Feb 2024 is a great time to sell

We have just seen a +14% increase since 2023 lowest price. Single family Homes in Ottawa prices Feb 15 2024. Detached 3 bedrooms home just went up +14.6% from 2023 prices.

source: oreb stats

Ottawa Real Estate Prices for 2024: Prices are going up 1.6% on a year-over-year

The OREB MLS OF Home Price Index (HPI) tracks price trends far more accurately than is possible using average or median price measures.

OREB cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price will vary from neighbourhood to neighbourhood.

LOW INVENTORY IN THE OTTAWA REAL ESATE MARKET JAN 2024

Still plague Market and causes prices to increase once again.

OTTAWA, December 5, 2023 – The number of

homes sold through the MLS® System of the

Ottawa Real Estate Board totaled 724 units in

November 2023. This was a small reduction of

1.6% from November 2022.

Home sales were 31.8% below the five-year

average and 27.4% below the 10-year average

for the month of November.

On a year-to-date basis, home sales totaled

11,421 units after 11 months of the year. This

was a large decline of 11.7% from the same

period in 2022.

“Sales are performing as expected with the

arrival of colder months, and an uptick in new

and active listings is bringing more choice back

into the market,” says OREB President Ken

Dekker. “While more choice may mean the pace

of buying and selling has slowed, that doesn’t

mean people looking to enter or upgrade in the

market should sit back. Prospective buyers or

those looking to upgrade have an opportunity

to collaborate with their REALTOR® to carefully

explore the market, identify the ideal property,

and negotiate an attractive deal at their

own pace. Sellers will have to manage their

expectations regarding the quantity of offers and

speed of transactions, and their REALTOR® is

the best resource to help them confidently price

and prepare their home for a quality sale.”

By the Numbers – Prices:

The MLS® Home Price Index (HPI) tracks price

trends far more accurately than is possible

using average or median price measures.

•

The overall MLS® HPI composite

benchmark price was $628,900 in

November 2023, a modest gain of 1.4%

from November 2022.

o The benchmark price for single-family

homes was $708,900, up 1.6% on a

year-over-year basis in November.

o By comparison, the benchmark price for

a townhouse/row unit was $492,300,

nearly unchanged, up 0.8% compared

to a year earlier.

o The benchmark apartment price was

$424,300, up 1.2% from year-ago

levels.

•

The average price of homes sold in

November 2023 was $633,138, decreasing

0.8% from November 2022. The more

comprehensive year-to-date average price

was $669,536, a decline of 5.7% from 11

months of 2022.

•

The dollar value of all home sales in

November 2023 was $458.4 million, down

2.4% from the same month in 2022.

OREB cautions that the average sale price

can be useful in establishing trends over

time but should not be used as an indicator

that specific properties have increased or

decreased in value. The calculation of the

average sale price is based on the total dollar

volume of all properties sold. Price will vary from

neighbourhood to neighbourhood.

By the Numbers – Inventory & New Listings

•

The number of new listings saw a minor

increase of 2.7% from November 2022.

There were 1,428 new residential listings

in November 2023. New listings were 8.4%

above the five-year average and 10.4%

above the 10-year average for the month

of November.

•

Active residential listings numbered

2,752 units on the market at the end of

November, a sizable gain of 15.8% from

the end of November 2022. Active listings

haven’t been this high in the month of

November in more than five years.

•

Active listings were 53.9% above the five-

year average and 6.7% below the 10-year

average for the month of November.

•

Months of inventory numbered 3.8 at the

end of November 2023, up from the 3.2

months recorded at the end of November

2022 and above the long-run average

of 3.3 months for this time of year. The

number of months of inventory is the

number of months it would take to sell

current inventories at the current rate of

sales activity.

