SOLD

Are you thinking of buying a newer home?

How about a home for one of our Ottawa builders.

Contact me for all builders, deals, discounts and free upgrades…. JUST SOLD

We get our clients more.

Now is the time…the time to start looking at buying before Spring 2025. Rates are going down faster than expected, and variable rates are making it happen for most buyers. Some buyers will get 30 year to pay off their mortgage come December we are told. The news says, that rates are going to keep dropping , but when this happened last few years back… the market became more expensive and prices went up drastically.

Oct 2024 Report – Please feel free to reach-out should you have any questions.

PLAY – full video report

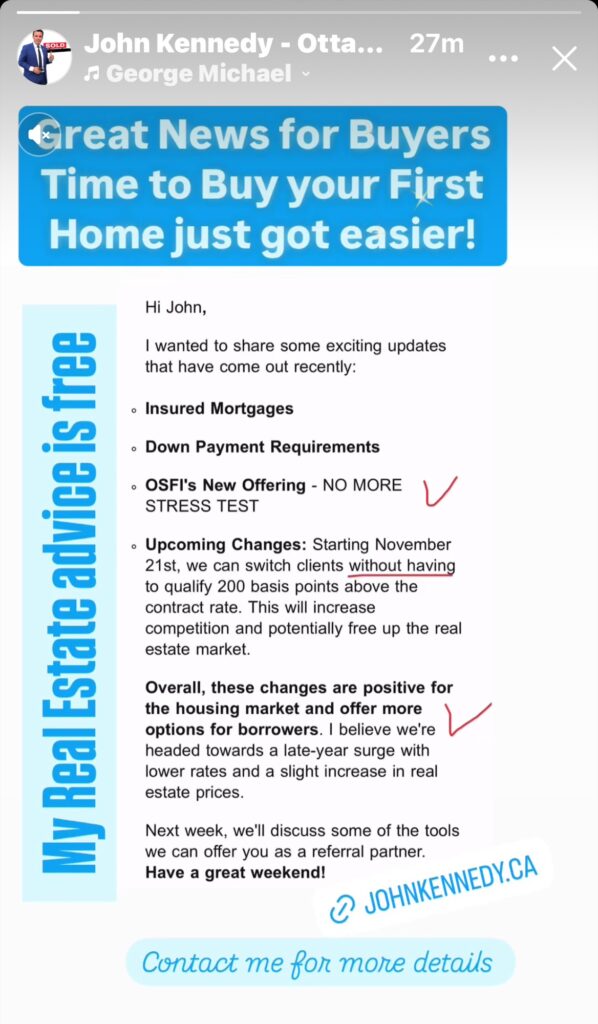

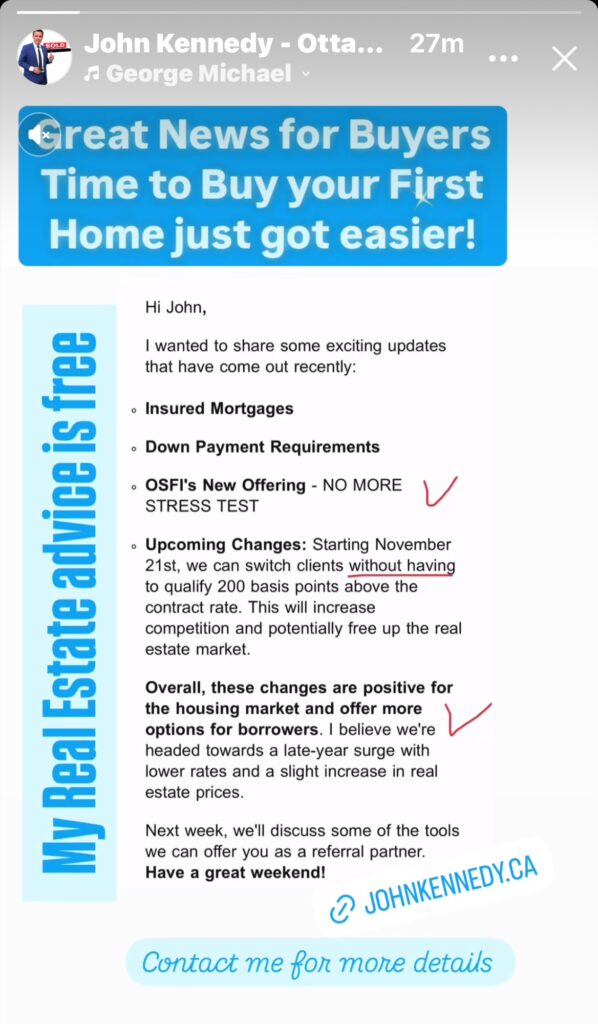

Hi John,

I wanted to share some exciting updates that have come out recently:

Overall, these changes are positive for the Ottawa and Kanata housing market and offer more options for borrowers. I believe we’re headed towards a late-year surge with lower rates and a slight increase in real estate prices.

Want to learn more and start looking at getting your first home?

Contact me:

No fees for buyers

Homes for sale in Ottawa

Homes for sale in Kanata

LET ME SHOW YOU A “FREE HOME EVALUATION” SIMILAR TO THIS – ESTIMATING THE PROPER VALUE OF A PROPERTY ON IRIS ST. OTTAWA

Example only:

