Blog

Tag: <span>KANATA REAL ESTATE NEWS</span>

February 2023 – Resale Market Starts Slow as Buyers Remain Cautious

February 2, 2023

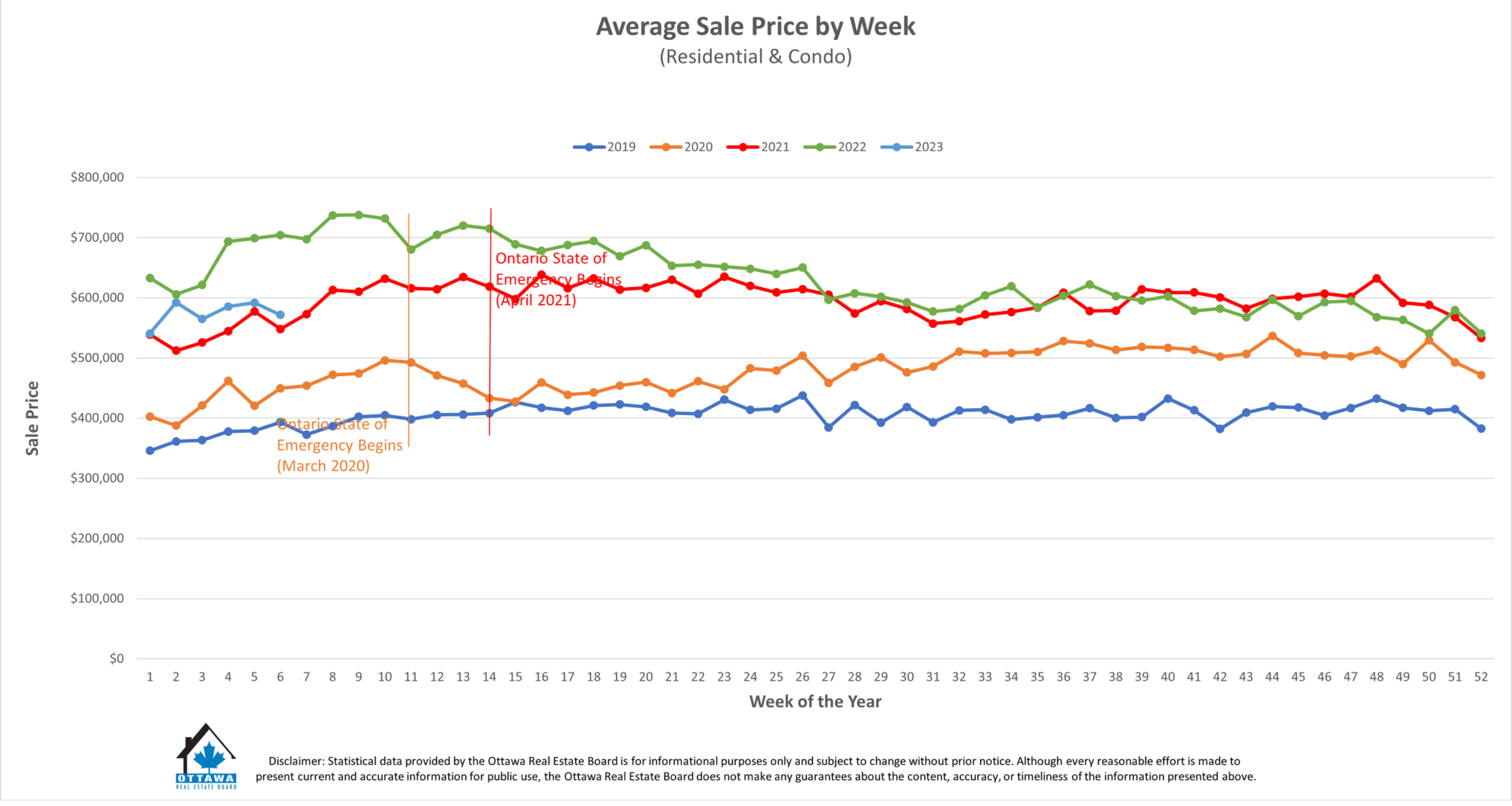

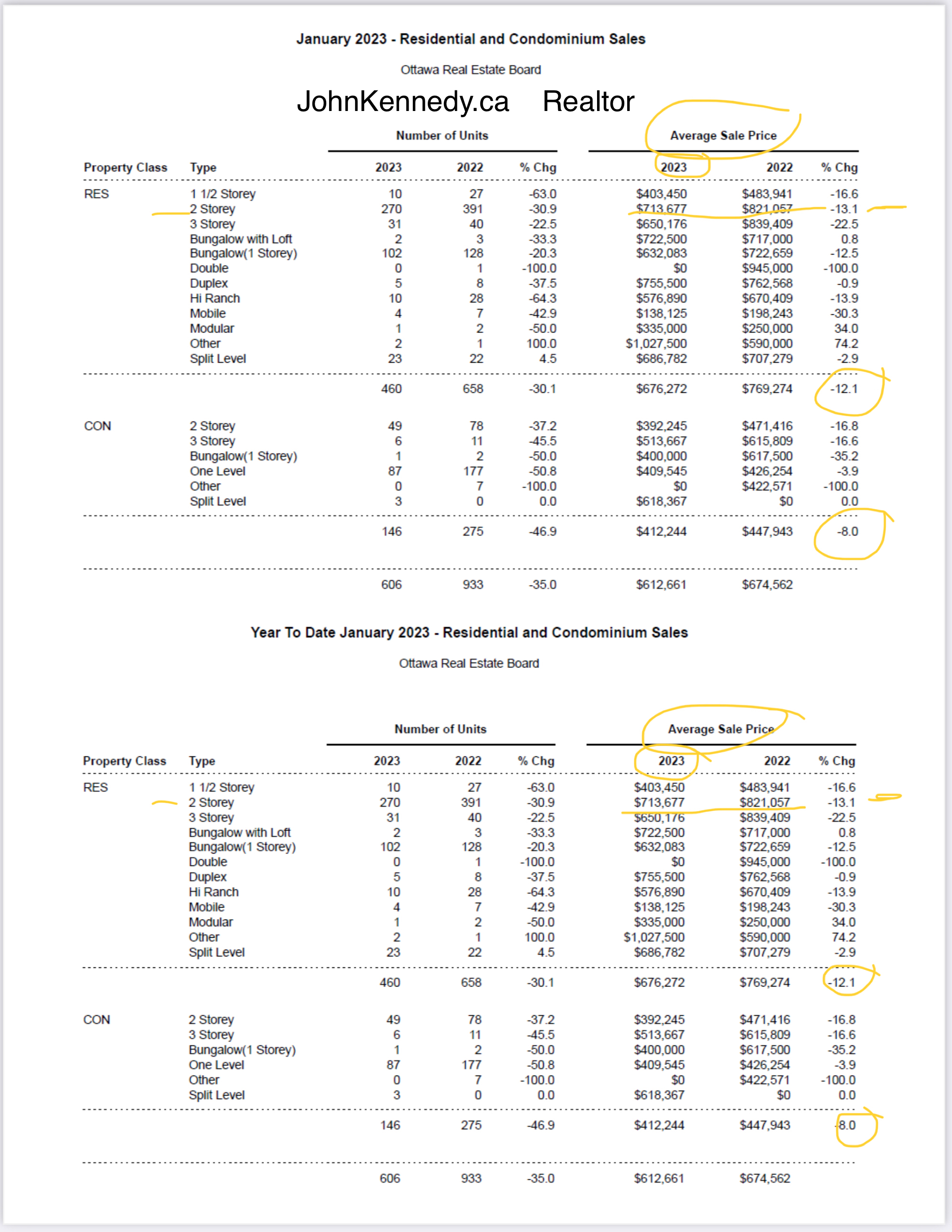

Members of the Ottawa Real Estate Board (OREB) sold 606 residential properties in January through the Board’s Multiple Listing Service® (MLS®) System, compared with 933 in January 2022, a decrease of 35%. January’s sales included 460 in the freehold-property class, down 30% from a year ago, and 146 in the condominium-property category, a decrease of 47% from January 2022. The five-year average for total unit sales in January is 819.