Sources : OREB -CREA

September 20th, 2023

Source: OREB

The Ottawa Real Estate Board reported that its members sold 1,196 residential properties in August through the Board’s Multiple Listing Service® (MLS®) System data service, compared with 1,130 in August 2022, an increase of 6%. August’s sales included 903 in the freehold-property class, up 7% from a year ago, and 293 in the condominium-property category, a 2% increase from August 2022. The five-year average for total unit sales in August is 1,525.

“Ottawa Sales activity was up marginally on a year-over-year basis in August but remained well below the historical average for this time of year,” says Ken Dekker, OREB President. “There is no shortage of demand given increased immigration and the large Canadian population cohort entering the market. The lack of suitable, affordable housing is a hindrance. High borrowing costs and economic uncertainty are impacting both sellers and buyers, which we expect will continue to result in further market fluctuations.”

NUMBER OF HOME FOR SALE ARE LOWER THAN OTHER YEARS

IT LOOKS LIKE 2022 AND 2023 HAVE THE SAME AVERAGE SALE PRICE

LOW NUMBER OF LISTINGS, LOW SALE VOLUME 2023

IT LOOKS LIKE WE ARE STILL LOW ON LISTINGS

July 27th, 2023

All homes available for sale in Kanata.

Searching for homes for sale in Kanata? Look no further than The KENNEDY Real Estate Team. With several years of experience in selling homes in Kanata. We have extensive knowledge about various models, builders, and neighbourhoods such as: Beaverbrook, Katimavik, Bridlewood, Kanata Lakes, Morgan’s Grant, Trail West, and Elmwood.

In Kanata Ontario, there are several types of dwellings available: Single detached homes, row units townhouses, semi-detached homes, stacked townhouses, and apartments.

We are Currently seeking, 113 listings for sale in Kanata with an average price of approximately:

ALL JULY 2023 DETACHED HOMES AVERAGE PRICE $857,900.

Count on us to provide you with the true value. This free service will ensure you make an informed decision for your next home purchase in Kanata.

ASK FOR OUR FREE “PROPERTY REPORT ON VALUE AND COMPARABLE”.

All Kanata Home Listings on our IDX website.