HOME PRICES ON IRIS ST. OTTAWA

| Address | Sold Price | Sold Date | Style | Type | BdsAG | Bds | Bths | #Gar |

| 2403 IRIS ST | $557,500 | 2024-05-29 | SEMIDET | BUNGLOW | 3 | 3 | 2 | 0 |

| 2380 IRIS ST | $540,000 | 2024-05-15 | SEMIDET | BUNGLOW | 3 | 3 | 2 | 0 |

| 2419 IRIS ST | $619,000 | 2023-06-16 | SEMIDET | BUNGLOW | 3 | 5 | 2 | 1 |

| 2394 IRIS ST | $562,500 | 2023-04-06 | SEMIDET | BUNGLOW | 3 | 3 | 2 | 0 |

| 2399 IRIS ST | $577,000 | 2022-09-29 | SEMIDET | BUNGLOW | 3 | 3 | 2 | 0 |

| 2411 IRIS ST | $635,000 | 2022-08-24 | SEMIDET | BUNGLOW | 3 | 4 | 2 | 0 |

| 2418 IRIS ST | $690,000 | 2022-06-09 | SEMIDET | BUNGLOW | 3 | 6 | 2 | 0 |

| 2357 IRIS ST | $651,000 | 2022-03-10 | SEMIDET | BUNGLOW | 3 | 3 | 1 | 0 |

| 2434 IRIS ST | $656,100 | 2022-02-02 | SEMIDET | 2STOREY | 3 | 3 | 2 | 0 |

| 2239 IRIS ST | $575,000 | 2021-10-31 | SEMIDET | 2STOREY | 3 | 3 | 2 | 1 |

| 2361 IRIS ST | $575,000 | 2021-08-11 | SEMIDET | BUNGLOW | 3 | 3 | 2 | 0 |

| 2240 IRIS ST | $325,000 | 2019-08-08 | SEMIDET | 2STOREY | 3 | 3 | 1 | 0 |

| 2427 IRIS ST | $239,900 | 2017-10-23 | SEMIDET | BUNGLOW | 3 | 3 | 1 | 0 |

| 2416 IRIS ST | $325,300 | 2016-11-22 | SEMIDET | BUNGLOW | 3 | 3 | 2 | 0 |

| 2411 IRIS ST | $312,000 | 2016-11-10 | SEMIDET | BUNGLOW | 2 | 2 | 2 | 0 |

| 2382 IRIS ST | $303,000 | 2016-01-21 | SEMIDET | BUNGLOW | 3 | 4 | 2 | 1 |

| 2422 IRIS ST | $302,000 | 2014-07-20 | SEMIDET | BUNGLOW | 3 | 3 | 2 | 0 |

| 2400 IRIS ST | $282,500 | 2011-12-11 | SEMIDET | BUNGLOW | 3 | 3 | 2 | 0 |

| 2238 IRIS ST | $290,000 | 2011-10-03 | SEMIDET | 2STOREY | 3 | 4 | 2 | 0 |

| 2396 IRIS ST | $284,000 | 2011-09-14 | SEMIDET | BUNGLOW | 3 | 4 | 2 | 0 |

| 2247 IRIS ST | $320,000 | 2011-06-10 | SEMIDET | 2STOREY | 3 | 3 | 2 | 1 |

| 2412 IRIS ST | $272,000 | 2010-07-26 | SEMIDET | BUNGLOW | 3 | 4 | 2 | 0 |

| 2413 IRIS ST | $269,000 | 2009-10-02 | SEMIDET | BUNGLOW | 3 | 5 | 2 | 0 |

| 2419 IRIS ST | $264,300 | 2009-06-15 | SEMIDET | BUNGLOW | 3 | 5 | 2 | 1 |

| 2397 IRIS ST | $190,000 | 2009-02-18 | SEMIDET | BUNGLOW | 2 | 2 | 1 | 0 |

| 2415 IRIS ST | $227,500 | 2008-11-11 | SEMIDET | BUNGLOW | 3 | 3 | 1 | 0 |

| 2393 IRIS ST | $245,000 | 2008-06-04 | SEMIDET | BUNGLOW | 3 | 3 | 2 | 0 |

