HOMES-FOR-SALE-OTTAWA – KANATA-HOMES-KANATA-OTTAWA HOMES FOR SALE – OTTAWA HOME PRICES SEPTEMBER 2022- OTTAWA CONDOS FOR SALE SEPTEMBER 2022 – LATEST OTTAWA REAL ESTATE NEWS.

Buyer Uncertainty Slows Down August Resale numbers.

But Prices are still up in Residential homes 10.2% and Condominium 8.8% from last year August .

September 6, 2022, Update from the Ottawa Real Estate Board.

September 6, 2022

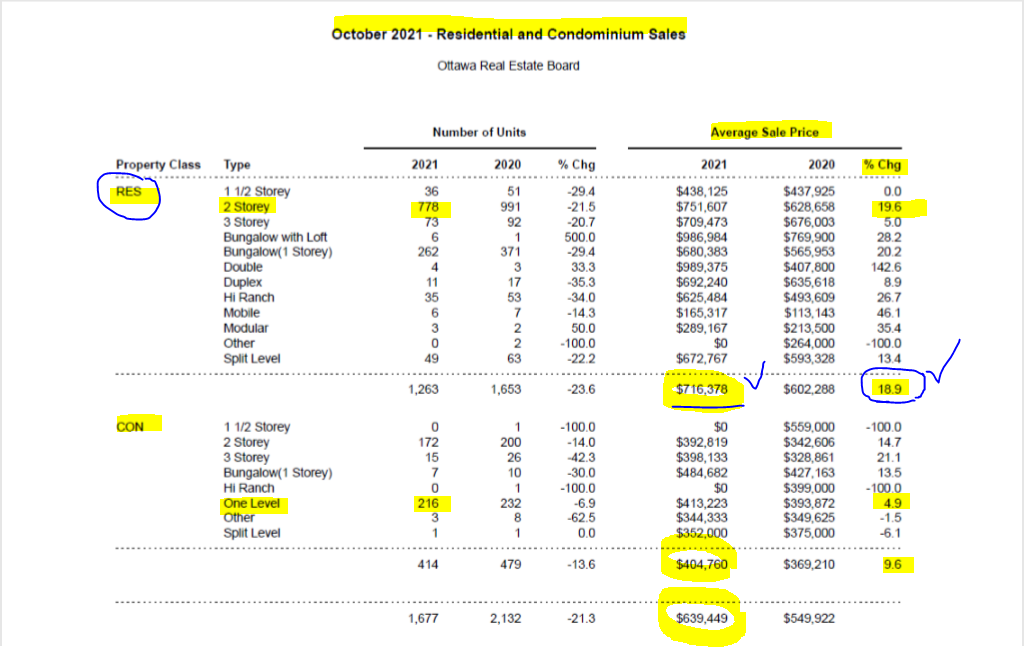

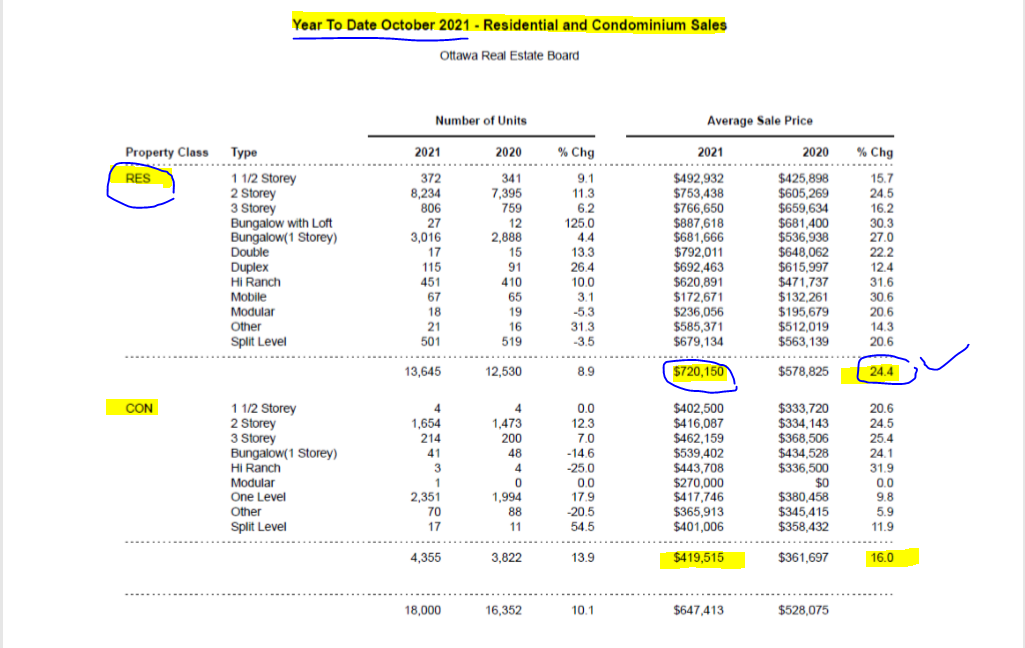

Members of the Ottawa Real Estate Board sold 1,137 residential properties in August through the Board’s Multiple Listing Service® System, compared with 1,565 in August 2021, a decrease of 27 per cent. August’s sales included 850 in the residential-property class, down 27 per cent from a year ago, and 287 in the condominium-property category, a decrease of 28 per cent from August 2021. The five-year average for total unit sales in August is 1,603.

“August is a traditionally slower month in Ottawa’s resale market ebb and flow cycle due to summer vacations. Compounding the slowdown in market activity, Buyers are uncertain about their purchasing power given impending additional interest rate hikes,” states Ottawa Real Estate Board President Penny Torontow.

“The lightning speed at which homes were selling at the start of 2022 is a thing of the past, evidenced by Days on Market (DOMs) inching closer to that 30-day mark. We have also observed a return to standard financing and inspection conditions and fewer multiple offer scenarios,” she adds.

Additional figures:

- The average sale price for a condominium-class property in August was $421,966, an increase of 4 per cent from 2021.

- The average sale price for a residential-class property was $707,712, increasing 5 per cent from a year ago.

- With year-to-date average sale prices at $795,978 for residential and $457,771 for condominiums, these values represent a 10 per cent and 9 percent increase over 2021, respectively.*