| ML# | Address | List Price | Type | Style | Bds | Bths |

| 1349274 | 1016 TANGUAY CRT | $339,900 | 2STOREY | STACK | 2 | 2 |

| 1346861 | 1006 TANGUAY CRT | $349,900 | 2STOREY | STACK | 2 | 2 |

| 1347644 | 103 SALTER CRES | $379,900 | 2STOREY | ROW | 3 | 2 |

| 1353521 | 239 PICKFORD DR | $429,900 | 2STOREY | ROW | 3 | 2 |

| 1352685 | 21 BEST WAY | $438,000 | 2STOREY | ROW | 3 | 3 |

| 1345297 | 2033 CAMPEAU DR | $449,000 | 2STOREY | STACK | 2 | 2 |

| 1347915 | 300 TULUM CRES #H | $485,000 | 1LEVEL | STACK | 2 | 1 |

| 1339787 | 310 TULUM CRES #C | $499,900 | OTHER | STACK | 2 | 2 |

| 1339789 | 310 TULUM CRES #B | $499,900 | OTHER | STACK | 2 | 2 |

| 1349944 | 106 KINCARDINE DR | $516,000 | 2STOREY | ROW | 2 | 3 |

| 1344162 | 598 FOXLIGHT CIR | $528,900 | 3STOREY | ROW | 2 | 3 |

| 1352430 | 373 HILLSBORO PVT | $534,900 | 2STOREY | ROW | 3 | 3 |

| 1353245 | 21 STREAMBANK ST | $539,900 | 3STOREY | ROW | 2 | 2 |

| 1351777 | 516 ABERFOYLE CIR | $549,900 | 2STOREY | ROW | 3 | 2 |

| 1351967 | 1505 CAMPEAU DR | $549,999 | 2STOREY | STACK | 2 | 3 |

| 1351412 | 14 MEADOWBREEZE DR | $550,000 | 2STOREY | ROW | 3 | 3 |

| 1351319 | 29 STREAMBANK ST | $558,000 | 3STOREY | ROW | 3 | 2 |

| 1352962 | 127 ATTWELL PVT | $559,900 | 3STOREY | ROW | 2 | 3 |

| 1350428 | 161 ATTWELL PVT | $569,000 | 3STOREY | ROW | 2 | 2 |

| 1338221 | 398 HILLSBORO PVT | $569,900 | 2STOREY | ROW | 3 | 3 |

| 1350177 | 63 SPRINGCREEK CRES | $575,000 | 2STOREY | ROW | 3 | 2 |

| 1351338 | 4 SUNNYBROOKE DR | $575,000 | 2STOREY | ROW | 3 | 2 |

| 1351016 | 60 HELMSDALE DR | $599,900 | 2STOREY | ROW | 3 | 3 |

| 1351828 | 833 TABARET ST | $618,000 | 2STOREY | ROW | 3 | 3 |

| 1353591 | 586 BARRICK HILL RD | $619,900 | 2STOREY | ROW | 3 | 3 |

| 1353394 | 1326 HALTON TERR | $625,000 | 2STOREY | ROW | 3 | 3 |

| 1349339 | 738 OAKGLADE AVE | $629,900 | 2STOREY | ROW | 3 | 3 |

| 1352422 | 220 FORESTBROOK ST | $639,000 | 2STOREY | ROW | 3 | 3 |

| 1351156 | 94 SADDLESMITH CIR | $639,000 | 2STOREY | ROW | 3 | 3 |

| 1352406 | 201 OPUS ST | $649,900 | 2STOREY | ROW | 3 | 3 |

| 1352958 | 80 ROBARTS CRES | $649,900 | 2STOREY | ROW | 3 | 4 |

| 1352924 | 276 MAXWELL BRIDGE RD | $649,900 | 2STOREY | ROW | 3 | 3 |

| 1346702 | 30 HIGHMONT CRT | $650,000 | 2STOREY | SEMIDET | 3 | 3 |

| 1353652 | 29 COURTNEY RD | $654,900 | BUNGLOW | DETACH | 4 | 2 |

| 1346498 | 218 HUNTERBROOK ST N | $659,999 | 2STOREY | ROW | 3 | 3 |

| 1346233 | 100 PATRIOT PL | $669,900 | 2STOREY | ROW | 3 | 3 |

| 1350846 | 560 PEPPERVILLE CRES | $669,900 | 2STOREY | ROW | 3 | 3 |

| 1350828 | 120 SPRINGCREEK CRES | $674,900 | 2STOREY | DETACH | 3 | 2 |