“January’s marked slow down in unit sales over 2022 indicates potential home buyers are taking their time,” says OREB President Ken Dekker. “While last month saw the culmination of the succession of interest rate hikes announced by the Bank of Canada, affordability remains a factor. They may be waiting for a shift in listing prices. They’re being cautious in uncertain conditions.”

By the Numbers – Average Prices*:

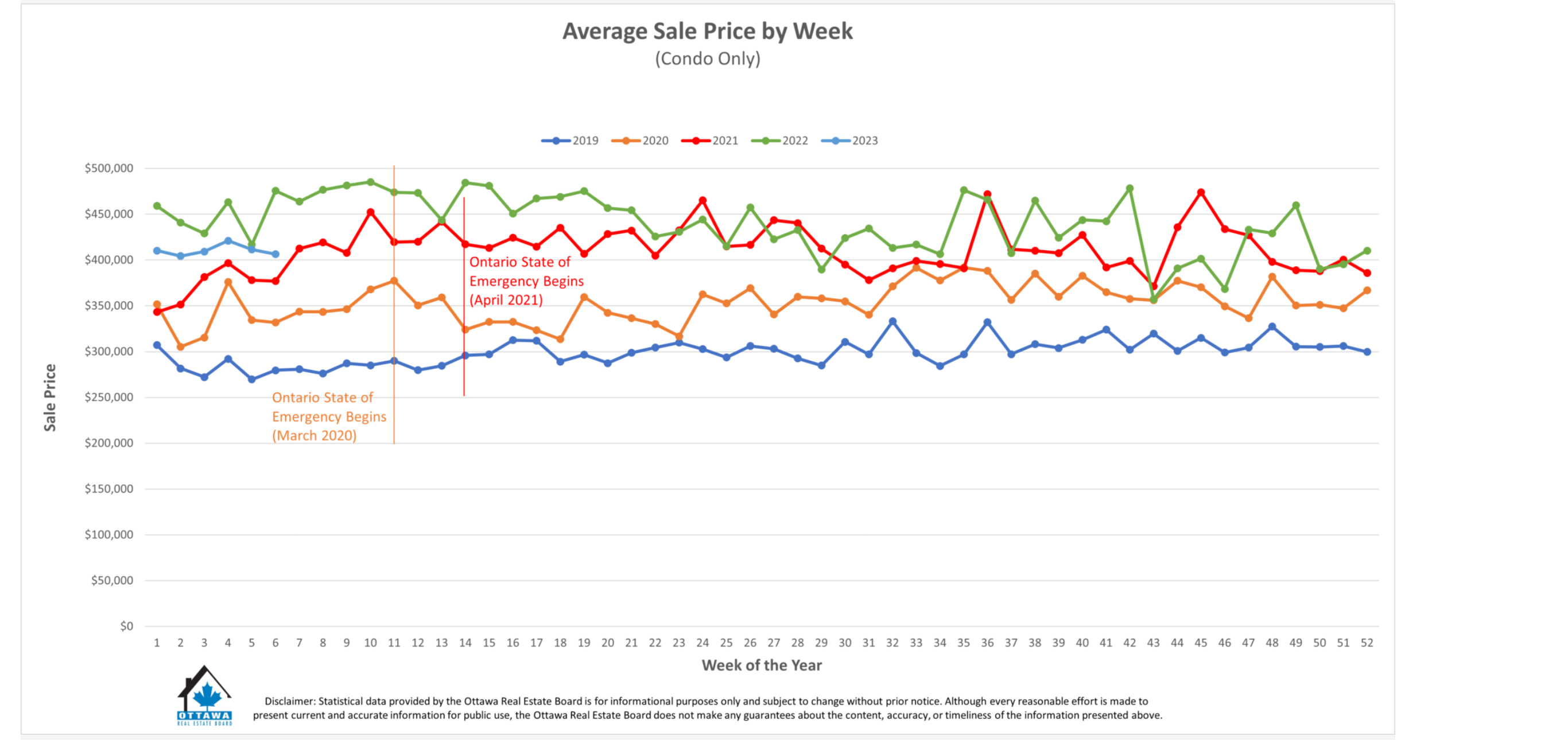

- The average sale price for a condominium-class property in January was $412,244, a decrease of 8% from 2022.

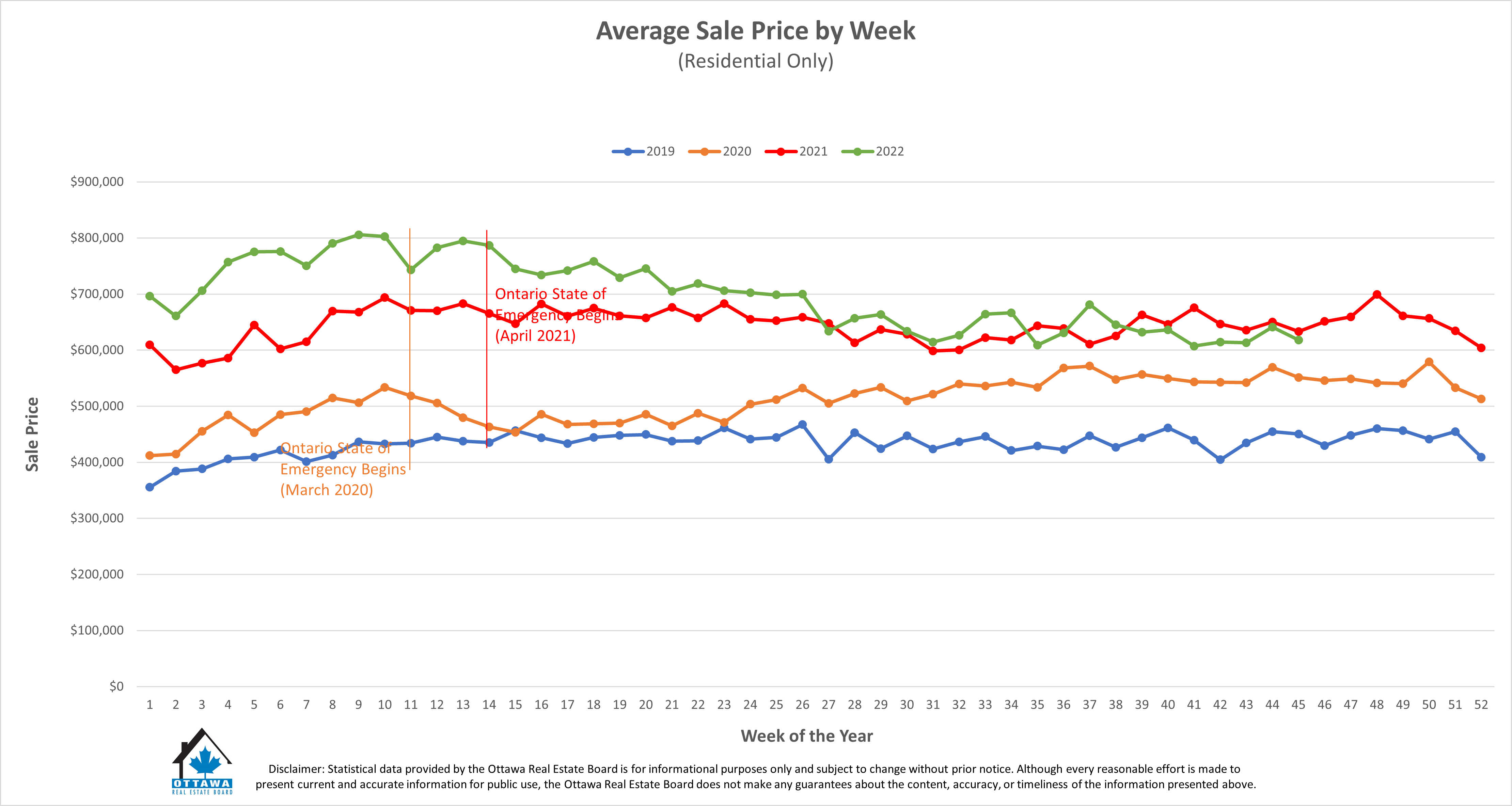

- The average sale price for a freehold-class property was $676,272, decreasing 12% from a year ago.

