The Market- knowing when to sell.

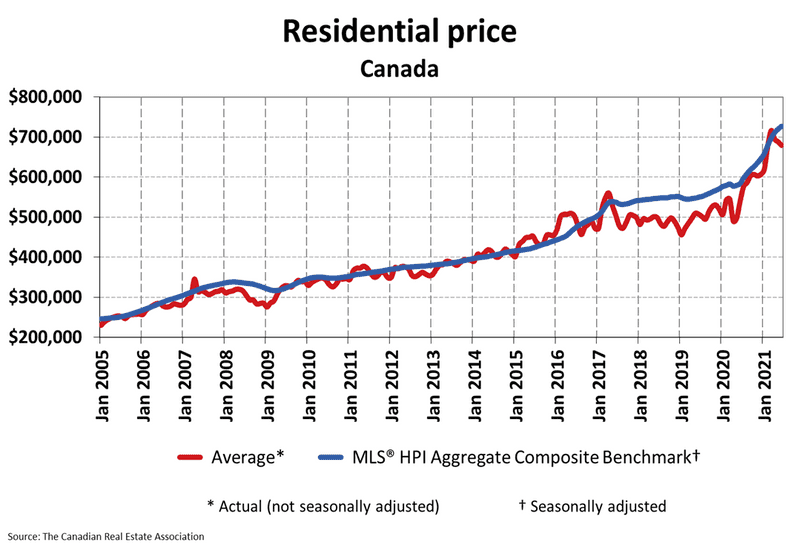

The Canadian Real Estate Market – Prices are still up.

