HOMES-FOR-SALE-OTTAWA – KANATA-HOMES-KANATA-OTTAWA HOMES FOR SALE – OTTAWA HOME PRICES FEBRUARY 2022- OTTAWA CONDOS FOR SALE FEBRUARY 2022 – LATEST OTTAWA REAL ESTATE NEWS.

February 2022 – OTTAWA REAL ESTATE PRICES UP +17.8%

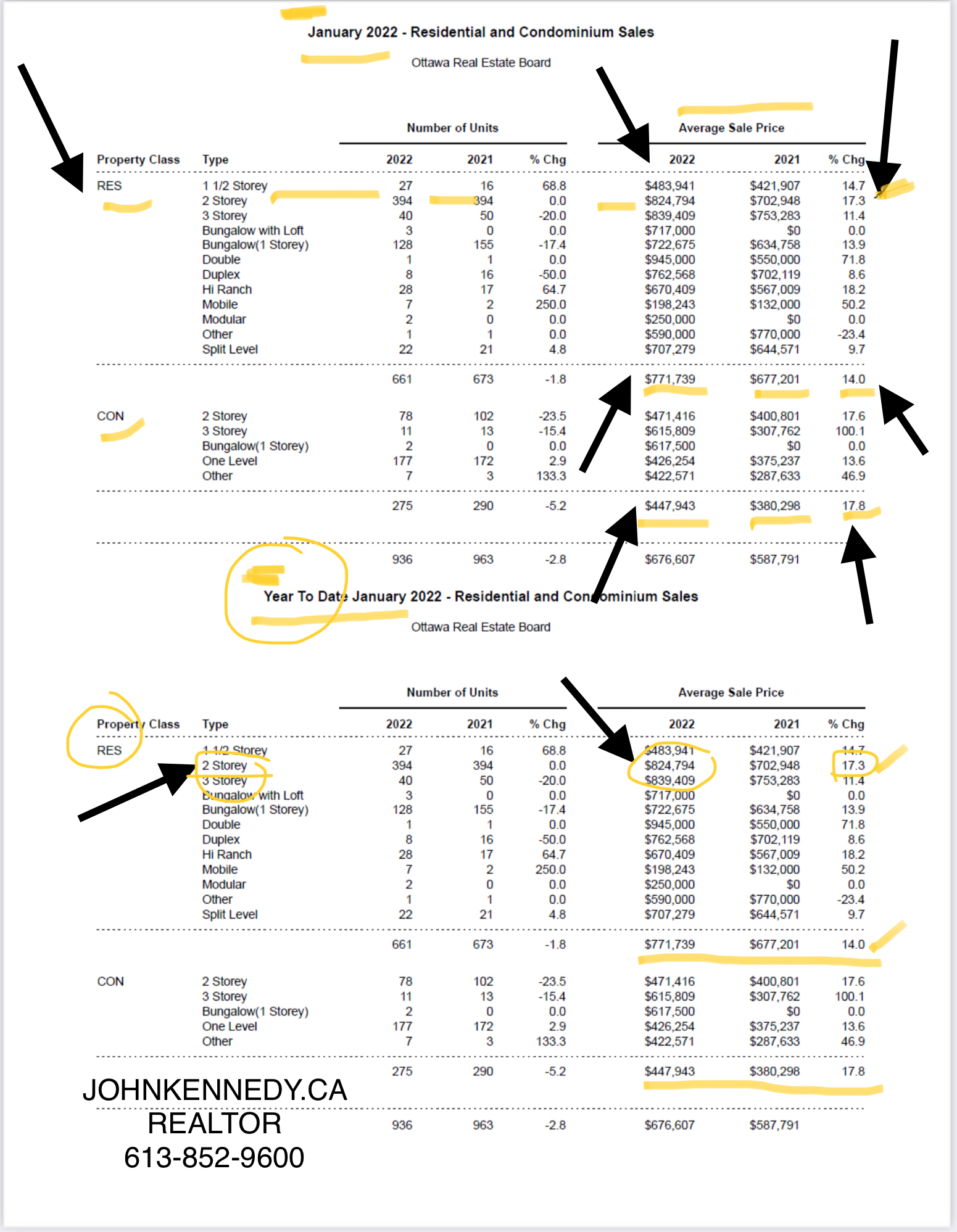

The Members of the Ottawa Real Estate Board sold 936 residential properties in January through the Board’s Multiple Listing Service® System, compared with 963 in January 2021, a decrease of 3 per cent. January’s sales included 661 in the residential-property class, down 2 per cent from a year ago, and 275 in the condominium-property category, a decrease of 5 per cent from January 2021. The five-year average for total unit sales in January is 840.

