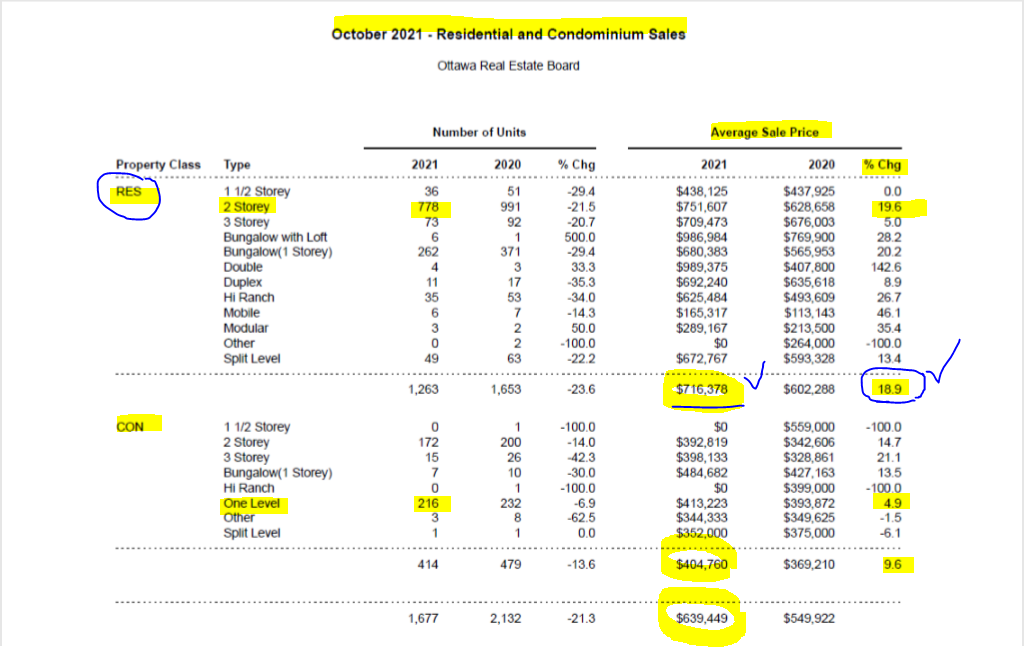

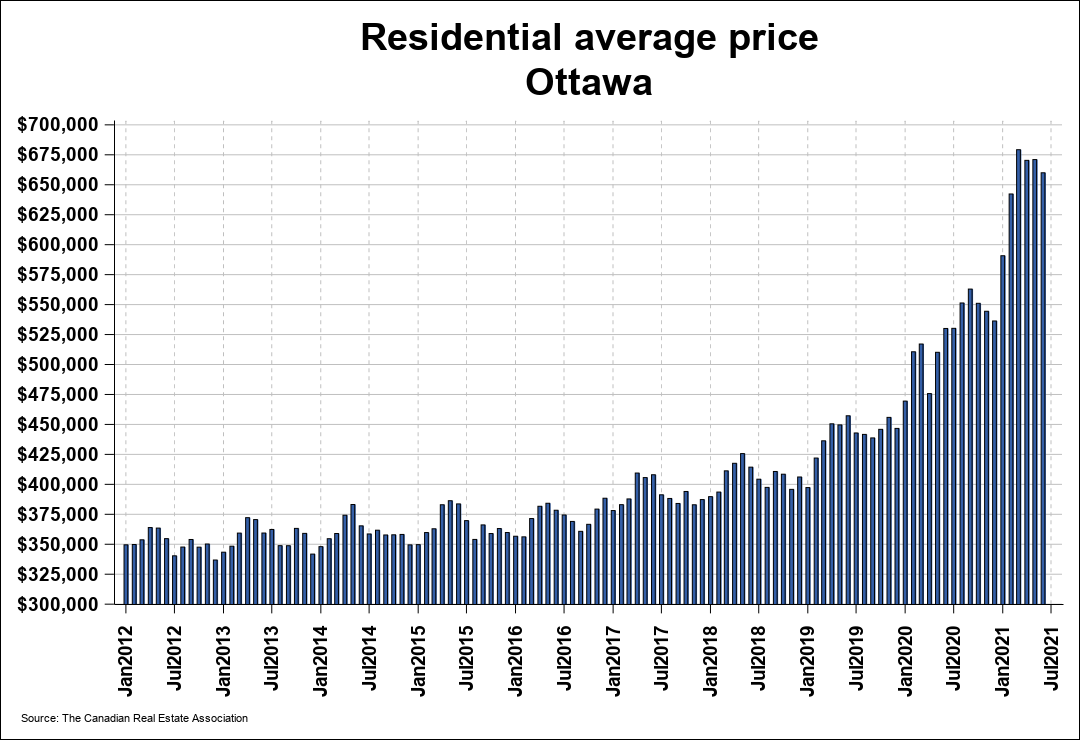

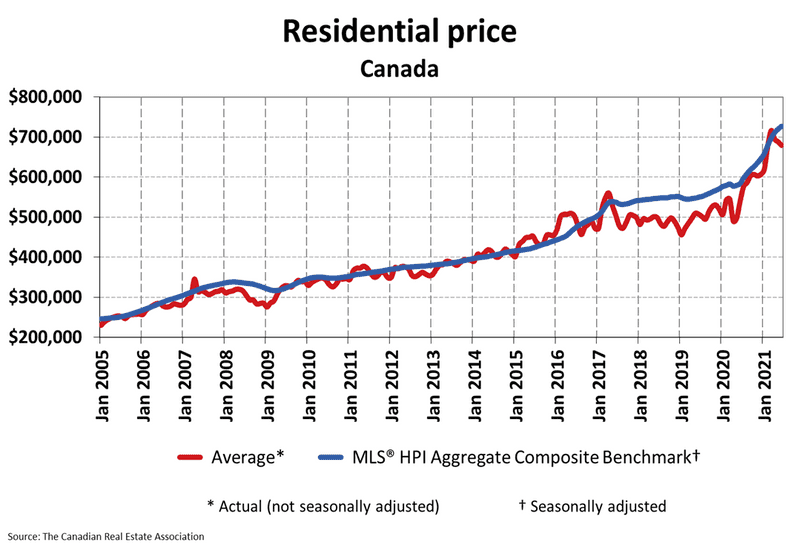

Taking a closer look at Ottawa