“Despite the decrease in average prices, the market should not be considered on a downward slide,” says Dekker. “A hyper COVID-19 seller’s market is now leveling out to our current balanced market state.”

“On a positive note, in comparison to December’s figures, January’s average price of freehold properties increased by 3%. The average price of condos did fall by 5% compared to December but condo pricing tends to fluctuate more due to the small data set.”

By the Numbers – Inventory & New Listings:

- Months of Inventory for the freehold-class properties has increased to 3.8 months from 0.9 months in January 2022.

- Months of Inventory for condominium-class properties has increased to 3.8 months from 0.8 months in January 2022.

- January’s new listings (1,324) were 16% higher than 2022 (1,142) and up 89% from December 2022 (699). The 5-year average for new listings in January is 1,233.

“Ottawa’s inventory and days on market figures are typical for a balanced market and another sign that buyers are no longer racing to put in an offer,” says Dekker. “The increase in new listings and supply is a boon for home buyers, who now have more selection and the ability to put in conditions at a less frantic pace. REALTORS® are an essential resource in finding the right property for the right buyer. On the other side of the transaction, REALTORS® can help sellers with hyper-local insights about how to sell in their neighbourhood at a time when pricing is key.”

More people are turning to REALTORS® for help renting properties — 509 this month compared to 410 in January 2022, an increase of 24%. “Even with the increase in housing stock, the tighter rental market is another indication that affordability is keeping some potential buyers on the sidelines.”

* OREB cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price will vary from neighbourhood to neighbourhood.

Market Prices Sold and Changes

2022 AWARD WINNER FOR SALES AND CUSTOMER SATISFACTION

Thank you for your trust and referrals!

STILL WAITING TO BUY YOUR HOME?

Market stats show an +8% increase over 2021. Interest rates are still lower than this year-to-year Ottawa real estate market increase %. That means, there is still profit in the market of about 3-4% yearly for you to make. Ask me to teach you about leveraging and mortgage % when buying a home in Ottawa.

Real Estate news in Ottawa.

With year-to-date average sale prices at $774,422 for residential units and $454,436 for condominiums, these values represent an 8% increase over 2021 for both property classes

Real estate questions in Ottawa. Get the answers: Ottawa real Estate tips.

How does leveraging work in Real estate?

How to leverage to gain profits % when buying a home in Ottawa.

How to make sure your investment funds are insured when buying a home in Ottawa.

Get all the answers. Free consultation.

Taking a closer look at Ottawa home prices for November 2022. Down -4.3%

As we take a closer look at these November 2022 Real Estate prices below and above. We are seeing a 2 storey home selling for less this month. Listing a higher price, but Selling Less. The average price has dropped to (-4.3%) and homes are staying longer on the market.

So let’s look even closer:

Year to date chart: November 2022 to November 2023 prices are UP +8.7% for that same average price on the same home. The way we are seeing things..is that more or less we are entering into a Normal Market +4%to 5% per year increases as per normal before 2015. Everyone at my brokerage thinks, home prices in Ottawa went up too aggressively and now the party is over in Toronto and now in Ottawa!

We don’t think Double digits profit and these aggressive increases per year in the Ottawa Real Estate market is a healthy market.

Lets talk a bit about supply:

New Homes Supply is still very low and will continue to create demand and that means you pay more. See Condos went up 9.3% this month because of affordability and a lack of homes. Over Supply of homes are also not good, and that was the case in the US HOUSING CRASH around 2008 it stalled or crashed most economies including Canada.

Construction and Renovation a difficult permit process.

I would say, we do need to get more homes constructed right now, and building a home should be made much much easier. But it seems today you need a University Degree to deal with the building departments for the Construction of a family home. Apparently my grandfather grade 8 education is no good in our times. With his hand drawings or ruler and pencil wouldn’t work today to get a permit and he constructed 100s of homes as a carpenter, and he had 9 children all educated and fed well. Some people can only afford 1 child. What is wrong with our system in 2022? It simply broken with greed and we are seeing life keeps getting more expensive, harder and more controls placed upon us. It’s impossible building a home or renovation for an apartment in your basement, or building a sons home at the back on your 5 acre land . Our permit system is designed to stop us from building homes. All construction approval is controlled by a few, just like oil.

Conclusion: How about if the city would design 5-10 home models (standard family homes) for you to chose from, free of charge and ready to go, engineered stamped and approved drawings, with all technical drawing stamped for insurance. All designed and Ready for a person to build his/her home on a piece of land. Wouldn’t that be cheaper for the citizen and our kids to build a home? Wouldn’t that ready to go models stop all this red tape, delays, paperwork dance, back and forth approval drawings, months of planning? Just my thoughts on helping people get a home faster! I also think the government should be more involved in the home building for its citizens in 2022 as many developing countries do and since we all now know we have a supply problem.

Did you know: In the last 10 years Builders were only releasing to build a few homes at a time, and selling them in an Auction Sales day Now!! 10 homes for a 100 buyer and you bid. First release Sales day! Prices will continue to climb aggressively if we don’t address these lack of new home supply issues soon. That’s just my thoughts.

Have a super month and remember investing in a property is always a good investment. Ask your parents what they paid for a home and see the future prices unfold.

Investment and opportunity

Let me help you to Build family Wealth in Real Estate. Join me one evening and let me show you where to invest in Real Estate for a wealthier family future.