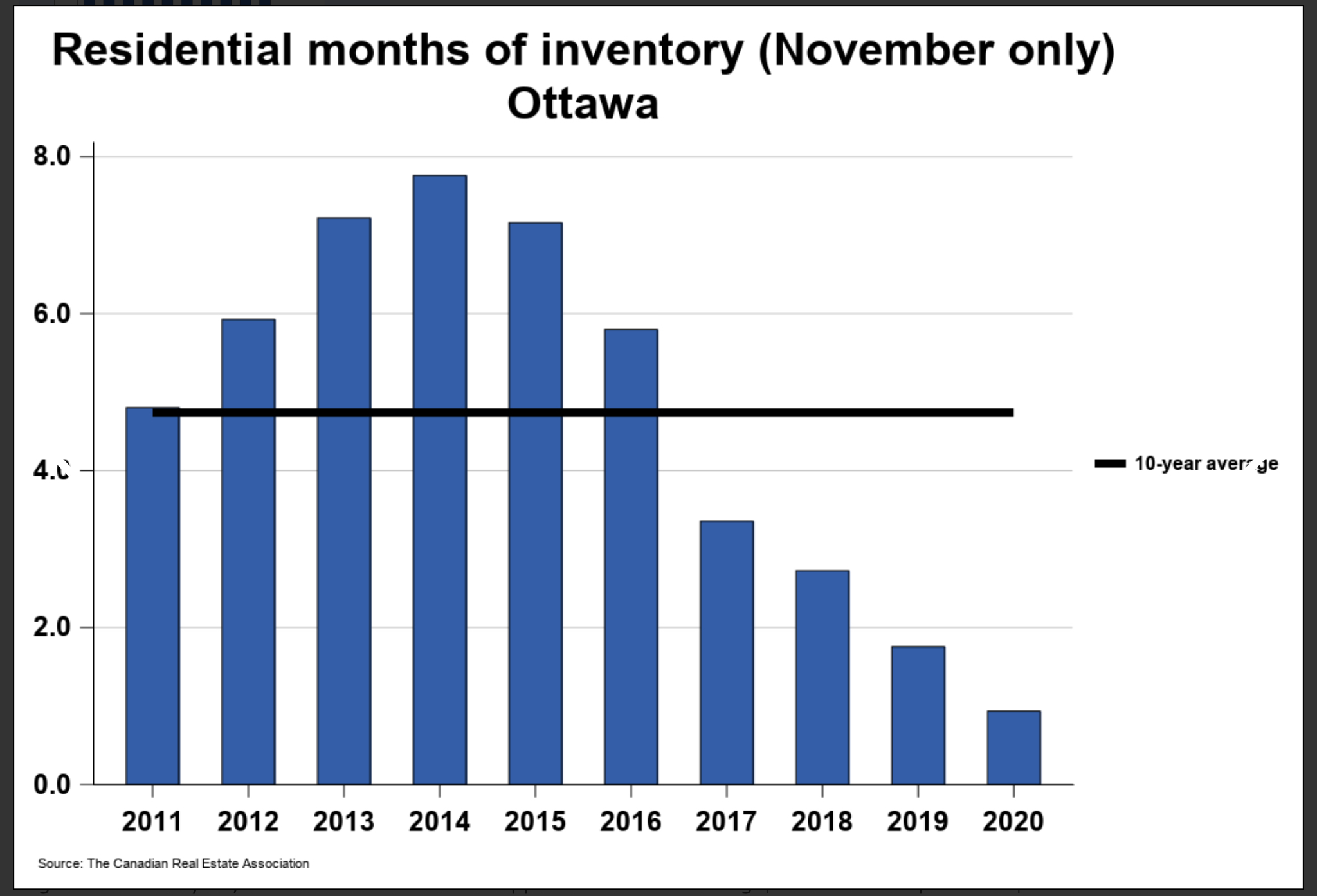

- 2,093 properties were listed in August, boosting inventory to nearly 3 months for residential class properties and 2.2 months for condominiums.

“Prices are still rising slightly in some areas, albeit lower single-digit percentage increases, bringing back the moderate price-growth stability that is characteristic of the Ottawa resale market. What happened to prices in 2020 and 2021 was unusual. We are moving towards a balanced market state, where Buyers have choices and Sellers need to ensure they are pricing their properties accurately,” Torontow advises.

“The informed market knowledge and insight of a licensed REALTOR® is critical to both Buyers and Sellers navigating market shifts. Sellers will want to closely explore with their REALTOR® the best time and price to list their home to optimize a property’s days on market. Buyers can use the extra time to work with their REALTOR® on due diligence and finding a dream home that meets their needs within their financial parameters.”

REALTORS® also help with finding rentals and vetting potential tenants. Since the beginning of the year, OREB Members have assisted clients with renting 4,172 properties compared to 3,182 last year at this time.

* OREB cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price will vary from neighbourhood to neighbourhood.

source OREB.

HOMES-FOR-SALE-OTTAWA – KANATA-HOMES-KANATA-OTTAWA HOMES FOR SALE – OTTAWA HOME PRICES FEBRUARY 2022- OTTAWA CONDOS FOR SALE 2022 – LATEST OTTAWA REAL ESTATE NEWS.