| 1340559 | 804 STAR PVT | $684,900 | 3STOREY | ROW | 2 | 4 |

| 1343773 | 31 BACHMAN TERR | $694,900 | 3STOREY | ROW | 2 | 4 |

| 1342872 | 58 BLACKDOME CRES | $699,000 | 2STOREY | ROW | 3 | 2 |

| 1351794 | 7 CURRAN ST | $699,000 | 2STOREY | DETACH | 3 | 2 |

| 1347144 | 80 GOLDRIDGE DR | $699,900 | 2STOREY | ROW | 3 | 3 |

| 1350013 | 70 MERSEY AVE | $699,900 | 2STOREY | DETACH | 3 | 3 |

| 1343158 | 27 BACHMAN TERR | $704,900 | 3STOREY | ROW | 4 | 4 |

| 1345027 | 45 BACHMAN TERR | $714,900 | 3STOREY | ROW | 3 | 3 |

| 1344899 | 110 MACASSA CIR | $724,900 | SPLIT | ROW | 3 | 3 |

| 1348075 | 51 WATERTHRUSH CRES | $724,900 | BUNGLOW | SEMIDET | 3 | 3 |

| 1333567 | 69 EQUESTRIAN DR | $729,900 | 2STOREY | DETACH | 3 | 3 |

| 1344890 | 37 BACHMAN TERR | $734,900 | 3STOREY | ROW | 4 | 4 |

| 1350053 | 993 KLONDIKE RD | $735,000 | 2STOREY | ROW | 3 | 3 |

| 1339680 | 432 MEADOWBREEZE DR | $739,900 | 2STOREY | ROW | 4 | 3 |

| 1349133 | 283 KINGHAVEN CRES | $749,000 | 2STOREY | ROW | 3 | 4 |

| 1347577 | 95 VILLAGE GREEN | $749,999 | 2STOREY | DETACH | 4 | 2 |

| 1345492 | 21 WESTMEATH CRES | $757,000 | 2STOREY | DETACH | 3 | 3 |

| 1352433 | 2 SEWELL WAY | $769,900 | 2STOREY | DETACH | 4 | 3 |

| 1348719 | 554 HITZLAY CRES | $770,250 | 2STOREY | ROW | 3 | 3 |

| 1352974 | 66 MACASSA CIR | $790,000 | 3STOREY | ROW | 2 | 3 |

| 1352026 | 42 FOULIS CRES | $794,000 | BUNGLOW | ROW | 3 | 3 |

| 1348104 | 4 TURNBULL AVE | $799,900 | 2STOREY | DETACH | 3 | 3 |

| 1351607 | 26 FOXLEIGH CRES | $799,900 | 2STOREY | DETACH | 4 | 4 |

| 1353089 | 33 SPUR AVE | $799,900 | 2STOREY | DETACH | 4 | 4 |

| 1353349 | 58 BRIDLE PARK DR | $799,900 | 2STOREY | DETACH | 4 | 3 |

| 1347391 | 182 OVERBERG WAY | $809,900 | 2STOREY | ROW | 3 | 4 |

| 1352046 | 194 FLOWING CREEK CIR | $829,900 | 2STOREY | DETACH | 4 | 4 |

| 1348237 | 65 CROWNRIDGE DR | $839,900 | 2STOREY | DETACH | 3 | 3 |

| 1352949 | 24 RIVERGREEN CRES | $839,900 | 2STOREY | DETACH | 3 | 3 |

| 1352972 | 140 BRIDGESTONE DR | $849,900 | 2STOREY | DETACH | 4 | 3 |

| 1339798 | 819 PETRA PVT | $850,000 | 3STOREY | ROW | 3 | 4 |

| 1352306 | 135 SOLARIS DR | $855,000 | 2STOREY | DETACH | 4 | 4 |

| 1351387 | 441 TILLSONBURG ST | $875,000 | 2STOREY | DETACH | 3 | 3 |

| 1350782 | 122 WHERNSIDE TERR | $885,000 | 2STOREY | DETACH | 4 | 4 |

| 1353183 | 2 BRADLEY FARM CRT | $899,900 | 2STOREY | DETACH | 4 | 4 |

| 1346499 | 4 BRADLEY FARM CRT | $899,999 | 2STOREY | DETACH | 6 | 4 |

| 1348913 | 26 PELLAN CRES N | $936,000 | 2STOREY | DETACH | 4 | 3 |

| 1348723 | 15 RUTHERFORD CRES | $945,000 | 2STOREY | DETACH | 4 | 3 |

| 1346322 | 803 OAKSIDE CRES | $959,000 | 2STOREY | DETACH | 5 | 4 |