Contact me anytime,

John

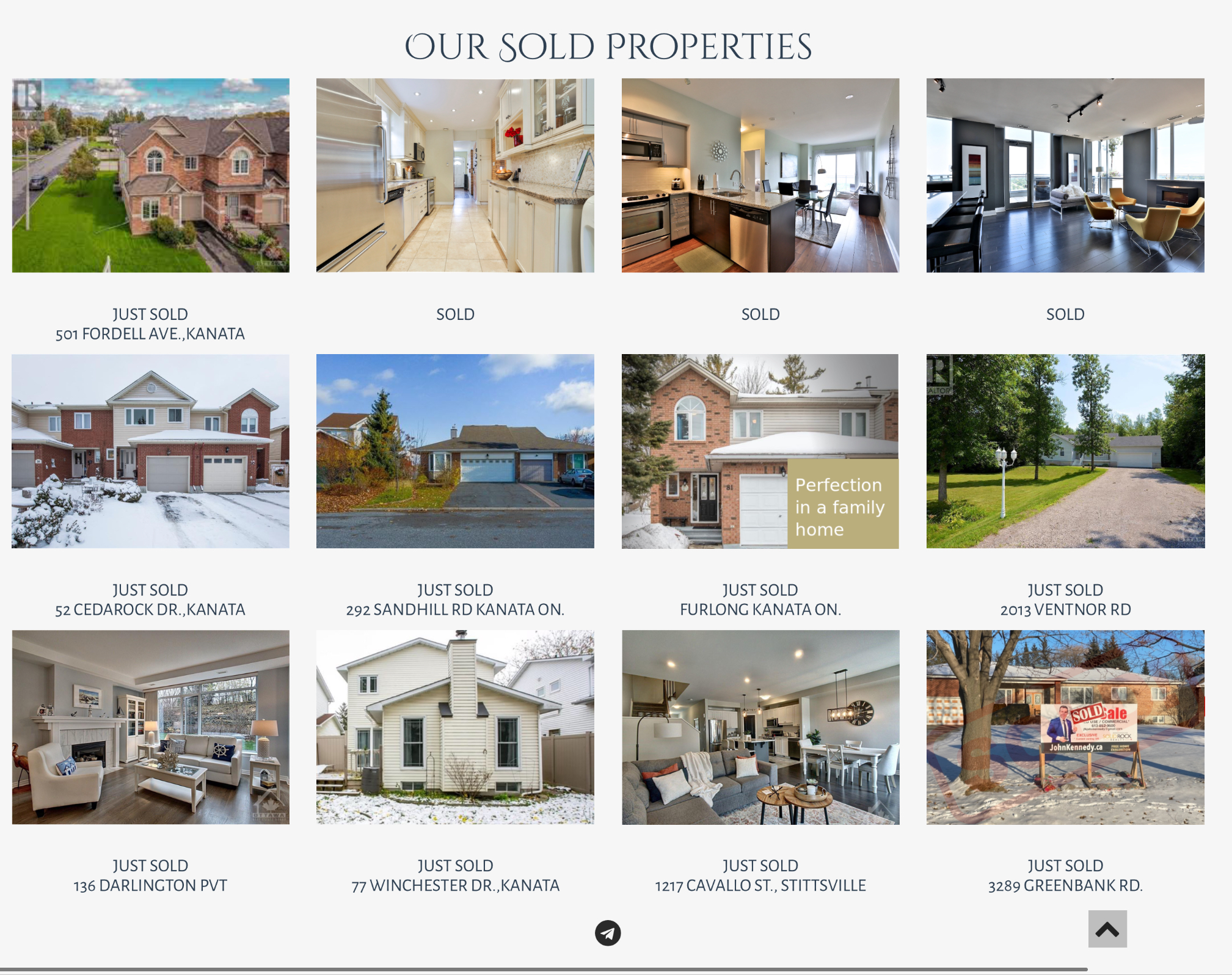

Just Sold

#barrhavenhomesforsale

#kanatahomesforsale

#ottawahomesforsale

#2022homepricesottawa

HOMES-FOR-SALE-OTTAWA – KANATA-HOMES-KANATA-OTTAWA HOMES FOR SALE – OTTAWA HOME PRICES SEPTEMBER 2022- OTTAWA CONDOS FOR SALE SEPTEMBER 2022 – LATEST OTTAWA REAL ESTATE NEWS.