| 2421 IRIS ST | $213,000 | 2007-03-21 | SEMIDET | BUNGLOW | 3 | 3 | 1 | 0 |

| 2419 IRIS ST | $205,000 | 2006-11-26 | SEMIDET | BUNGLOW | 3 | 3 | 2 |

HOMES FOR SALE ON IRIST ST. OTTAWA –

2380 IRIS ST, OTTAWA, ONTARIO, K2C-1C6

IRIS ST, OTTAWA, ONTARIO, K2C-1C6

IRIS ST, OTTAWA, HOMES FOR SALE

K2C HOMES FOR SALE

OTTAWA HOME GUIDES

THINKING OF BUYING A HOME ON IRIS ST. OTTAWA?

Ottawa Real Estate Prices for 2024: Prices are going up 1.6% on a year-over-year

The OREB MLS OF Home Price Index (HPI) tracks price trends far more accurately than is possible using average or median price measures.

OREB cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price will vary from neighbourhood to neighbourhood.

LOW INVENTORY IN THE OTTAWA REAL ESATE MARKET JAN 2024

Still plague Market and causes prices to increase once again.

OTTAWA, December 5, 2023 – The number of

homes sold through the MLS® System of the

Ottawa Real Estate Board totaled 724 units in

November 2023. This was a small reduction of

1.6% from November 2022.

Home sales were 31.8% below the five-year

average and 27.4% below the 10-year average

for the month of November.

On a year-to-date basis, home sales totaled

11,421 units after 11 months of the year. This

was a large decline of 11.7% from the same

period in 2022.

“Sales are performing as expected with the

arrival of colder months, and an uptick in new

and active listings is bringing more choice back

into the market,” says OREB President Ken

Dekker. “While more choice may mean the pace

of buying and selling has slowed, that doesn’t

mean people looking to enter or upgrade in the

market should sit back. Prospective buyers or

those looking to upgrade have an opportunity

to collaborate with their REALTOR® to carefully

explore the market, identify the ideal property,

and negotiate an attractive deal at their

own pace. Sellers will have to manage their

expectations regarding the quantity of offers and

speed of transactions, and their REALTOR® is

the best resource to help them confidently price

and prepare their home for a quality sale.”

By the Numbers – Prices:

The MLS® Home Price Index (HPI) tracks price

trends far more accurately than is possible

using average or median price measures.