| 1348720 | 360 ABBEYDALE CIR | $969,900 | 2STOREY | DETACH | 4 | 3 |

| 1346305 | 614 BRIDLEGLEN CRES | $979,990 | 2STOREY | DETACH | 3 | 3 |

| 1330947 | 27 SOLARIS DR | $989,900 | 2STOREY | DETACH | 4 | 4 |

| 1350083 | 19 RUTHERFORD CRES | $989,900 | 2STOREY | DETACH | 4 | 4 |

| 1342008 | 42 STONECROFT TERR | $998,000 | BUNGLOW | DETACH | 4 | 3 |

| 1346782 | 178 GYRFALCON CRES | $999,000 | 2STOREY | DETACH | 5 | 4 |

| 1347064 | 11 TURTLE POINT PVT | $999,000 | BGWL | ROW | 4 | 4 |

| 1347484 | 2004 ALLEGRINI TERR | $999,900 | 2STOREY | DETACH | 4 | 3 |

| 1343628 | 343 SUGAR PINE CRES | $1,029,000 | 2STOREY | DETACH | 3 | 3 |

| 1350372 | 10 JARLAN TERR | $1,039,000 | 2STOREY | DETACH | 4 | 3 |

| 1346589 | 11 MENDOZA WAY | $1,049,000 | 2STOREY | DETACH | 4 | 3 |

| 1352264 | 328 LAUGHLIN CIR | $1,050,000 | 2STOREY | DETACH | 4 | 3 |

| 1345277 | 8 EVANSHEN CRES | $1,100,000 | 2STOREY | DETACH | 4 | 3 |

| 1350338 | 26 VARLEY DR | $1,150,000 | 2STOREY | DETACH | 4 | 3 |

| 1349314 | 9 ROSETHORN WAY | $1,188,800 | 2STOREY | DETACH | 5 | 4 |

| 1345120 | 138 STEEPLE CHASE DR | $1,199,900 | 2STOREY | DETACH | 4 | 4 |

| 1350186 | 36 ROSENFELD CRES | $1,225,000 | 2STOREY | DETACH | 4 | 4 |

| 1340309 | 123 GRAINSTONE WAY | $1,299,900 | 2STOREY | DETACH | 4 | 4 |

| 1350133 | 50 OSPREY CRES | $1,299,900 | 2STOREY | DETACH | 8 | 5 |

| 1345061 | 28 GREENSAND PL | $1,300,000 | 2STOREY | DETACH | 4 | 4 |

| 1343176 | 396 HUNTSVILLE DR | $1,349,000 | 2STOREY | DETACH | 4 | 4 |

| 1344490 | 250 KETCHIKAN CRES | $1,395,800 | 2STOREY | DETACH | 4 | 4 |

| 1346597 | 55 IRONSIDE CRT | $1,399,000 | 2STOREY | DETACH | 4 | 3 |

| 1350049 | 523 BRECCIA HTS | $1,399,000 | 2STOREY | DETACH | 4 | 5 |

| 1350623 | 139 INGERSOLL CRES | $1,424,900 | 2STOREY | DETACH | 5 | 3 |

| 1345728 | 348 ABBEYDALE CIR | $1,450,000 | 2STOREY | DETACH | 5 | 5 |

| 1352289 | 60 ROSENFELD CRES | $1,495,000 | 2STOREY | DETACH | 4 | 4 |

| 1352517 | 15 KANATA ROCKERIES PVT | $1,495,000 | 2STOREY | DETACH | 4 | 5 |

| 1352529 | 65 IRONSIDE CRT | $1,499,000 | 2STOREY | DETACH | 5 | 3 |

| 1345689 | 1098 BLANDING ST | $1,539,000 | 2STOREY | DETACH | 4 | 5 |

| 1347414 | 525 BRECCIA HTS | $1,548,000 | 2STOREY | DETACH | 5 | 5 |

| 1349077 | 44 IRONSIDE CRT | $1,625,000 | 2STOREY | DETACH | 4 | 4 |

| 1351597 | 3 GOULDING CRES | $1,685,000 | 2STOREY | DETACH | 4 | 3 |

| 1349776 | 65 WALDEN DR | $1,750,000 | 2STOREY | DETACH | 6 | 5 |

Count on us to provide you with the true value. This free service will ensure you make an informed decision for your next home purchase in Kanata.

ASK FOR OUR FREE “PROPERTY REPORT ON VALUE AND COMPARABLE”.