“January’s sales, almost identical to 2021’s, were very strong for a traditionally slower month, especially given the frigid temperatures and increased government Covid-19 restrictions we experienced,” states Ottawa Real Estate Board President Penny Torontow. “This increased activity compared to previous years is not solely a pandemic phenomenon. Yes, the pandemic has accelerated market activity in some ways, but pent-up Buyer demand due to the housing supply shortage has been an ongoing fundamental issue for the Ottawa resale market for well over 5 years now – and the price increases will continue to reflect that until the housing stock grows.”

The average sale price for a condominium-class property in January was $447,943, an increase of 18 per cent from 2021, while the average sale price for a residential-class property was $771,739, increasing 14 per cent from a year ago.*

“Average prices continue to rise steadily with the lack of inventory pushing prices to levels previously unseen. We only need to observe the number of homes now selling over $1M for a clear demonstration. In 2020, they represented 3% of residential sales, in 2021, they held 9% of the market’s resales, and now in 2022, that number reflects close to 14% of detached home sales.”

“Meanwhile, the residential-class properties selling within the $650-$900K range represent 47% of all of January’s residential unit sales. In 2021, it was 33%. But we must keep in mind, average prices statistics amalgamate data from the entire city, so while in some areas the increases would be less, other pockets of Ottawa may see more,” advises Torontow.

“The condo market is also flourishing both in number of sales and prices. Possibly due to the fact that residential units may be out of reach for some Buyers, they are finding themselves more open to this option and are actually able to find a condominium-class property within their budget.”

“Bad weather, pandemic lockdowns, it doesn’t matter – Ottawa remains a fast-moving, active, and robust market. So, if you are thinking of selling your property, there has never been a better time. Contact a REALTOR® who can explain the various factors that will help you get the best price for your home today.” In addition to residential sales, OREB Members assisted clients with renting 410 properties in January 2022 compared to 333 in 2021.

* OREB cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price will vary from neighbourhood to neighbourhood.

source OREB.

HOMES-FOR-SALE-OTTAWA – KANATA-HOMES-KANATA-OTTAWA HOMES FOR SALE – OTTAWA HOME PRICES FEBRUARY 2022- OTTAWA CONDOS FOR SALE 2022 – LATEST OTTAWA REAL ESTATE NEWS.