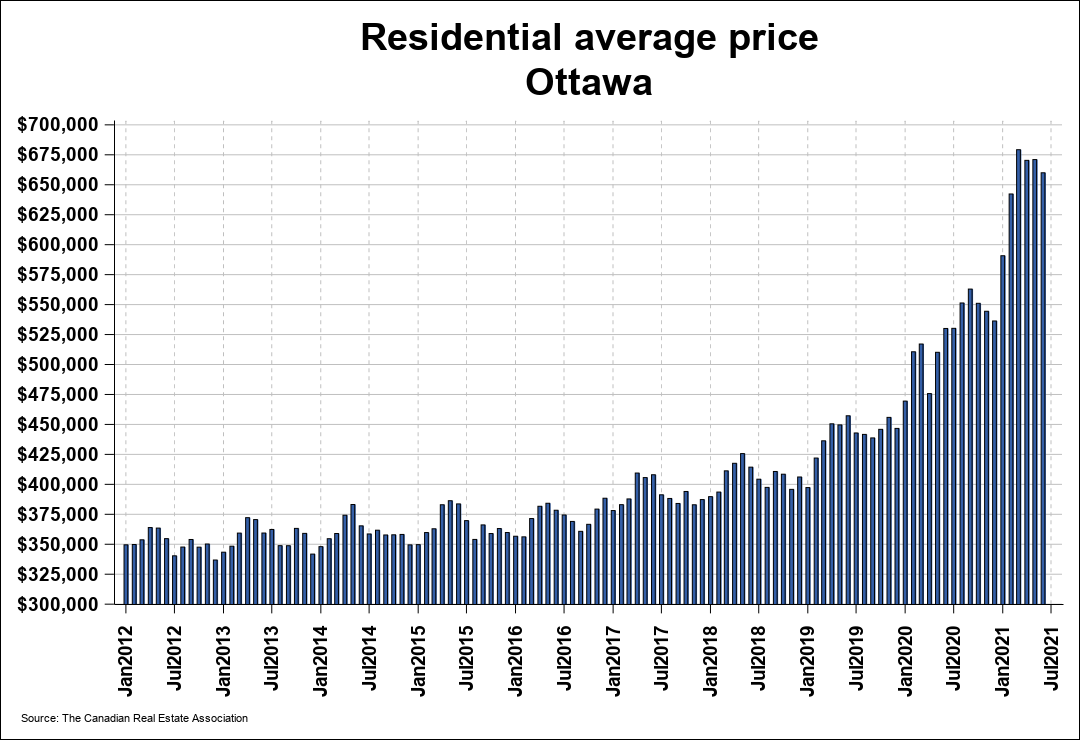

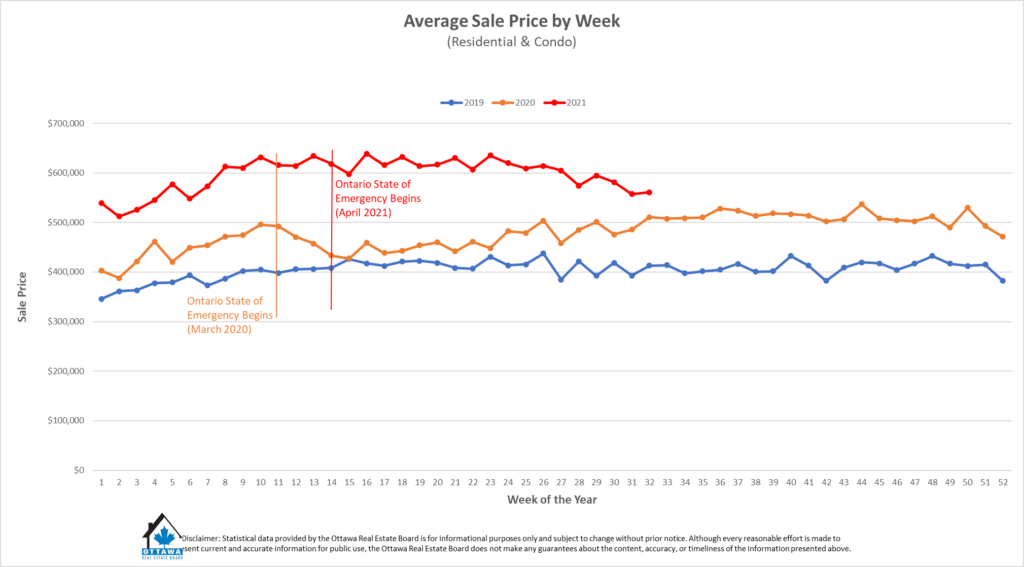

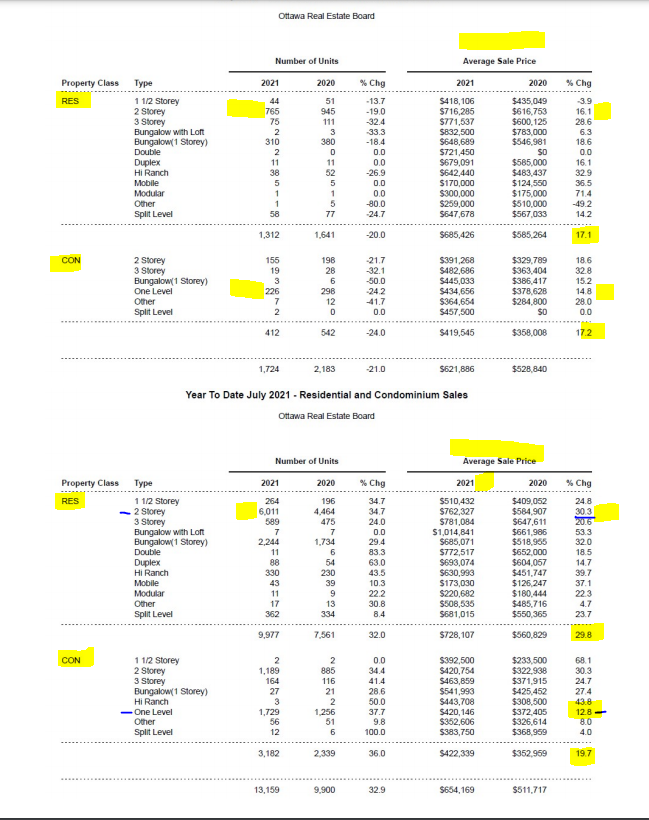

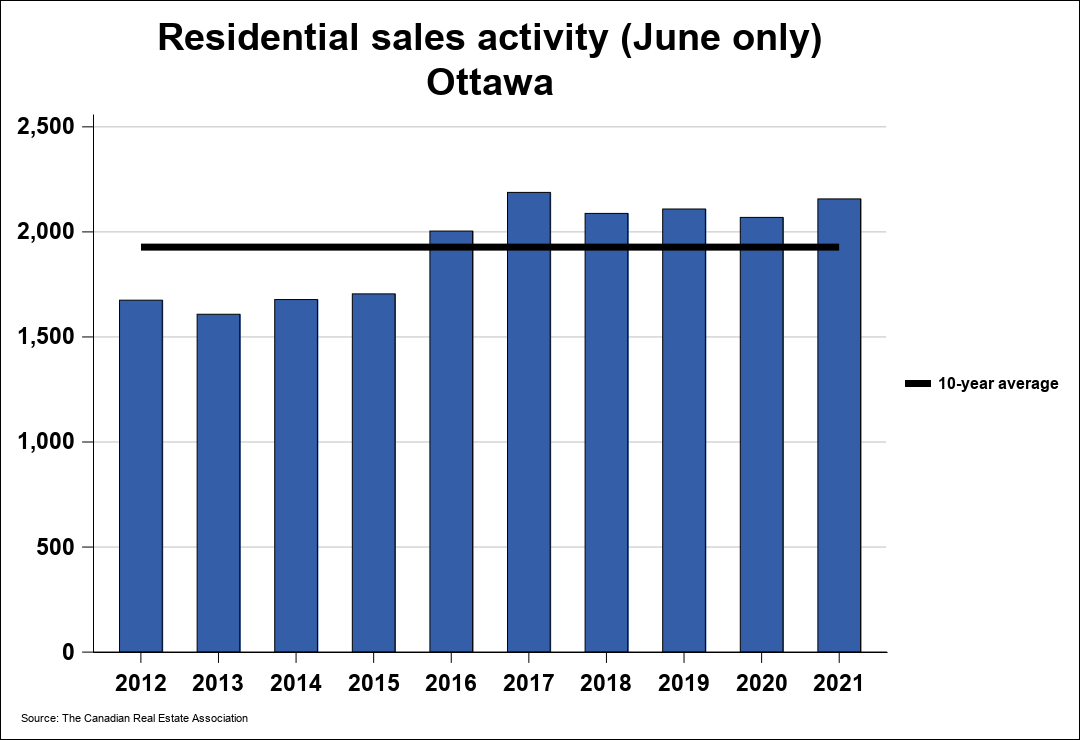

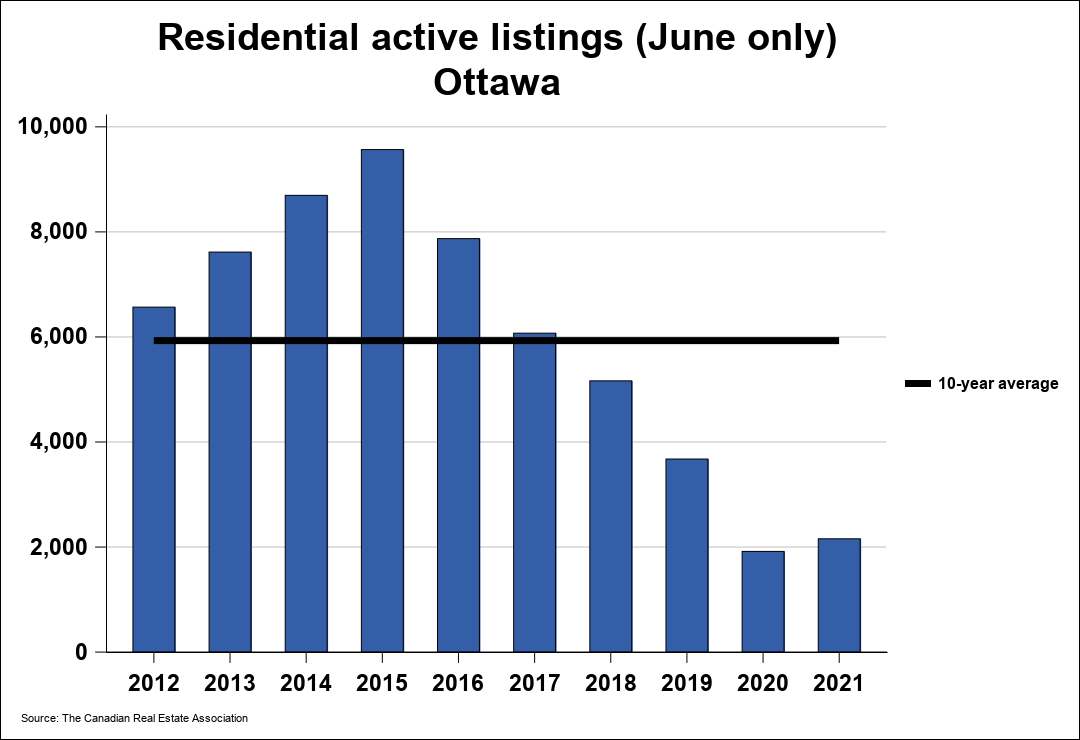

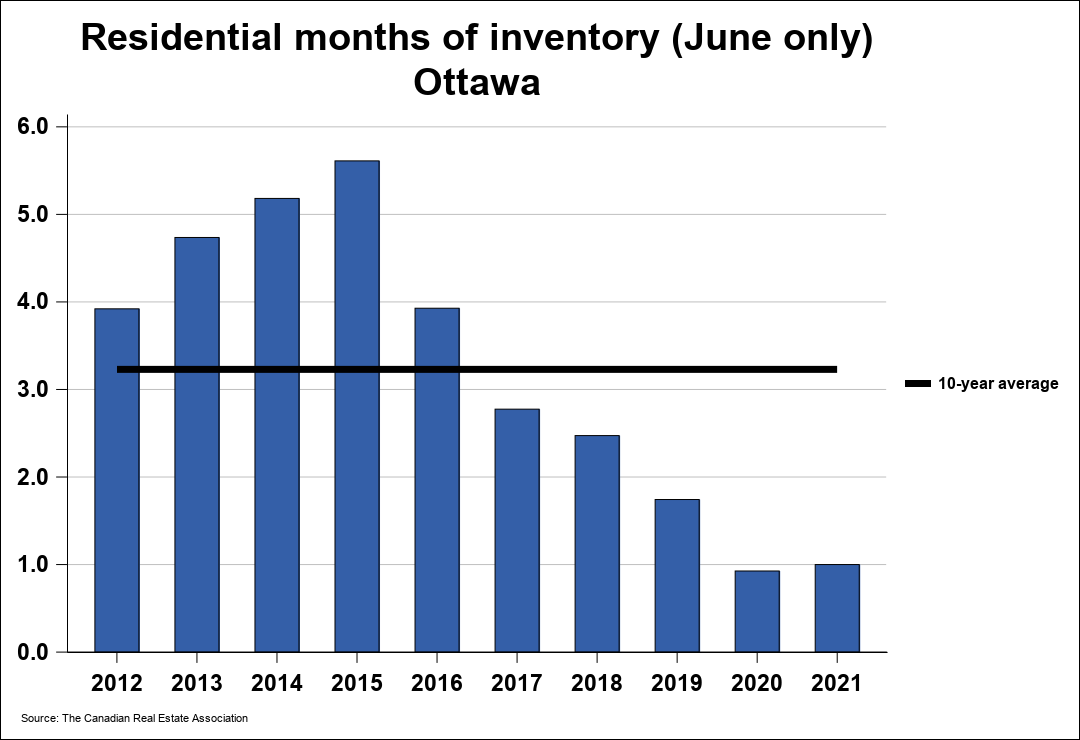

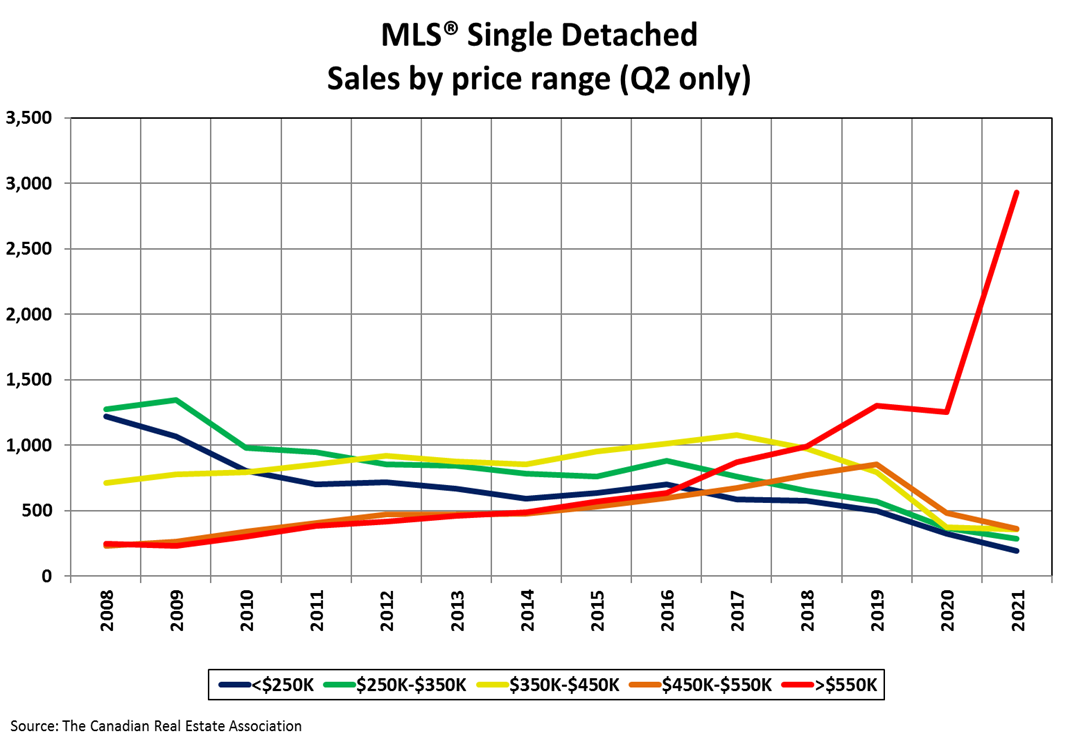

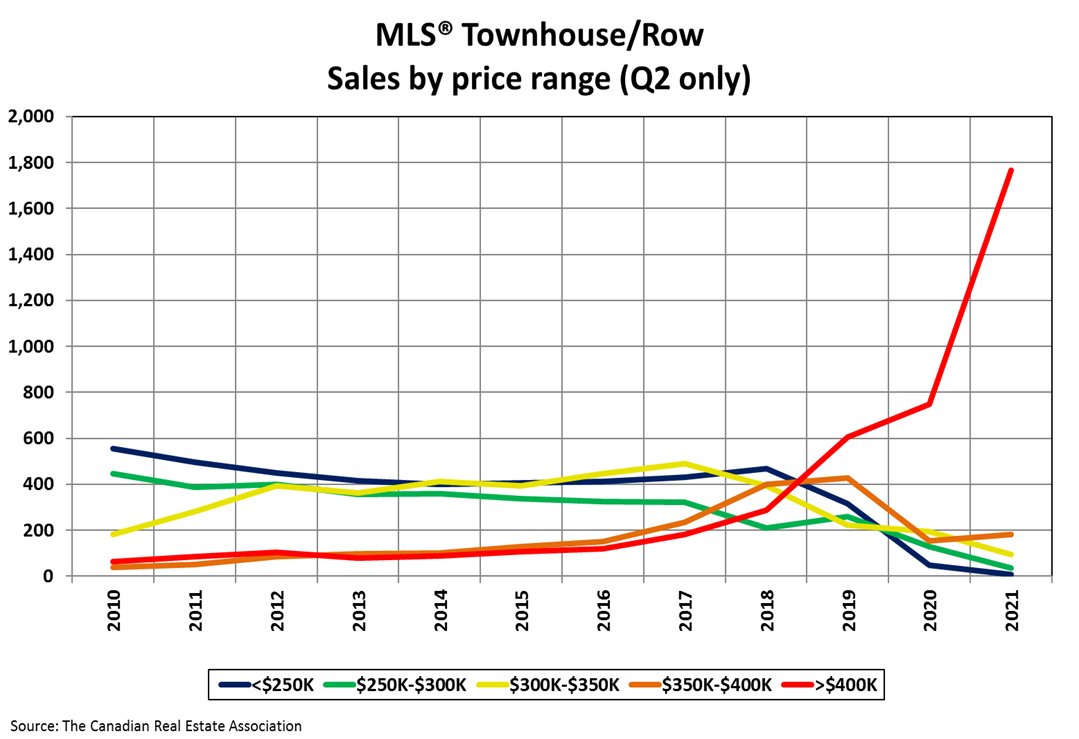

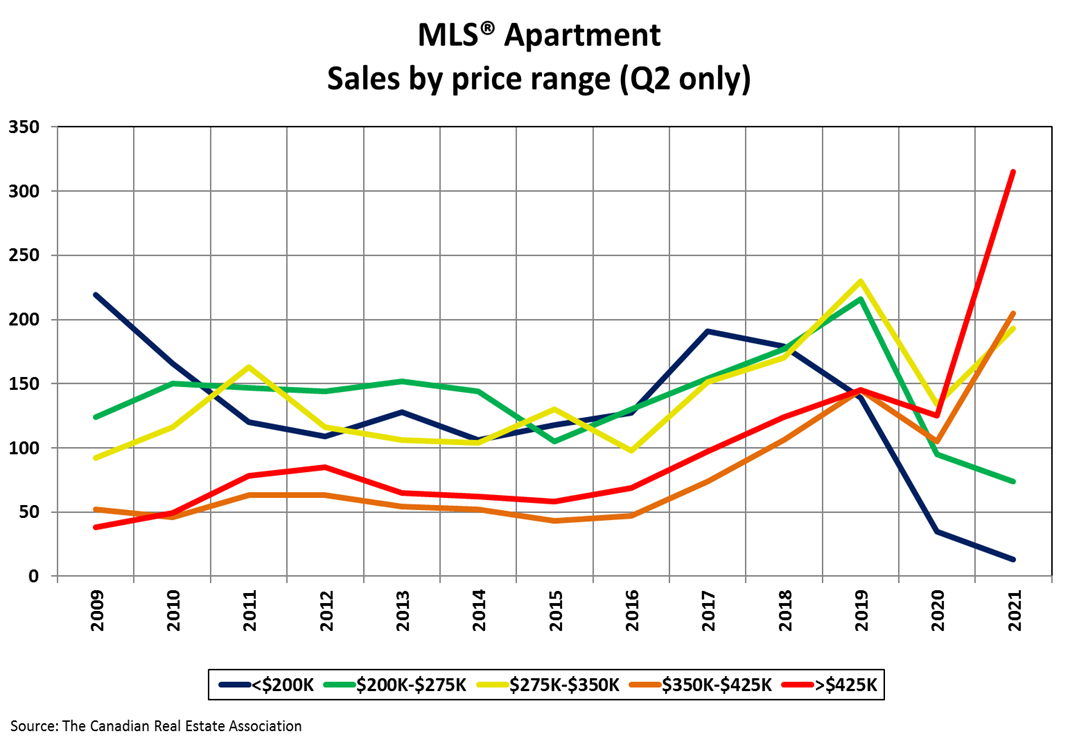

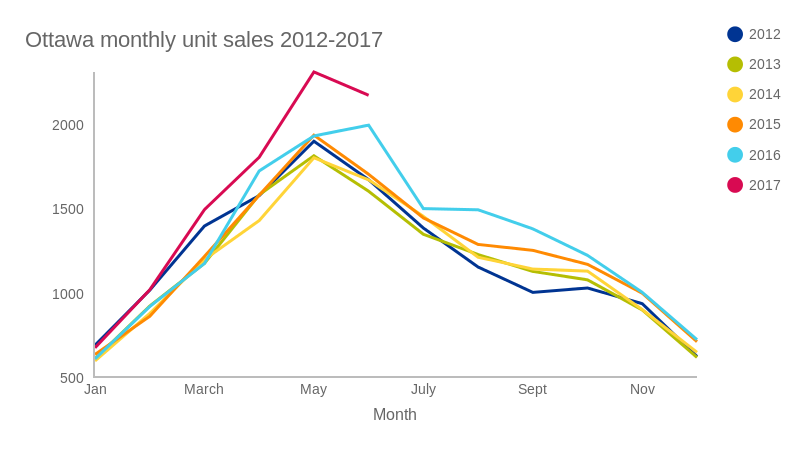

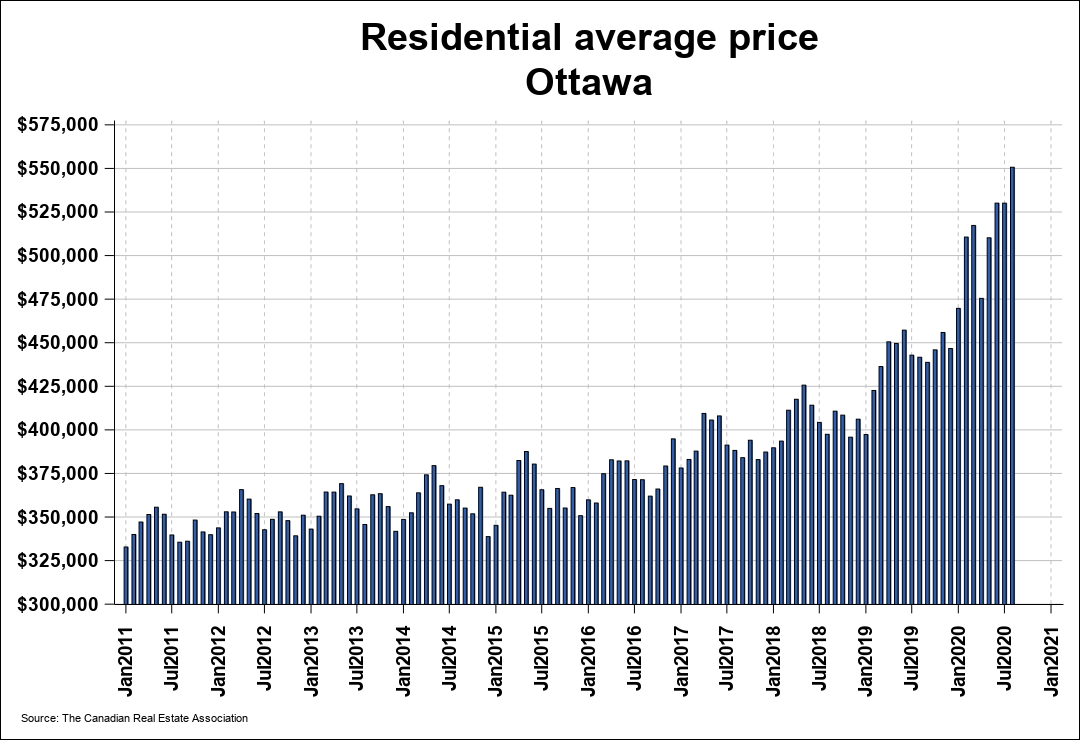

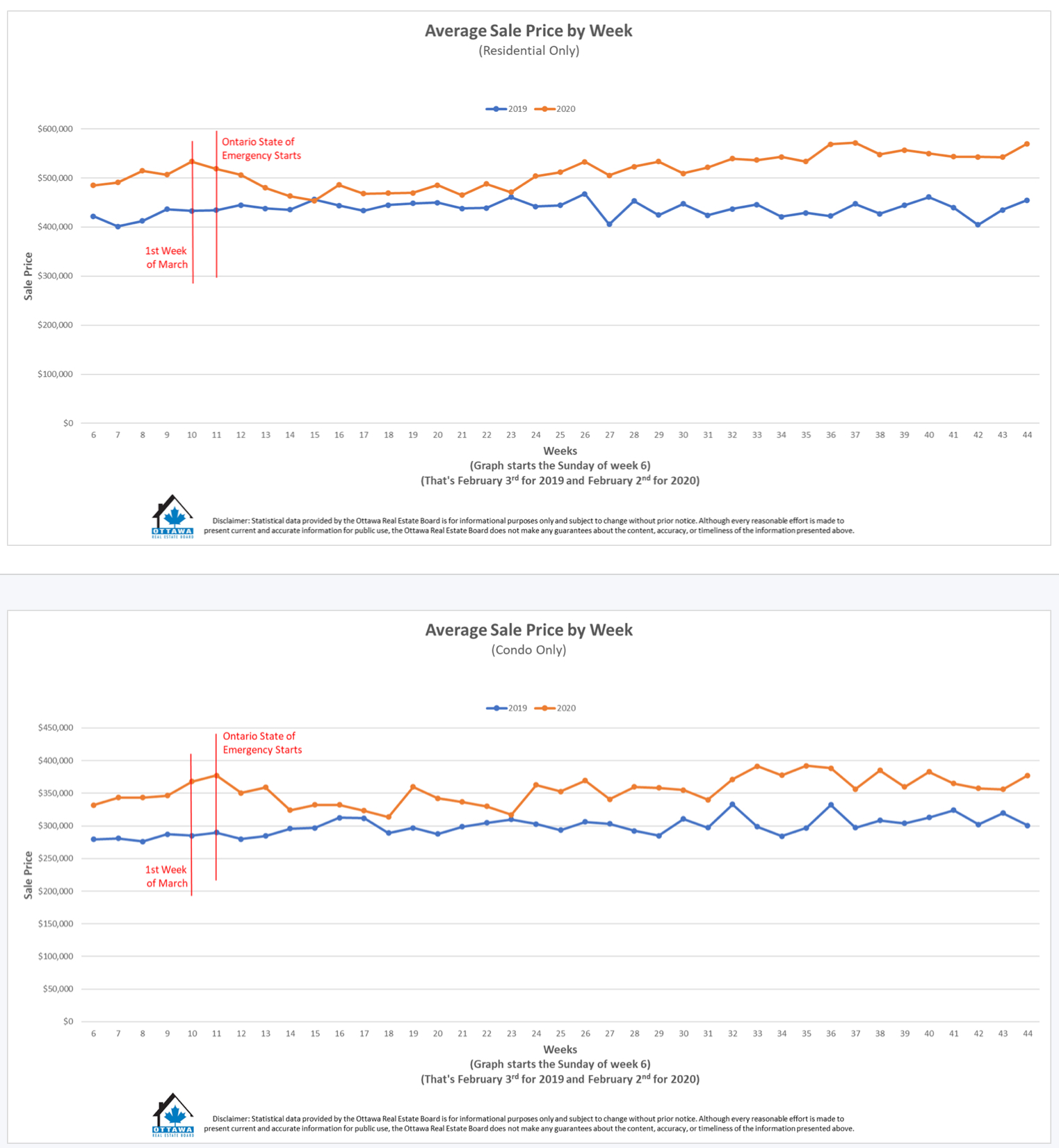

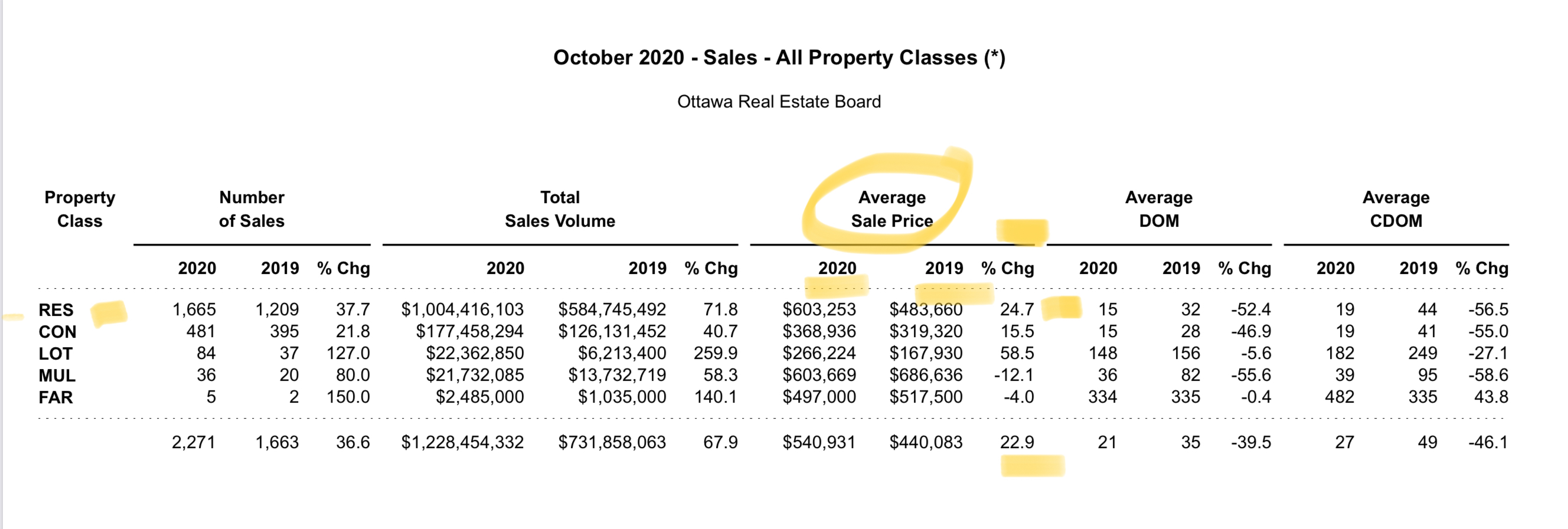