home prices for November 2022. Down -4.3%

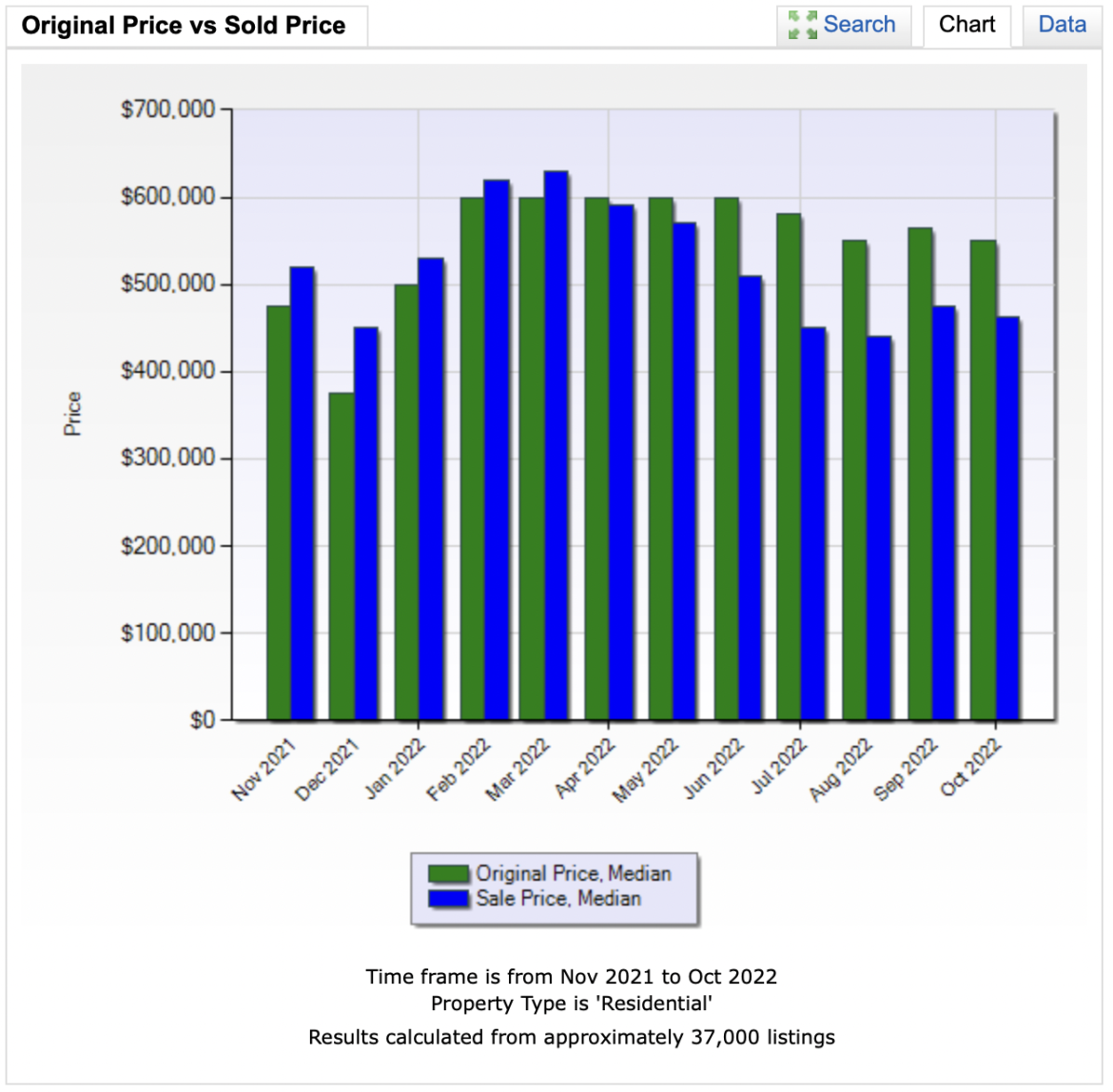

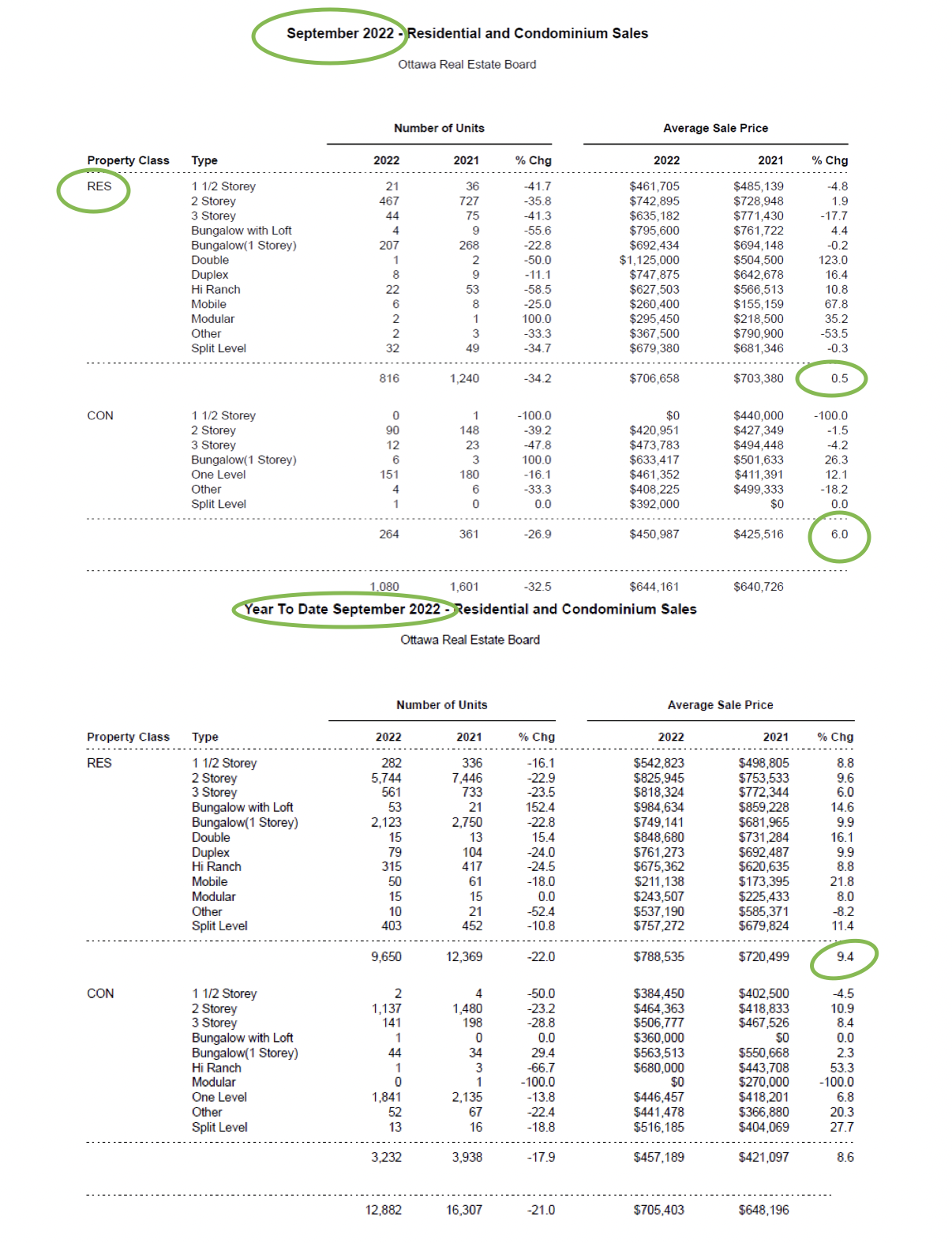

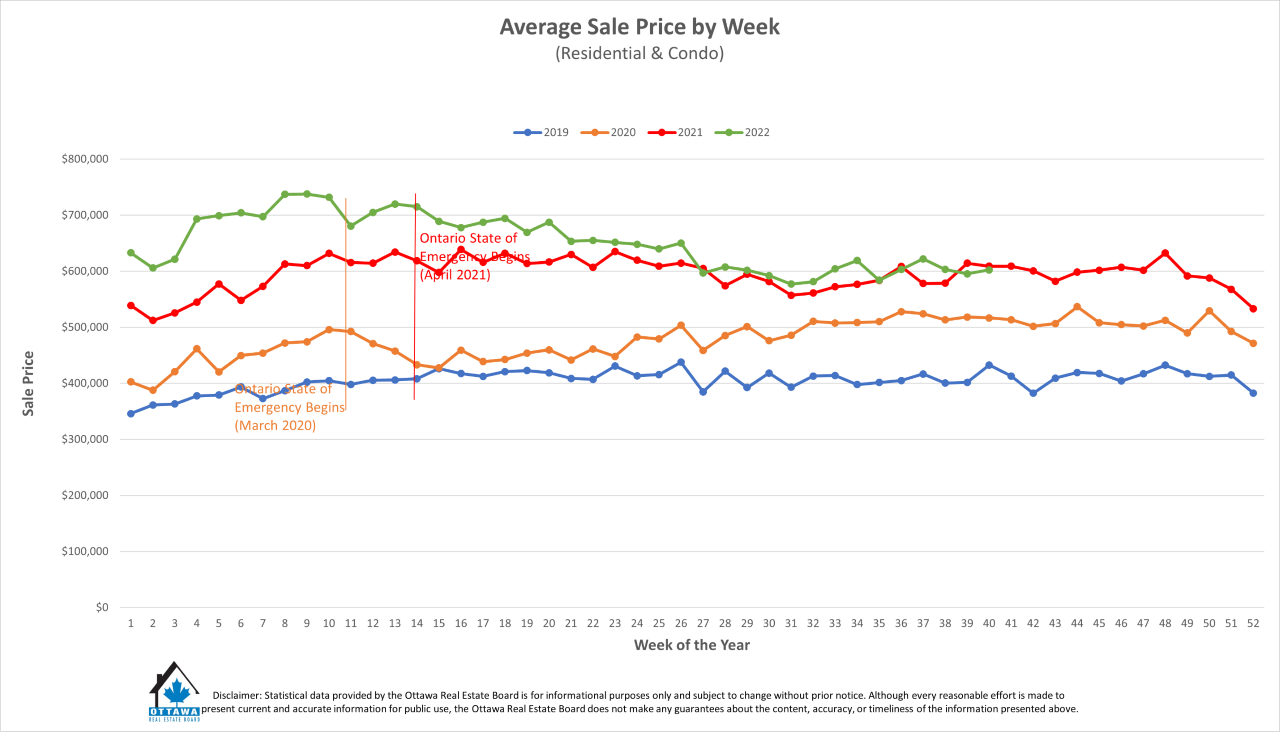