JUST SOLD

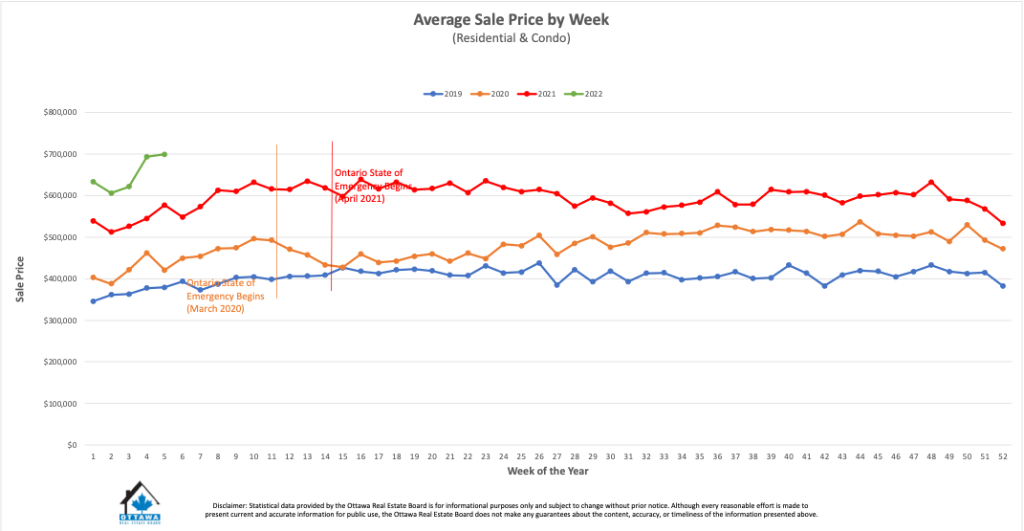

AVERAGE MOVING PRICE FEB 2022

JUST SOLD

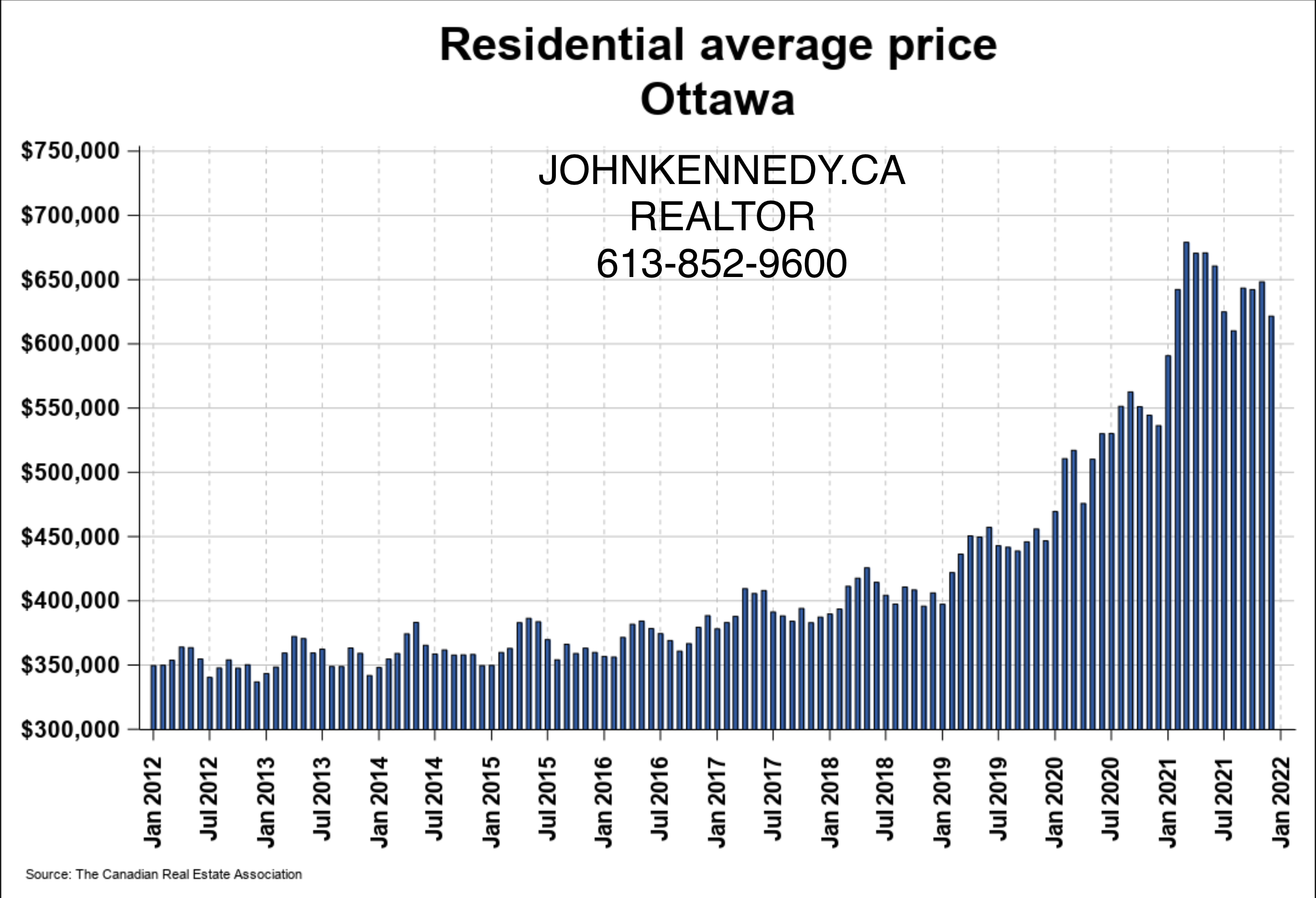

OTTAWA AVERAGE PRICES FROM JAN 2012 TO FEB 2022

OTTAWA AVERAGE PRICES FROM JAN 2012 TO FEB 2022

RECEIVE FREE PROFESSIONAL ADVICE BEFORE YOU BUY OR SELL.