OTTAWA, August 5, 2021 – Members of the Ottawa Real Estate Board sold 1,724 residential properties in July through the Board’s Multiple Listing Service® System, compared with 2,183 in July 2020, a decrease of 21 per cent. July’s sales included 1,312 in the residential-property class, down 20 per cent from a year ago, and 412 in the condominium-property category, a decrease of 24 per cent from July 2020. The five-year average for total unit sales in July is 1,775. “July’s unit sales followed the traditional cycle of the spring and summer markets, which tend to peak around April or May and then slow down as Buyers and Sellers turn their attention to their vacations and other outdoor recreational activities,” states Ottawa Real Estate Board President Debra Wright. “This year’s figure is closer to 2019’s (1,838 sales) and just shy of the 5-year average, with the slight decline in transactions perhaps due to the combination of summer and the reopening of the economy last month. Certainly, the marked decrease from last year’s July sales is due to the spring 2020 lockdown, which had shifted the 2020 resale market’s peak to the summer and fall months,” she adds. July’s average sale price for a condominiumclass property was $419,545, an increase of 17 per cent from last year, while the average sale price for a residentialclass property was $685,426, also an increase of 17 per cent from a year ago. With year-to-date average sale prices at $728,107 for residential and $422,339 for condominiums, these values represent a 30 per cent and 20 percent increase over 2020, respectively.* “Following the same trend as sales, the month-to-month average prices decreased marginally by 4-6% compared to June; however, this minor dip is consistent to what typically happens during the summer months. Overall, average prices have increased