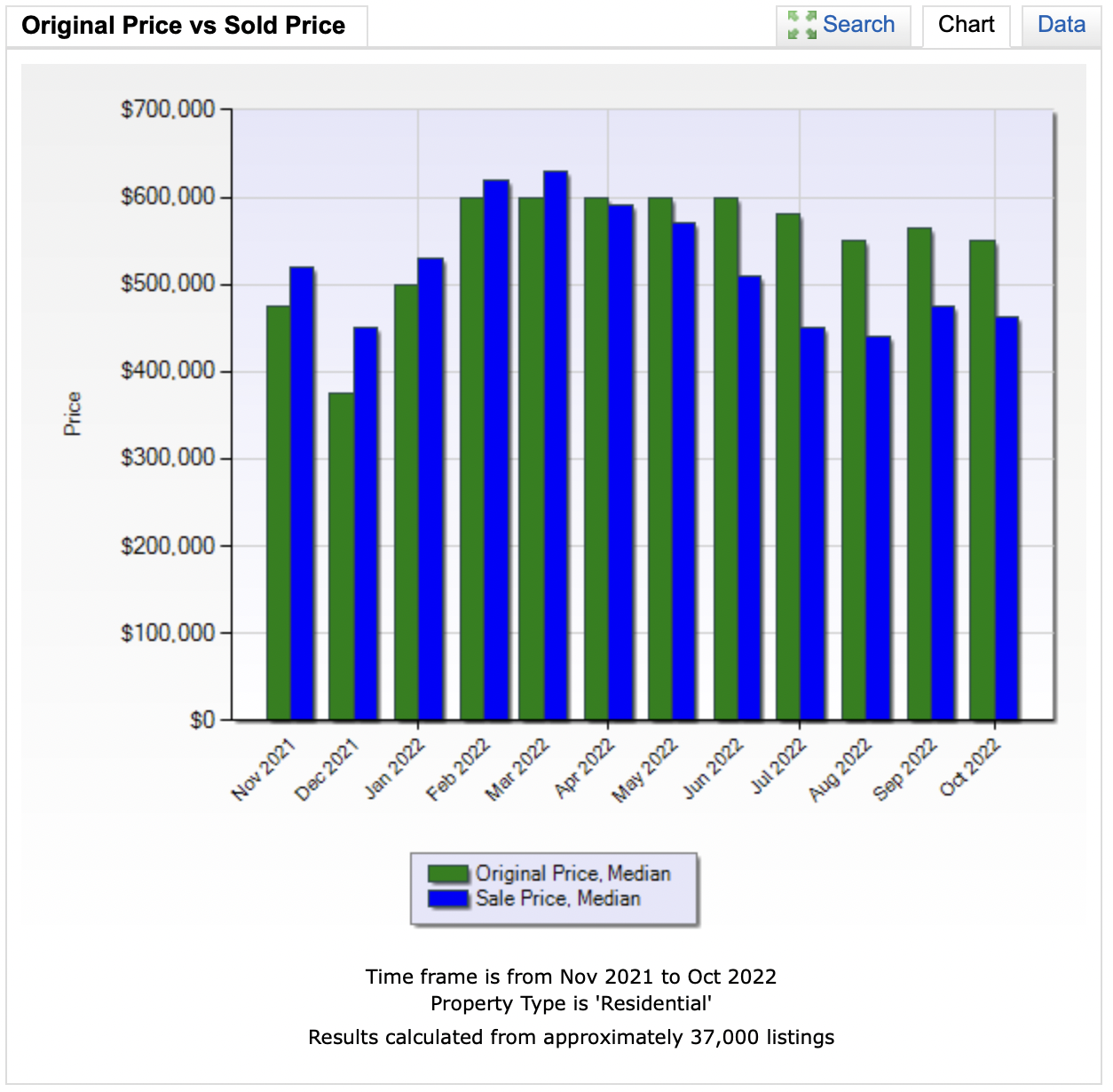

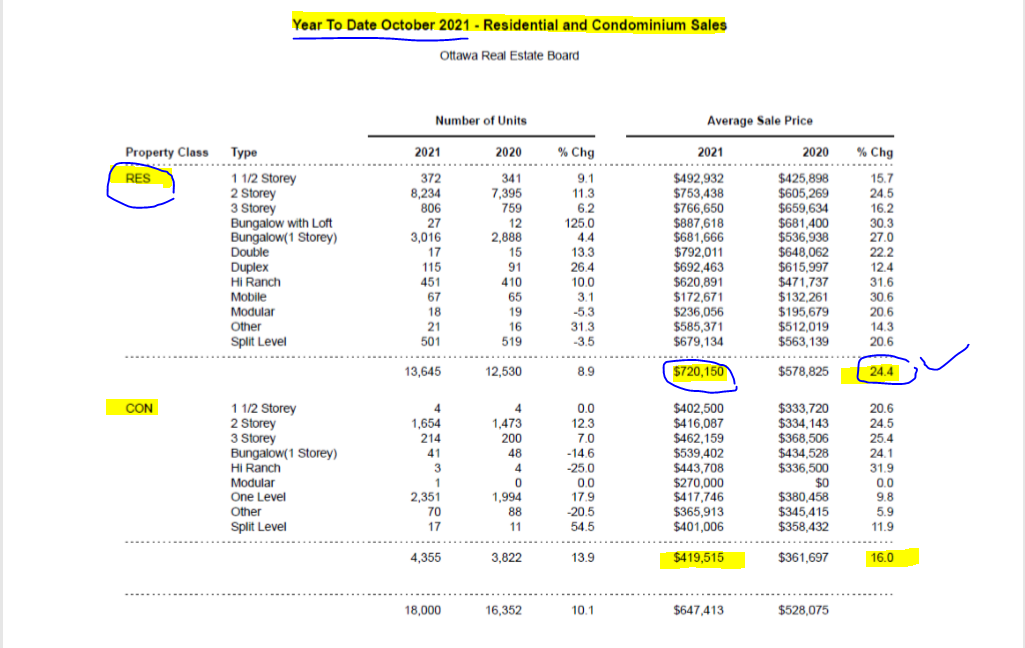

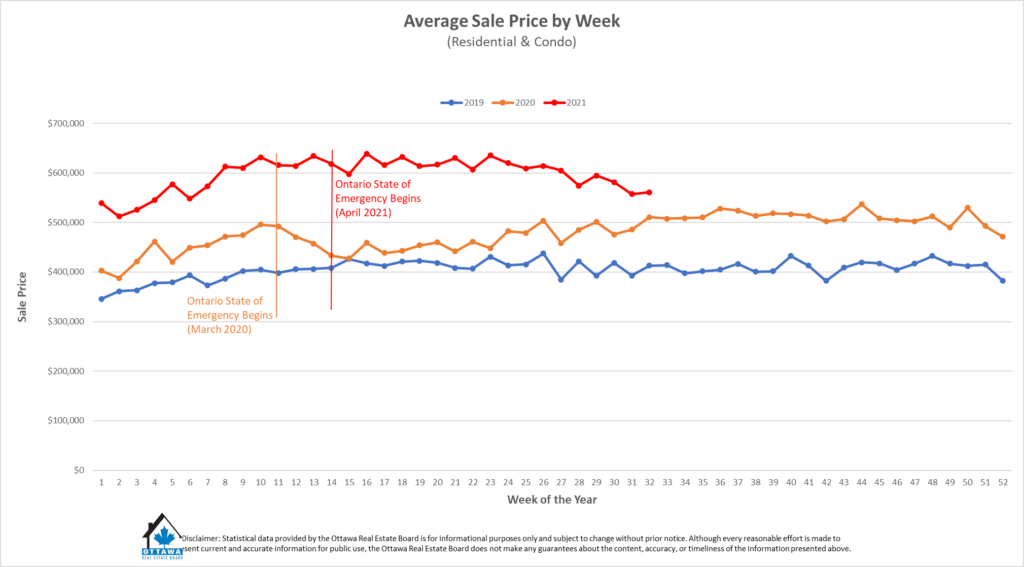

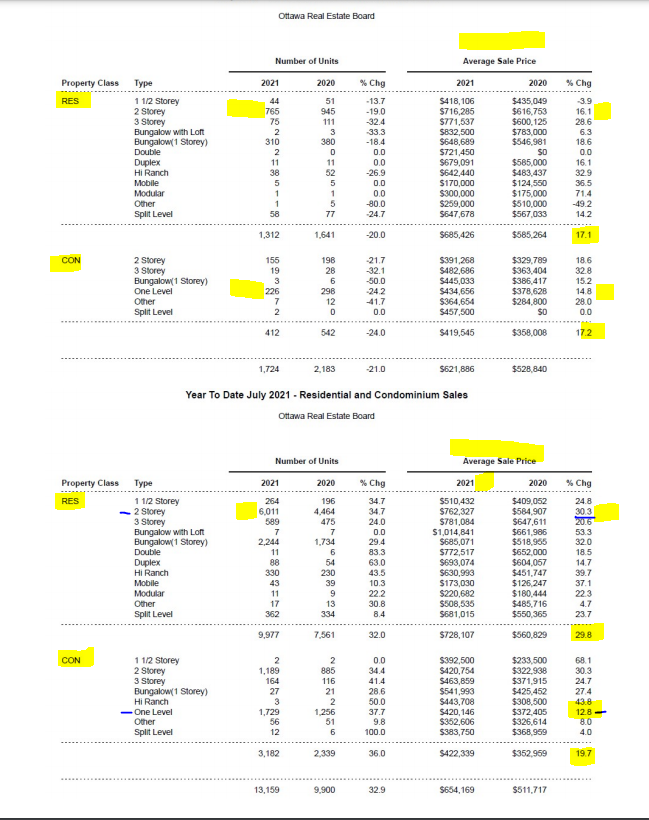

As we take a closer look at these November 2022 Real Estate prices below and above. We are seeing a 2 storey home selling for less this month. Listing a higher price, but Selling Less. The average price has dropped to (-4.3%) and homes are staying longer on the market.

So let’s look even closer:

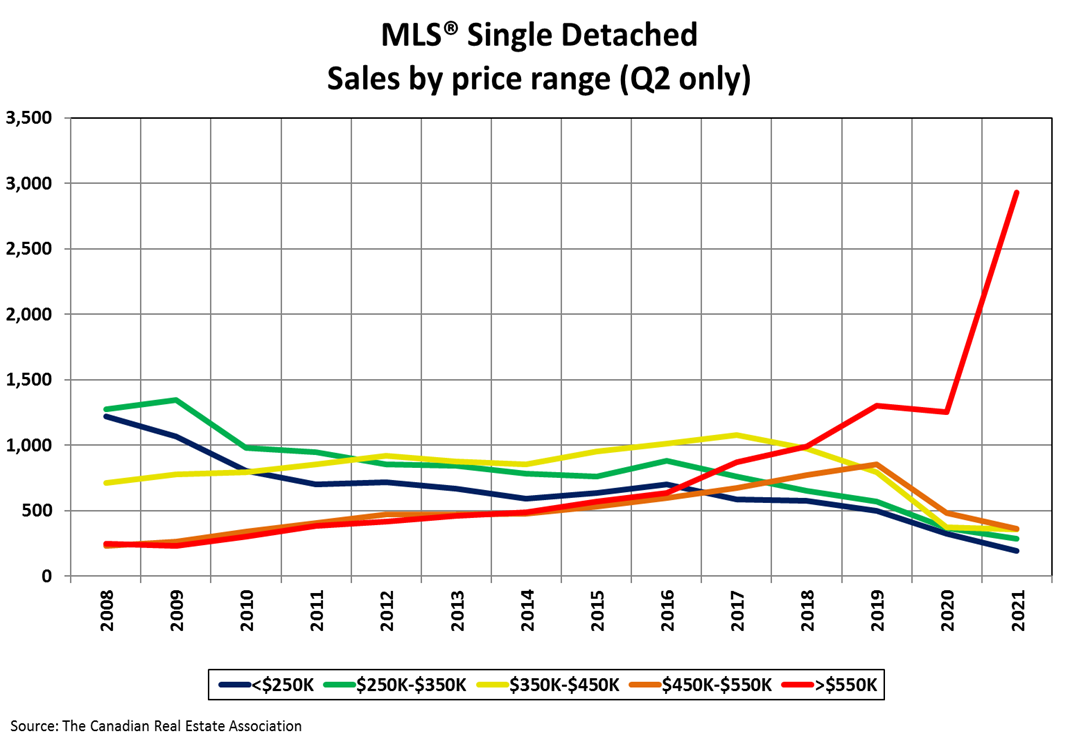

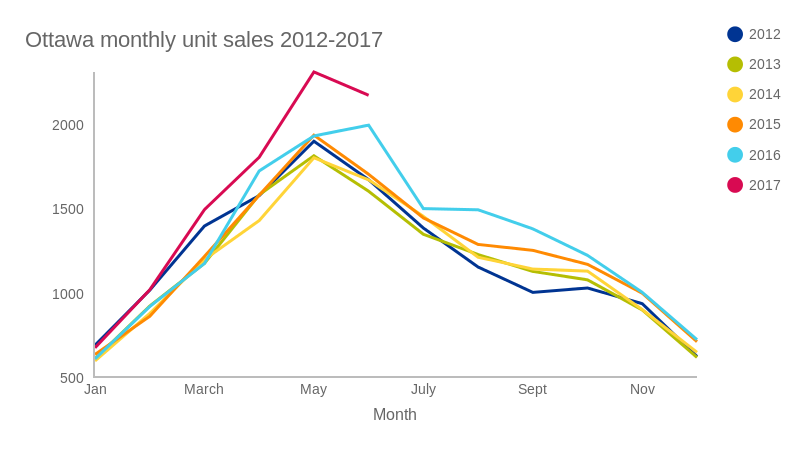

Year to date chart: November 2022 to November 2023 prices are UP +8.7% for that same average price on the same home. The way we are seeing things..is that more or less we are entering into a Normal Market +4%to 5% per year increases as per normal before 2015. Everyone at my brokerage thinks, home prices in Ottawa went up too aggressively and now the party is over in Toronto and now in Ottawa!

We don’t think Double digits profit and these aggressive increases per year in the Ottawa Real Estate market is a healthy market.