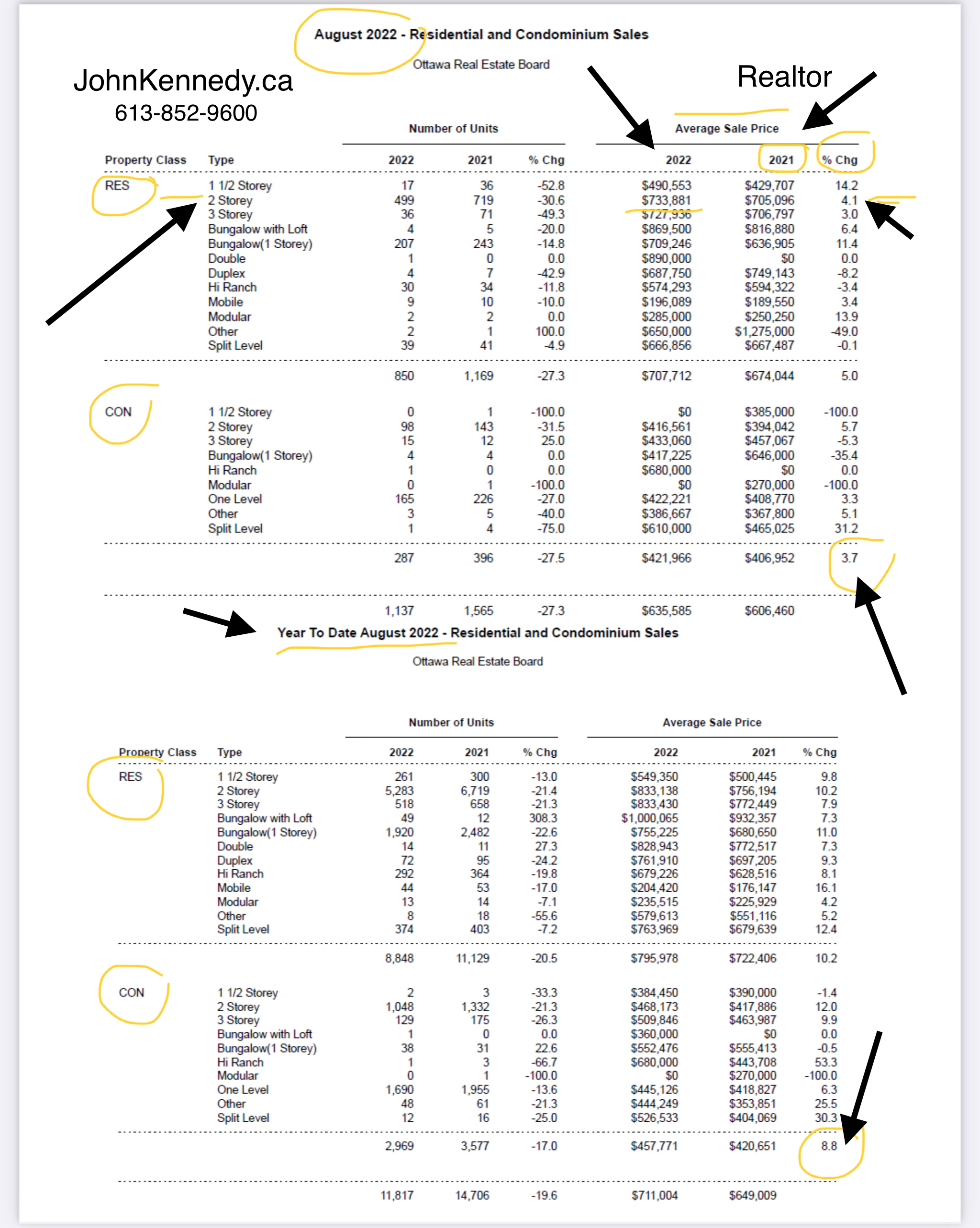

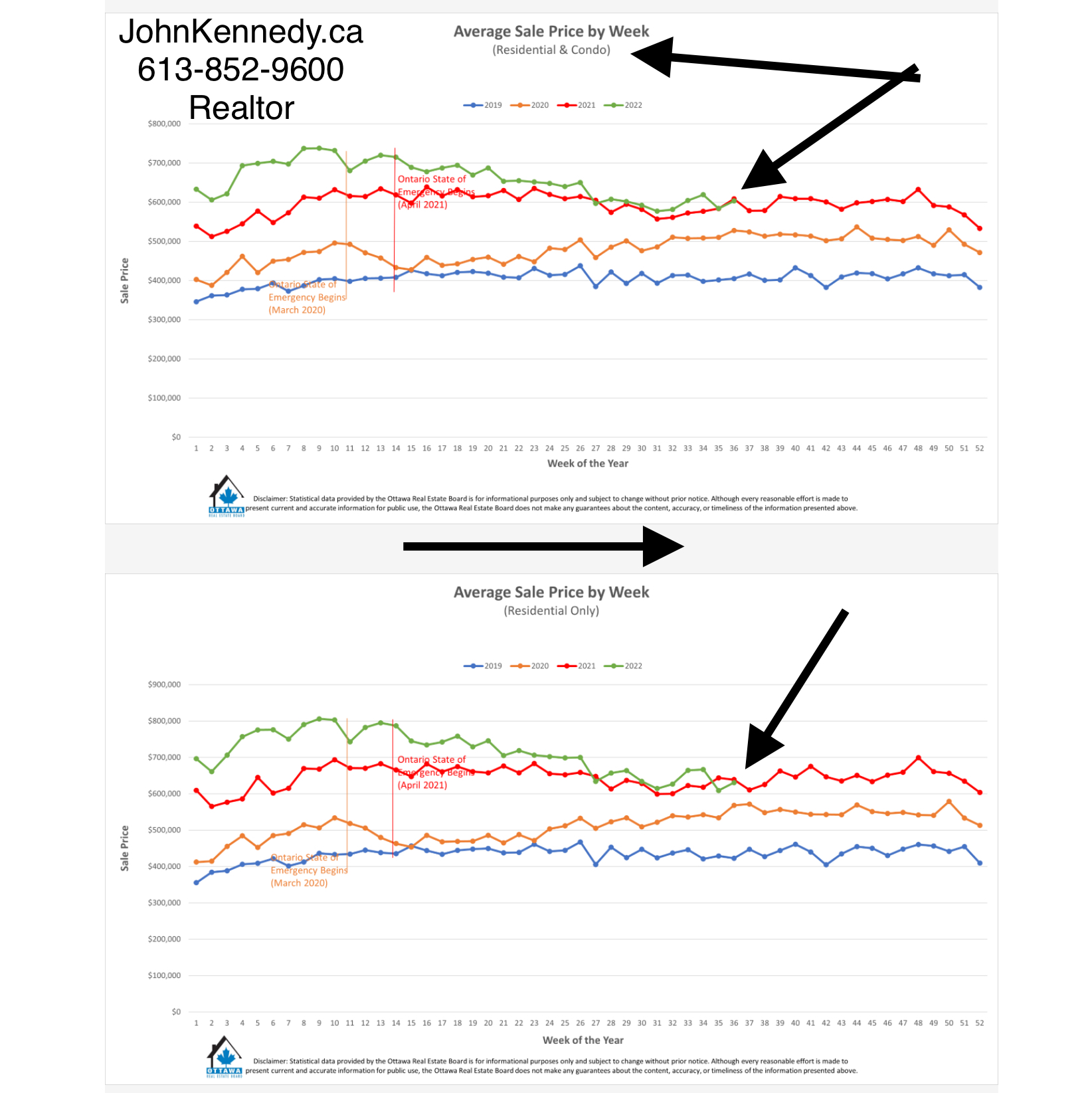

Buyer Uncertainty Slows Down August Resale numbers.

But Prices are still up in Residential homes 10.2% and Condominium 8.8% from last year August .

September 6, 2022, Update from the Ottawa Real Estate Board.

September 6, 2022

Members of the Ottawa Real Estate Board sold 1,137 residential properties in August through the Board’s Multiple Listing Service® System, compared with 1,565 in August 2021, a decrease of 27 per cent. August’s sales included 850 in the residential-property class, down 27 per cent from a year ago, and 287 in the condominium-property category, a decrease of 28 per cent from August 2021. The five-year average for total unit sales in August is 1,603.

“August is a traditionally slower month in Ottawa’s resale market ebb and flow cycle due to summer vacations. Compounding the slowdown in market activity, Buyers are uncertain about their purchasing power given impending additional interest rate hikes,” states Ottawa Real Estate Board President Penny Torontow.

“The lightning speed at which homes were selling at the start of 2022 is a thing of the past, evidenced by Days on Market (DOMs) inching closer to that 30-day mark. We have also observed a return to standard financing and inspection conditions and fewer multiple offer scenarios,” she adds.

Additional figures:

- The average sale price for a condominium-class property in August was $421,966, an increase of 4 per cent from 2021.

- The average sale price for a residential-class property was $707,712, increasing 5 per cent from a year ago.

- With year-to-date average sale prices at $795,978 for residential and $457,771 for condominiums, these values represent a 10 per cent and 9 percent increase over 2021, respectively.*

- 2,093 properties were listed in August, boosting inventory to nearly 3 months for residential class properties and 2.2 months for condominiums.

“Prices are still rising slightly in some areas, albeit lower single-digit percentage increases, bringing back the moderate price-growth stability that is characteristic of the Ottawa resale market. What happened to prices in 2020 and 2021 was unusual. We are moving towards a balanced market state, where Buyers have choices and Sellers need to ensure they are pricing their properties accurately,” Torontow advises.

“The informed market knowledge and insight of a licensed REALTOR® is critical to both Buyers and Sellers navigating market shifts. Sellers will want to closely explore with their REALTOR® the best time and price to list their home to optimize a property’s days on market. Buyers can use the extra time to work with their REALTOR® on due diligence and finding a dream home that meets their needs within their financial parameters.”

REALTORS® also help with finding rentals and vetting potential tenants. Since the beginning of the year, OREB Members have assisted clients with renting 4,172 properties compared to 3,182 last year at this time.

* OREB cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price will vary from neighbourhood to neighbourhood.

source OREB.

HOMES-FOR-SALE-OTTAWA – KANATA-HOMES-KANATA-OTTAWA HOMES FOR SALE – OTTAWA HOME PRICES FEBRUARY 2022- OTTAWA CONDOS FOR SALE 2022 – LATEST OTTAWA REAL ESTATE NEWS.

JUST SOLD

HOW MUST IS MY HOME WORTH?

AVERAGE MOVING PRICE SEPTEMBER 2022

JUST SOLD

HOW MUST IS MY HOME WORTH?

OTTAWA AVERAGE PRICES FROM SEPTEMBER 2022

OTTAWA AVERAGE PRICES FROM SEPTEMBER 2022

RECEIVE FREE PROFESSIONAL ADVICE BEFORE YOU BUY OR SELL.