considerably from 2020, and year-to-date values are holding steady. Still, Sellers will need to keep in mind that the multiple offer frenzy experienced previously is no longer the norm, and they may need to have more realistic expectations when positioning their homes and settling on a listing price with their REALTORS®.” “We are seeing the housing stock increasing with residential inventory up 19% and condominium supply 23% higher than 2020. Although there were 700 fewer listings than in June, the number of properties that entered the market in July is over the fiveyear average by approximately 114 units. Along with the price stabilizations, we hope this may indicate that Ottawa’s resale market is moving towards a more balanced state, which would be good for everyone,” suggests Wright. “Established in 1921, on July 9th, the Ottawa Real Estate Board commemorated 100 years of helping our neighbours, friends, and fellow residents buy and sell their homes, cottages and investment properties. Over the past century, our Board has advocated for affordable and attainable homes, as well as a range of housing options for seniors, first-time homebuyers and everyone in between. We pledge to continue this endeavour for our future clients in the years to come. On behalf of the Ottawa Real Estate Board and our 3,500 REALTOR® Members, I would like to extend my heartfelt gratitude to all of you who have put your trust in us to help you make your real estate dreams come true. We hope to continue to serve our communities for the next 100 years and beyond.” OREB Members also assisted clients with renting 2,706 properties since the beginning of the year compared to 1,883 at this time last year. * OREB cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price will vary from neighborhoods’.