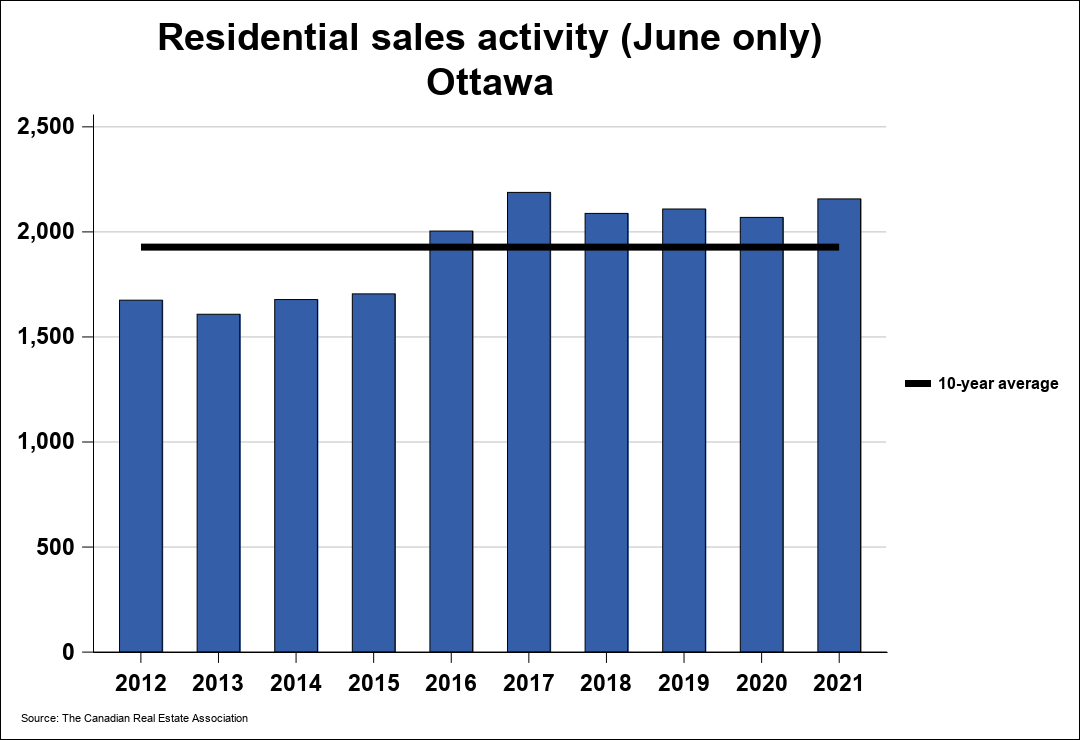

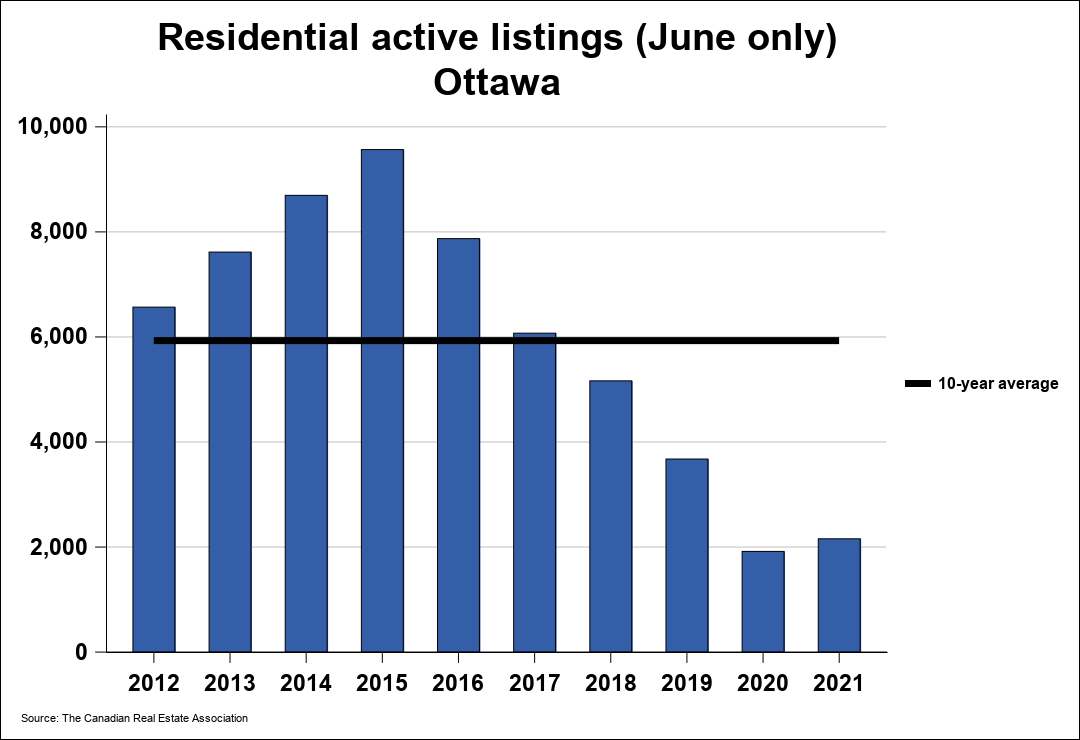

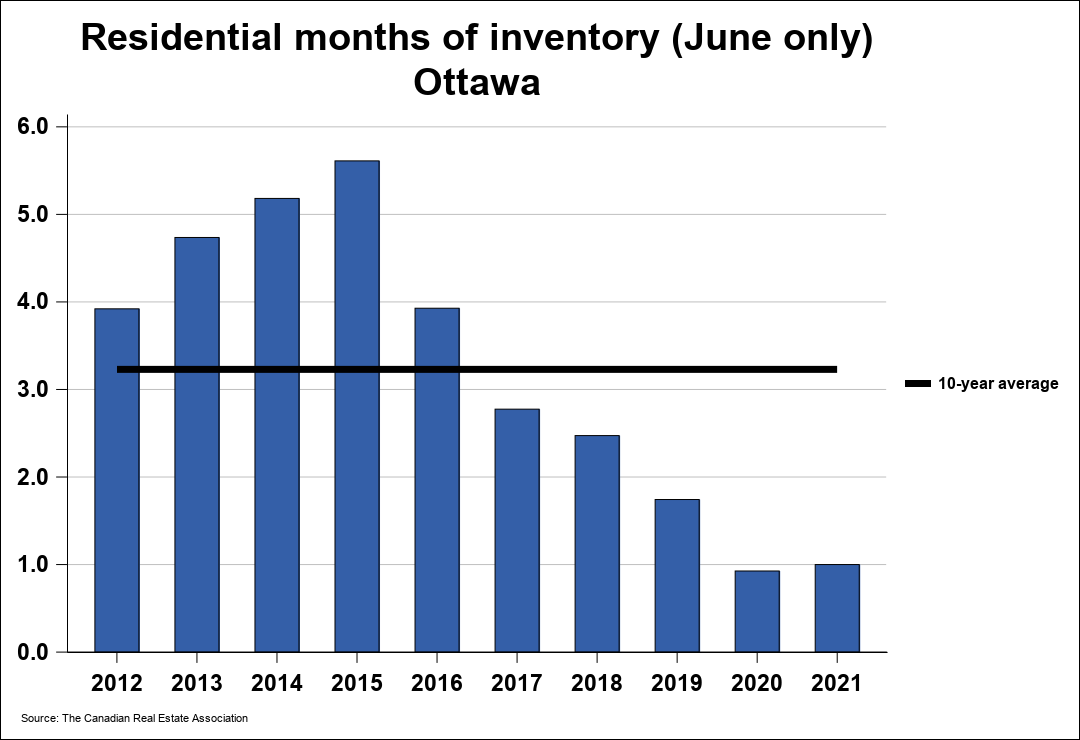

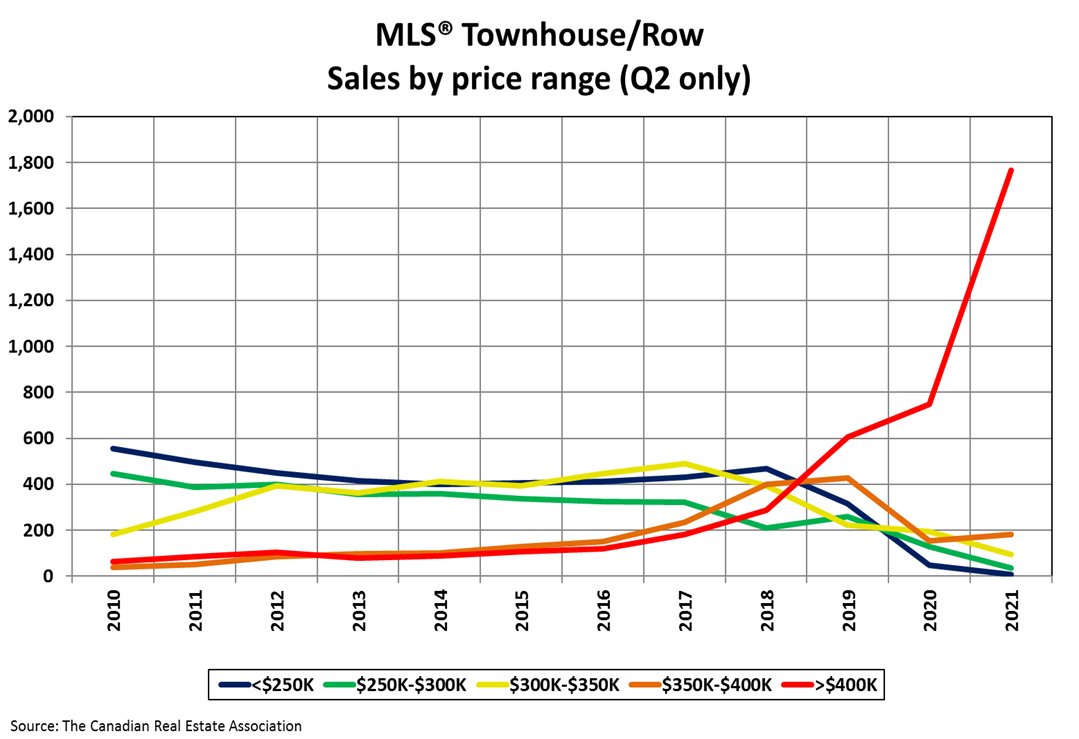

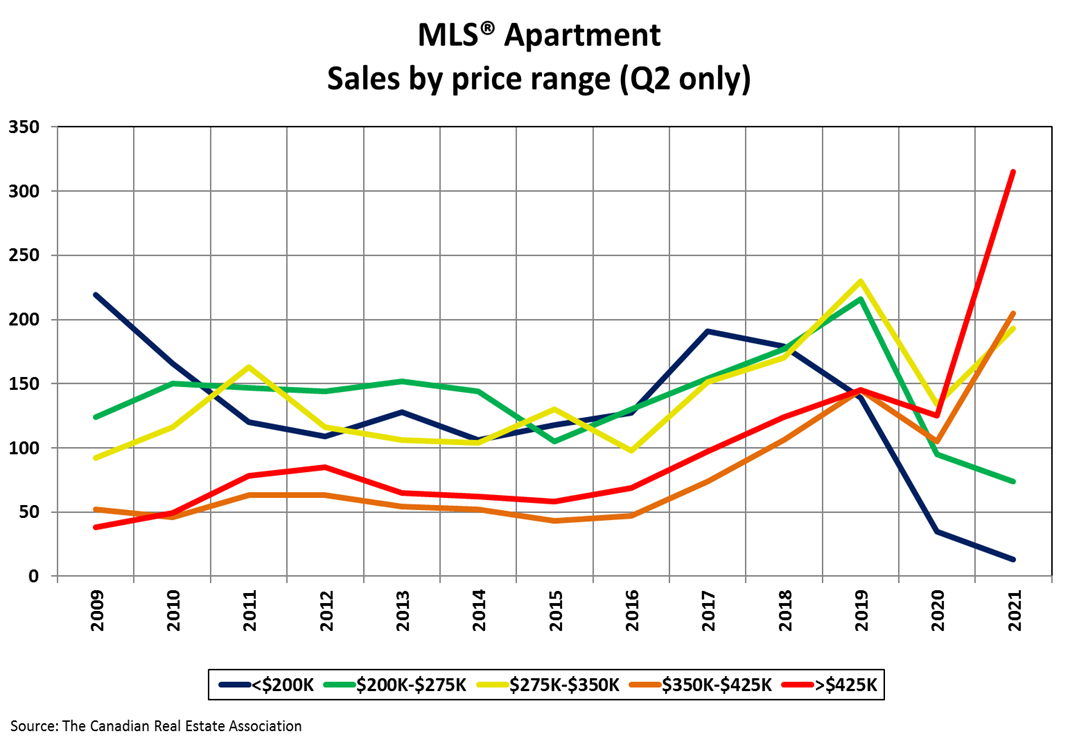

Lets talk a bit about supply:

New Homes Supply is still very low and will continue to create demand and that means you pay more. See Condos went up 9.3% this month because of affordability and a lack of homes. Over Supply of homes are also not good, and that was the case in the US HOUSING CRASH around 2008 it stalled or crashed most economies including Canada.

Construction and Renovation a difficult permit process.

I would say, we do need to get more homes constructed right now, and building a home should be made much much easier. But it seems today you need a University Degree to deal with the building departments for the Construction of a family home. Apparently my grandfather grade 8 education is no good in our times. With his hand drawings or ruler and pencil wouldn’t work today to get a permit and he constructed 100s of homes as a carpenter, and he had 9 children all educated and fed well. Some people can only afford 1 child. What is wrong with our system in 2022? It simply broken with greed and we are seeing life keeps getting more expensive, harder and more controls placed upon us. It’s impossible building a home or renovation for an apartment in your basement, or building a sons home at the back on your 5 acre land . Our permit system is designed to stop us from building homes. All construction approval is controlled by a few, just like oil.