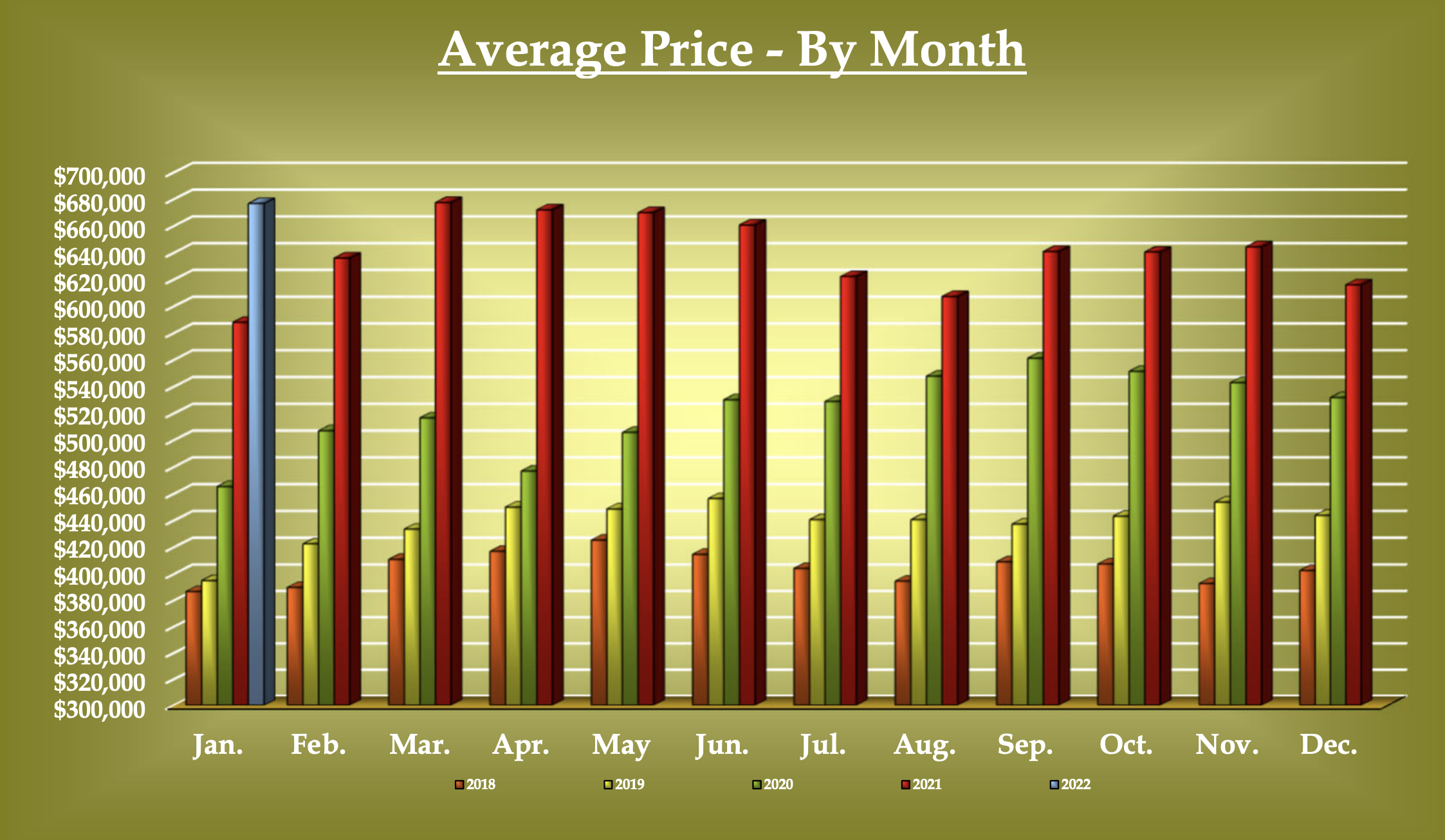

AVERAGE PRICE CHANGES BY MONTH

HOMES-FOR-SALE-OTTAWA – KANATA-HOMES-KANATA-OTTAWA HOMES FOR SALE – OTTAWA HOME PRICES FEBRUARY 2022- OTTAWA CONDOS FOR SALE FEBRUARY 2022 – LATEST OTTAWA REAL ESTATE NEWS.

JOIN MY NEWSLETTER