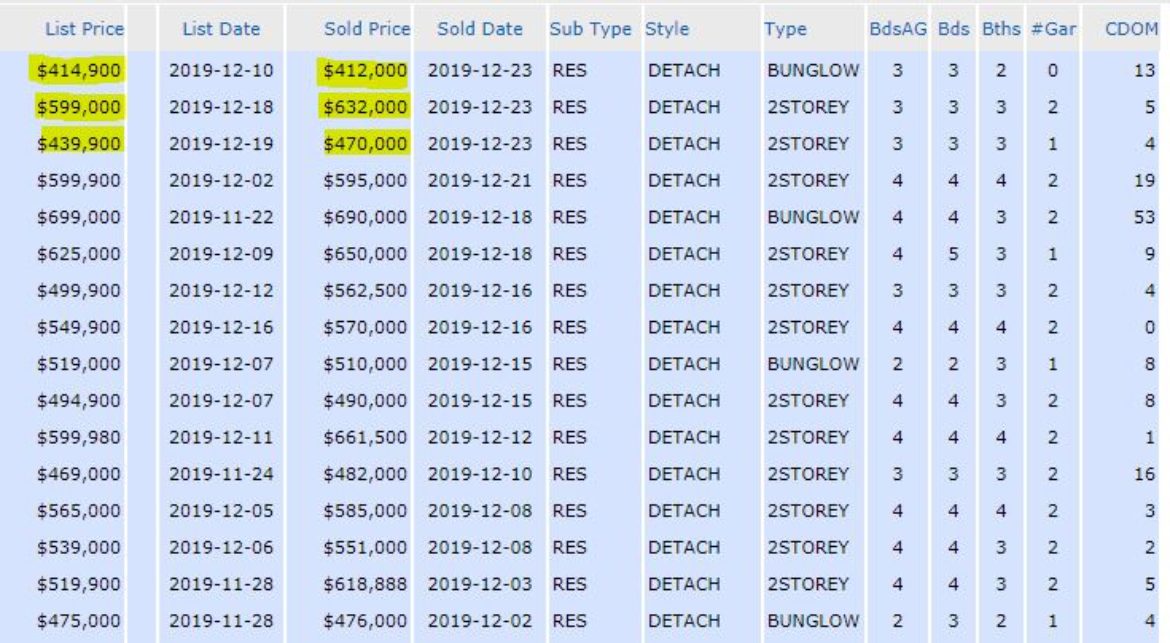

November’s average sale price for a condominium-class property was $313,734, an increase of 9.8 per cent from last year while the average sale price of a residential-class property was $501,201, an increase of 16.9 per cent from a year ago. Year to date figures show an 8.9 per cent and 9.1 per cent increase in average sale prices for residential and condominiums, respectively.*

“Prices have increased, and therefore there is shortage of units available in the lower end price range of both condos and residential properties,” reports Delahunt. “That being said, the Ottawa market still remains strong and

$749,999 range increased to 32 per cent of all residential resales.

“As for the higher end of the market, we are seeing substantial increases in the number of properties sold in those price ranges as well. In the $750K-$1M range, 65 units changed hands last month compared to 24 sales last year at this

time,” reveals Delahunt. “Further, the homes in the $1M+ plus range have increased to 29 sales last month from 15 sold in November 2018.”

“Year to date totals show the larger picture with a 41% increase in the $750K-$1M range from 610 to 861 unit sales, and a 30% increase in the $1M+ range from 266 to 345 transactions compared to this time last year,” he adds.

In addition to residential sales, OREB Members assisted clients with renting 2,559 properties since the beginning of the year.

The Board cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price and conditions will vary from neighbourhood to neighbourhood. sustainable with reasonable increases in year to date average prices of 9% in both the residential and condominium property classes.”

The most active price range in the condominium market was $225,000- $349,999, accounting for 57.5 per cent of the units sold while $350,000 to $499,999 represented the most prevalent price point in the residential market, accounting for 38.8 per cent of November’s transactions.

The Ottawa Real Estate Board is Ottawa’s largest trade association with over 3,150 sales representatives and brokers

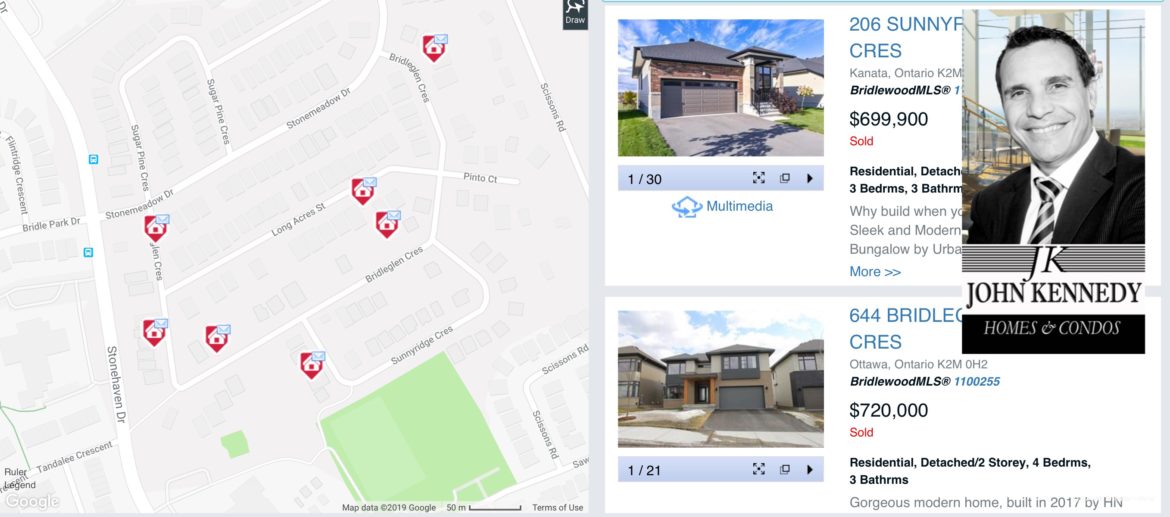

see the details:

Ottawa condos for sale – Ottawa condo prices – Ottawa condo buildings – Ottawa condo mls – ottawa condo rentals – Ottawa condo new developments- ottawa condo agent – Ottawa Downtown Condos