•

The overall MLS® HPI composite

benchmark price was $628,900 in

November 2023, a modest gain of 1.4%

from November 2022.

o The benchmark price for single-family

homes was $708,900, up 1.6% on a

year-over-year basis in November.

o By comparison, the benchmark price for

a townhouse/row unit was $492,300,

nearly unchanged, up 0.8% compared

to a year earlier.

o The benchmark apartment price was

$424,300, up 1.2% from year-ago

levels.

•

The average price of homes sold in

November 2023 was $633,138, decreasing

0.8% from November 2022. The more

comprehensive year-to-date average price

was $669,536, a decline of 5.7% from 11

months of 2022.

•

The dollar value of all home sales in

November 2023 was $458.4 million, down

2.4% from the same month in 2022.

OREB cautions that the average sale price

can be useful in establishing trends over

time but should not be used as an indicator

that specific properties have increased or

decreased in value. The calculation of the

average sale price is based on the total dollar

volume of all properties sold. Price will vary from

neighbourhood to neighbourhood.

By the Numbers – Inventory & New Listings

•

The number of new listings saw a minor

increase of 2.7% from November 2022.

There were 1,428 new residential listings

in November 2023. New listings were 8.4%

above the five-year average and 10.4%

above the 10-year average for the month

of November.

•

Active residential listings numbered

2,752 units on the market at the end of

November, a sizable gain of 15.8% from

the end of November 2022. Active listings

haven’t been this high in the month of

November in more than five years.

•

Active listings were 53.9% above the five-

year average and 6.7% below the 10-year

average for the month of November.

•

Months of inventory numbered 3.8 at the

end of November 2023, up from the 3.2

months recorded at the end of November

2022 and above the long-run average

of 3.3 months for this time of year. The

number of months of inventory is the

number of months it would take to sell

current inventories at the current rate of

sales activity.

Sources : OREB -CREA

Builder Agreements should include details such as:

PDI – Date

Assignment clause: a must

Evaluation of home value (Appraisal – you should pay for one)

Deposit Structure: Can you get a better deposit structure

Mortgage approval – a must

Pre-approval – a must

Insurance clause – a must

Location:

Flooding topography

Hwy access

Hydro box green

Road T

SITE PLAN disclosure – commercial or other future development, check with the city

Backing on to graveyards or other

WHAT FUTURE DEVELOPMENT WILL HAPPEN AROUND THE HOME is very import to value

Shopping close

Schools

Bus stops

Structure:

Model

Sqft cost

List of actual finishes

Design

Floor plan

How long is your Tarion Warranty, and what is under warranty and for how long?

Upgrades list and value $

Builder Insurance coverage

(* for information only – buyers need legal advice or to work with an agent)

September 20th, 2023

Source: OREB

The Ottawa Real Estate Board reported that its members sold 1,196 residential properties in August through the Board’s Multiple Listing Service® (MLS®) System data service, compared with 1,130 in August 2022, an increase of 6%. August’s sales included 903 in the freehold-property class, up 7% from a year ago, and 293 in the condominium-property category, a 2% increase from August 2022. The five-year average for total unit sales in August is 1,525.

“Ottawa Sales activity was up marginally on a year-over-year basis in August but remained well below the historical average for this time of year,” says Ken Dekker, OREB President. “There is no shortage of demand given increased immigration and the large Canadian population cohort entering the market. The lack of suitable, affordable housing is a hindrance. High borrowing costs and economic uncertainty are impacting both sellers and buyers, which we expect will continue to result in further market fluctuations.”

NUMBER OF HOME FOR SALE ARE LOWER THAN OTHER YEARS

IT LOOKS LIKE 2022 AND 2023 HAVE THE SAME AVERAGE SALE PRICE

LOW NUMBER OF LISTINGS, LOW SALE VOLUME 2023

IT LOOKS LIKE WE ARE STILL LOW ON LISTINGS