Conclusion: How about if the city would design 5-10 home models (standard family homes) for you to chose from, free of charge and ready to go, engineered stamped and approved drawings, with all technical drawing stamped for insurance. All designed and Ready for a person to build his/her home on a piece of land. Wouldn’t that be cheaper for the citizen and our kids to build a home? Wouldn’t that ready to go models stop all this red tape, delays, paperwork dance, back and forth approval drawings, months of planning? Just my thoughts on helping people get a home faster! I also think the government should be more involved in the home building for its citizens in 2022 as many developing countries do and since we all now know we have a supply problem.

Did you know: In the last 10 years Builders were only releasing to build a few homes at a time, and selling them in an Auction Sales day Now!! 10 homes for a 100 buyer and you bid. First release Sales day! Prices will continue to climb aggressively if we don’t address these lack of new home supply issues soon. That’s just my thoughts.

Have a super month and remember investing in a property is always a good investment. Ask your parents what they paid for a home and see the future prices unfold.

Investment and opportunity

Let me help you to Build family Wealth in Real Estate. Join me one evening and let me show you where to invest in Real Estate for a wealthier family future.

Contact me anytime,

John

Just Sold

#barrhavenhomesforsale

#kanatahomesforsale

#ottawahomesforsale

#2022homepricesottawa