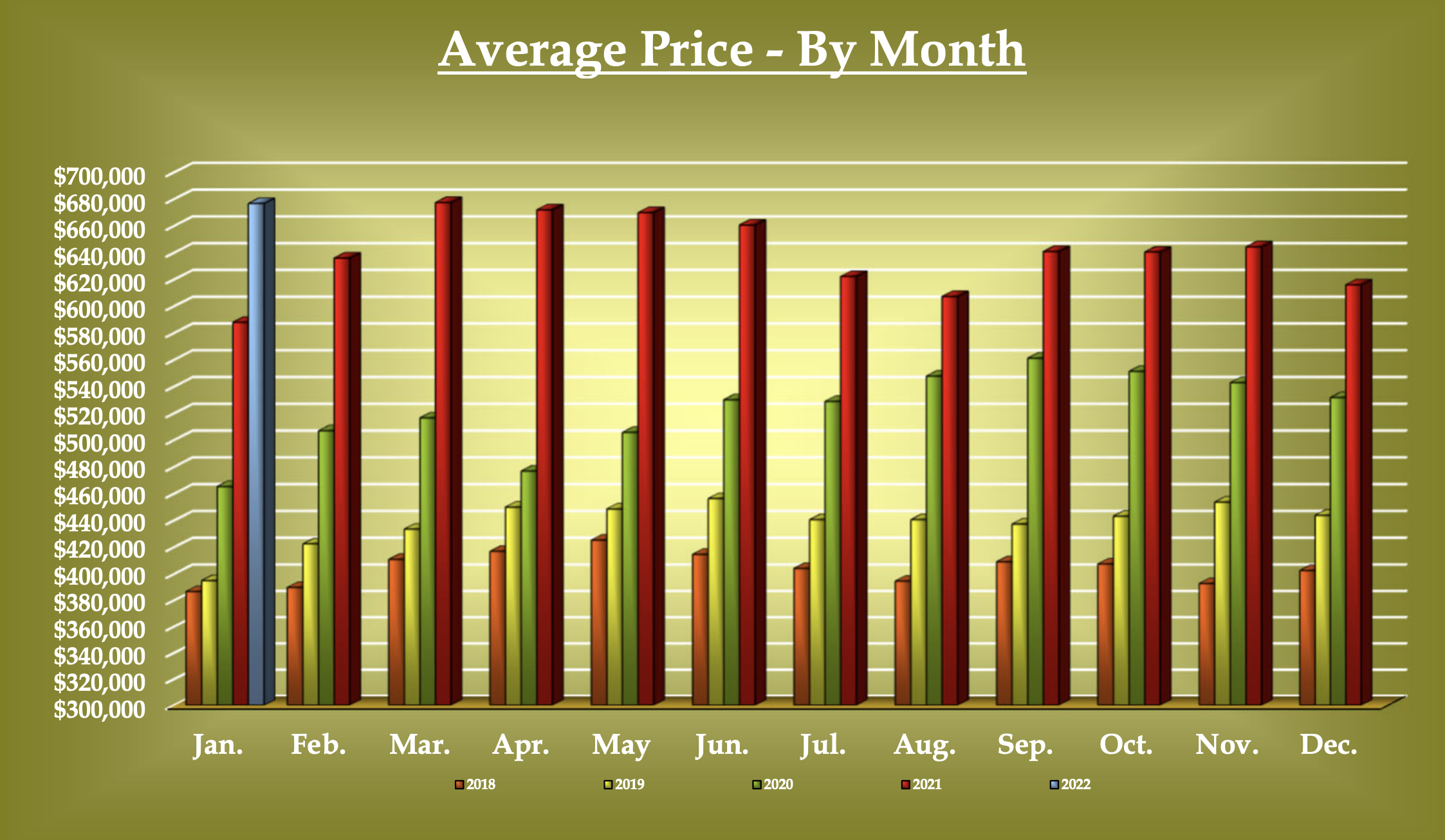

AVERAGE PRICE CHANGES BY MONTH

HOMES-FOR-SALE-OTTAWA – KANATA-HOMES-KANATA-OTTAWA HOMES FOR SALE – OTTAWA HOME PRICES FEBRUARY 2022- OTTAWA CONDOS FOR SALE FEBRUARY 2022 – LATEST OTTAWA REAL ESTATE NEWS.

JOIN MY NEWSLETTER

WHAT WE DO FOR OUR CLIENTS – 13 OFFERS – SOLD IN 7 DAYS

HOW MUST IS MY HOME WORTH?

HOMES-FOR-SALE-OTTAWA – KANATA-HOMES-KANATA-OTTAWA HOMES FOR SALE – OTTAWA HOME PRICES FEBRUARY 2022- OTTAWA CONDOS FOR SALE FEBRUARY 2022 – LATEST OTTAWA REAL ESTATE NEWS.

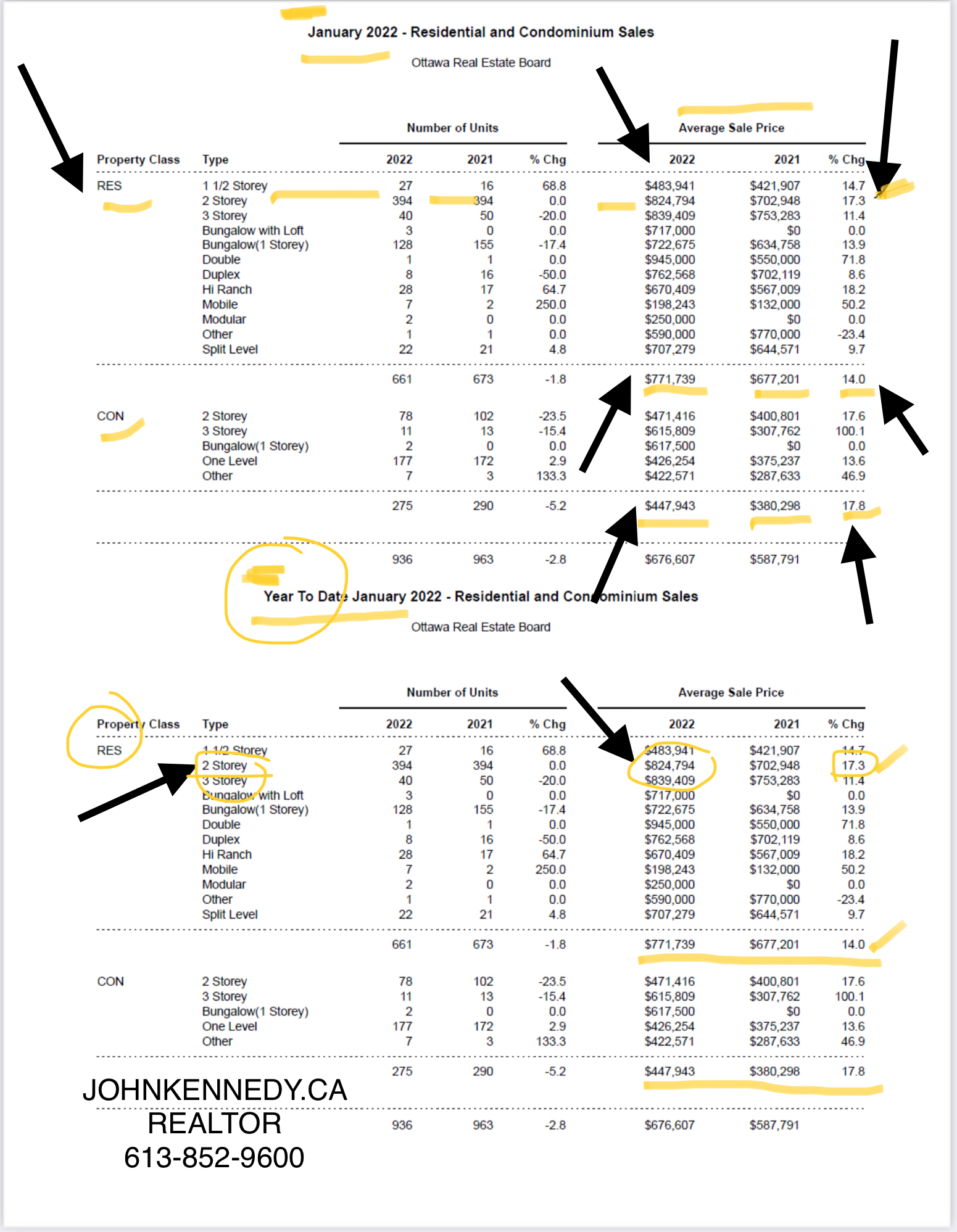

February 2022 – OTTAWA REAL ESTATE PRICES UP +17.8%

The Members of the Ottawa Real Estate Board sold 936 residential properties in January through the Board’s Multiple Listing Service® System, compared with 963 in January 2021, a decrease of 3 per cent. January’s sales included 661 in the residential-property class, down 2 per cent from a year ago, and 275 in the condominium-property category, a decrease of 5 per cent from January 2021. The five-year average for total unit sales in January is 840.

“January’s sales, almost identical to 2021’s, were very strong for a traditionally slower month, especially given the frigid temperatures and increased government Covid-19 restrictions we experienced,” states Ottawa Real Estate Board President Penny Torontow. “This increased activity compared to previous years is not solely a pandemic phenomenon. Yes, the pandemic has accelerated market activity in some ways, but pent-up Buyer demand due to the housing supply shortage has been an ongoing fundamental issue for the Ottawa resale market for well over 5 years now – and the price increases will continue to reflect that until the housing stock grows.”

The average sale price for a condominium-class property in January was $447,943, an increase of 18 per cent from 2021, while the average sale price for a residential-class property was $771,739, increasing 14 per cent from a year ago.*

“Average prices continue to rise steadily with the lack of inventory pushing prices to levels previously unseen. We only need to observe the number of homes now selling over $1M for a clear demonstration. In 2020, they represented 3% of residential sales, in 2021, they held 9% of the market’s resales, and now in 2022, that number reflects close to 14% of detached home sales.”

“Meanwhile, the residential-class properties selling within the $650-$900K range represent 47% of all of January’s residential unit sales. In 2021, it was 33%. But we must keep in mind, average prices statistics amalgamate data from the entire city, so while in some areas the increases would be less, other pockets of Ottawa may see more,” advises Torontow.

“The condo market is also flourishing both in number of sales and prices. Possibly due to the fact that residential units may be out of reach for some Buyers, they are finding themselves more open to this option and are actually able to find a condominium-class property within their budget.”