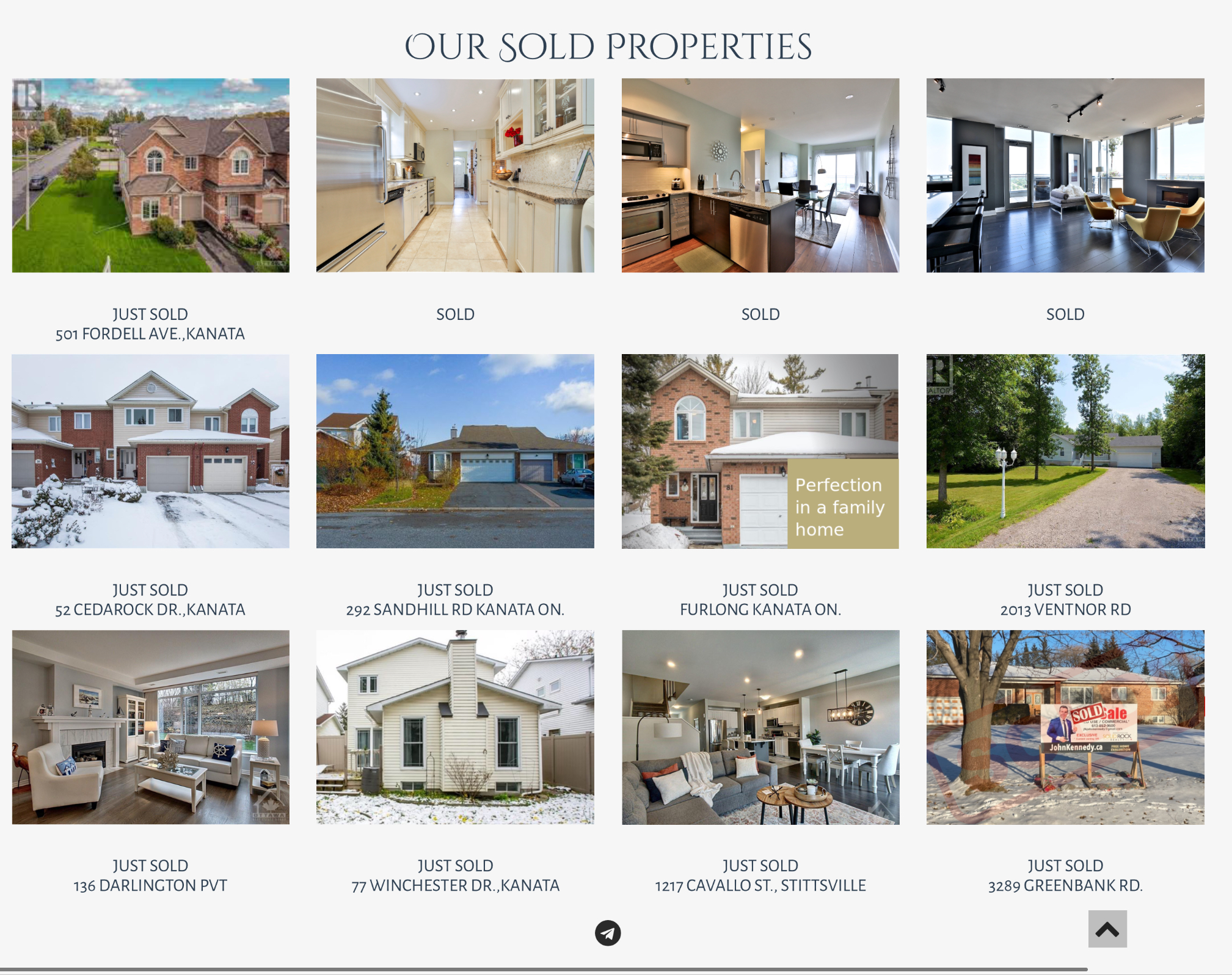

JUST SOLD

HOW MUST IS MY HOME WORTH?

AVERAGE MOVING PRICE SEPTEMBER 2022

JUST SOLD

HOW MUST IS MY HOME WORTH?

OTTAWA AVERAGE PRICES FROM SEPTEMBER 2022

OTTAWA AVERAGE PRICES FROM SEPTEMBER 2022

RECEIVE FREE PROFESSIONAL ADVICE BEFORE YOU BUY OR SELL.

AVERAGE PRICE CHANGES BY MONTH

HOMES-FOR-SALE-OTTAWA – KANATA-HOMES-KANATA-OTTAWA HOMES FOR SALE – OTTAWA HOME PRICES FEBRUARY 2022- OTTAWA CONDOS FOR SALE FEBRUARY 2022 – LATEST OTTAWA REAL ESTATE NEWS.

JOIN MY NEWSLETTER