“Bad weather, pandemic lockdowns, it doesn’t matter – Ottawa remains a fast-moving, active, and robust market. So, if you are thinking of selling your property, there has never been a better time. Contact a REALTOR® who can explain the various factors that will help you get the best price for your home today.” In addition to residential sales, OREB Members assisted clients with renting 410 properties in January 2022 compared to 333 in 2021.

* OREB cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price will vary from neighbourhood to neighbourhood.

source OREB.

HOMES-FOR-SALE-OTTAWA – KANATA-HOMES-KANATA-OTTAWA HOMES FOR SALE – OTTAWA HOME PRICES FEBRUARY 2022- OTTAWA CONDOS FOR SALE 2022 – LATEST OTTAWA REAL ESTATE NEWS.

JUST SOLD

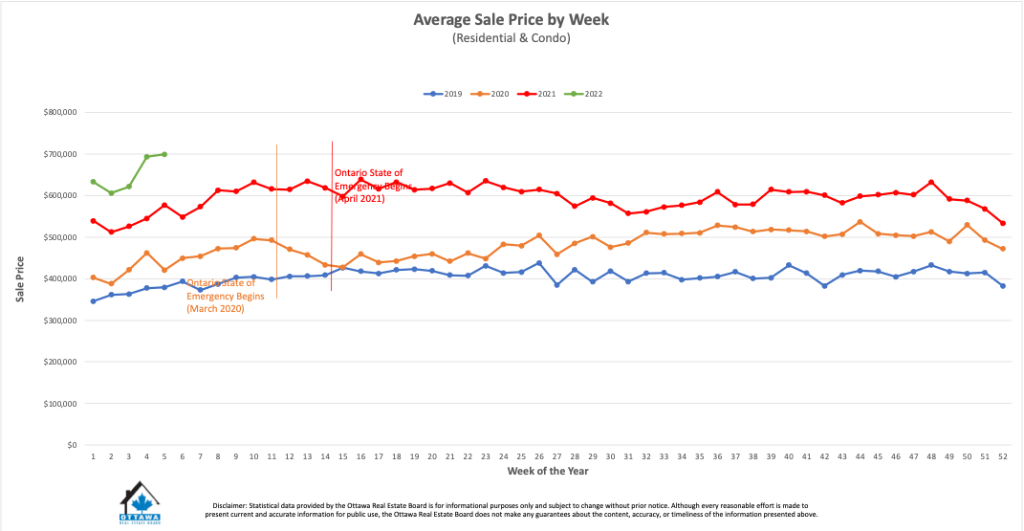

AVERAGE MOVING PRICE FEB 2022

JUST SOLD

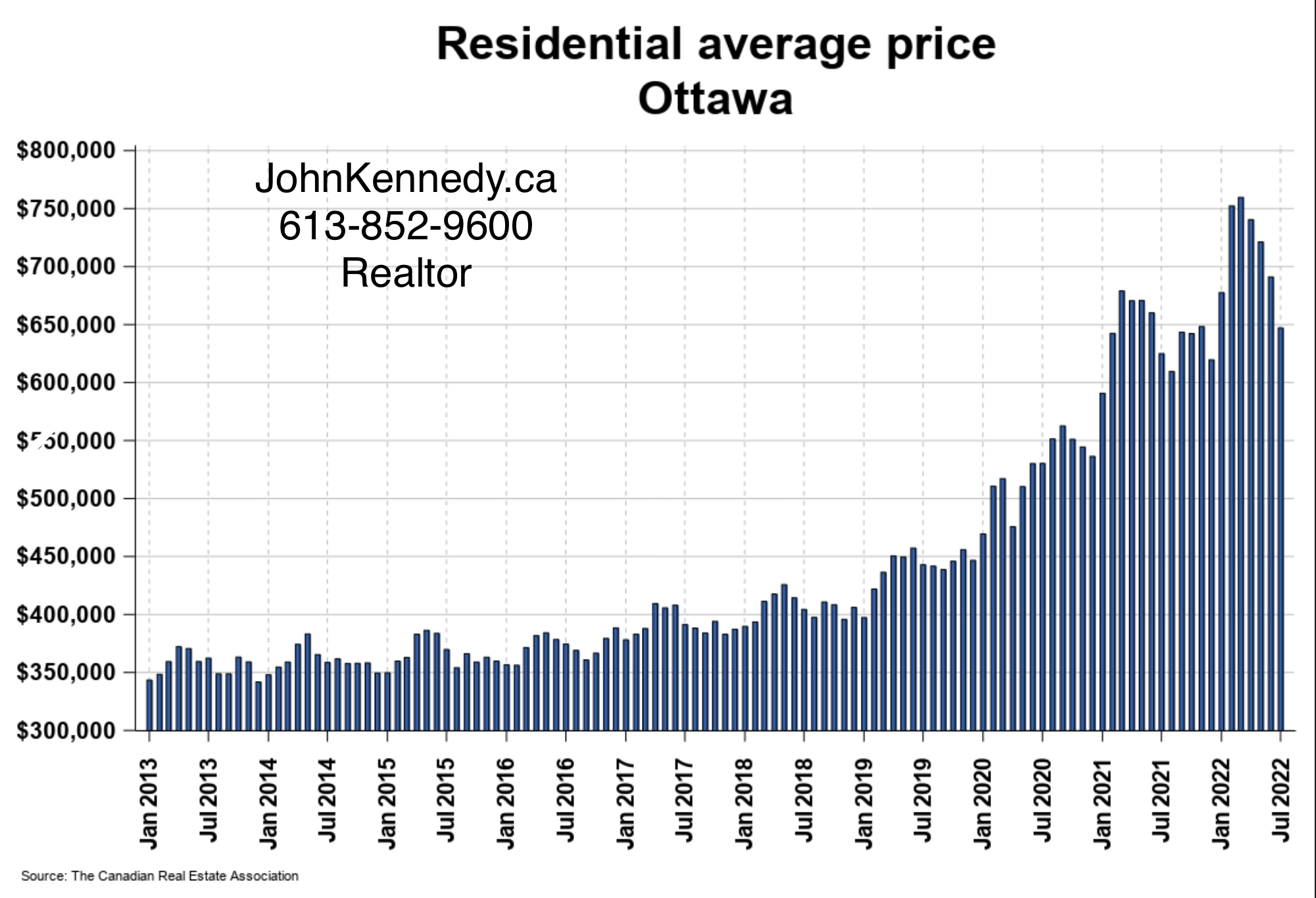

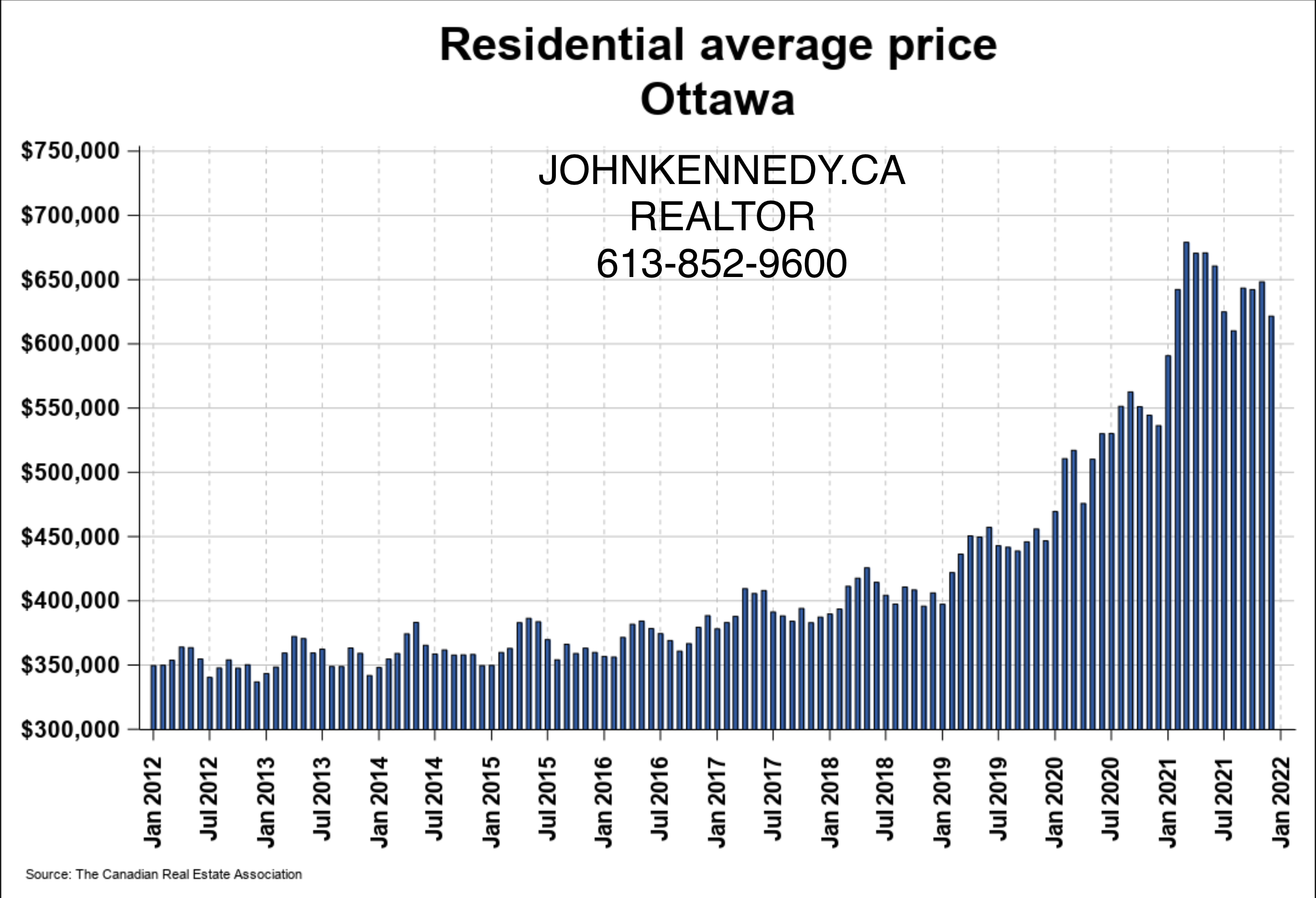

OTTAWA AVERAGE PRICES FROM JAN 2012 TO FEB 2022

OTTAWA AVERAGE PRICES FROM JAN 2012 TO FEB 2022

RECEIVE FREE PROFESSIONAL ADVICE BEFORE YOU BUY OR SELL.

AVERAGE PRICE CHANGES BY MONTH

HOMES-FOR-SALE-OTTAWA – KANATA-HOMES-KANATA-OTTAWA HOMES FOR SALE – OTTAWA HOME PRICES FEBRUARY 2022- OTTAWA CONDOS FOR SALE FEBRUARY 2022 – LATEST OTTAWA REAL ESTATE NEWS.

JOIN MY NEWSLETTER

WHAT WE DO FOR OUR CLIENTS – 13 OFFERS – SOLD IN 7 DAYS

The Market- knowing when to sell.

The Canadian Real Estate Market – Prices are still up.

OTTAWA, August 5, 2021 – Members of the Ottawa Real Estate Board sold 1,724 residential properties in July through the Board’s Multiple Listing Service® System, compared with 2,183 in July 2020, a decrease of 21 per cent. July’s sales included 1,312 in the residential-property class, down 20 per cent from a year ago, and 412 in the condominium-property category, a decrease of 24 per cent from July 2020. The five-year average for total unit sales in July is 1,775. “July’s unit sales followed the traditional cycle of the spring and summer markets, which tend to peak around April or May and then slow down as Buyers and Sellers turn their attention to their vacations and other outdoor recreational activities,” states Ottawa Real Estate Board President Debra Wright. “This year’s figure is closer to 2019’s (1,838 sales) and just shy of the 5-year average, with the slight decline in transactions perhaps due to the combination of summer and the reopening of the economy last month. Certainly, the marked decrease from last year’s July sales is due to the spring 2020 lockdown, which had shifted the 2020 resale market’s peak to the summer and fall months,” she adds. July’s average sale price for a condominiumclass property was $419,545, an increase of 17 per cent from last year, while the average sale price for a residentialclass property was $685,426, also an increase of 17 per cent from a year ago. With year-to-date average sale prices at $728,107 for residential and $422,339 for condominiums, these values represent a 30 per cent and 20 percent increase over 2020, respectively.* “Following the same trend as sales, the month-to-month average prices decreased marginally by 4-6% compared to June; however, this minor dip is consistent to what typically happens during the summer months. Overall, average prices have increased considerably from 2020, and year-to-date values are holding steady. Still, Sellers will need to keep in mind that the multiple offer frenzy experienced previously is no longer the norm, and they may need to have more realistic expectations when positioning their homes and settling on a listing price with their REALTORS®.” “We are seeing the housing stock increasing with residential inventory up 19% and condominium supply 23% higher than 2020. Although there were 700 fewer listings than in June, the number of properties that entered the market in July is over the fiveyear average by approximately 114 units. Along with the price stabilizations, we hope this may indicate that Ottawa’s resale market is moving towards a more balanced state, which would be good for everyone,” suggests Wright. “Established in 1921, on July 9th, the Ottawa Real Estate Board commemorated 100 years of helping our neighbours, friends, and fellow residents buy and sell their homes, cottages and investment properties. Over the past century, our Board has advocated for affordable and attainable homes, as well as a range of housing options for seniors, first-time homebuyers and everyone in between. We pledge to continue this endeavour for our future clients in the years to come. On behalf of the Ottawa Real Estate Board and our 3,500 REALTOR® Members, I would like to extend my heartfelt gratitude to all of you who have put your trust in us to help you make your real estate dreams come true. We hope to continue to serve our communities for the next 100 years and beyond.” OREB Members also assisted clients with renting 2,706 properties since the beginning of the year compared to 1,883 at this time last year. * OREB cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price will vary from neighborhoods’.

Call me today for a FREE MARKET EVALUATION OF YOUR PROPERTY.

Kanata Homes for Sale – March 13, 2021

-

The Question this week in Kanata real estate – Ottawa real estate.

-

How can I make a lot of money in real estate?

I received this question just the other day, and really got taken by it. Yes I had the answer, but never really put it into these words. My simple answer to this young man was “ Start buying real estate early” you need to get into the market and stay in it. That way you learn and earn as you go.

-

The money trick to Real Estate “ How can I make a lot of money in real estate.. Answer is simple : (Time = value in Real Estate.) Kanata Real Estate and Ottawa Real Estate are now seeing +31% yearly since Feb 2021. I don’t think anyone can save such funds with a job, savings in a bank vs as in a property.

-

So if you are looking at buying a home, or a condo, or thinking of starting to invest in rental properties, in KANATA or OTTAWA real estate market. You should sit with me, so we can go over your options available.

-

My free 30 minutes advise session will give you the answers and will included a Free pdf booklet:

-

Step by step “Buying your first home” in Kanata or Ottawa.

-

10 steps you should follow when investing in Real Estate and plan to retire at 55.

-

Step by step real estate investment guide.

-

Real estate getting started “ leveraging” and why this works.

-

No fees for buyers !

-

Have more questions in Kanata Real Estate or Ottawa Real Estate shoot me an email.

-

Your local Kanata and Ottawa homes for sale expert.

-

As Always: here to help, always talking Real estate, always loving real estate.

HOMES WITH 4 BEDROOMS SOLD PRICES IN KANATA TODAY

Source OREB

Kanata Homes for Sale

REQUEST A FREE HOME EVALUATION