Try to broaden your current search criteria

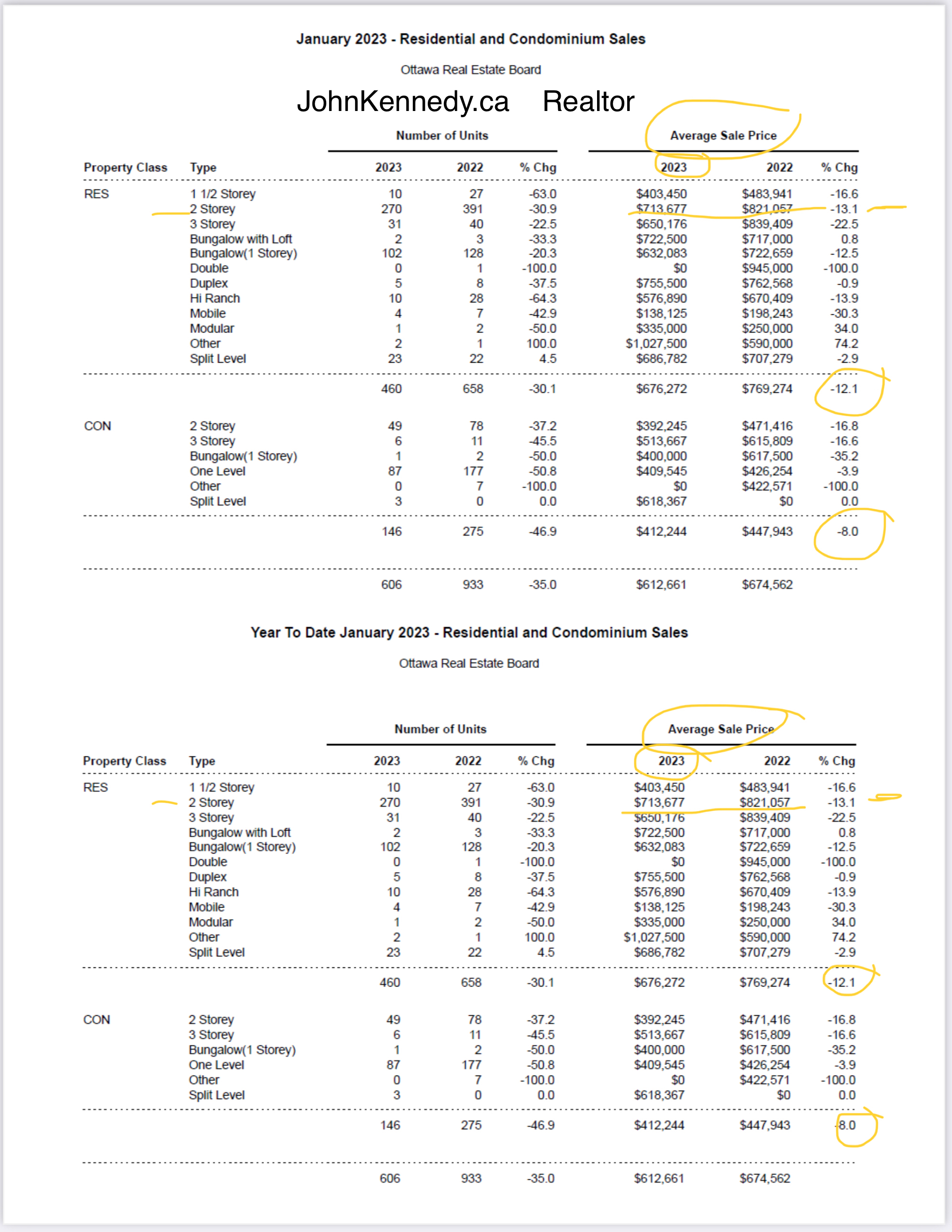

February 2, 2023

Members of the Ottawa Real Estate Board (OREB) sold 606 residential properties in January through the Board’s Multiple Listing Service® (MLS®) System, compared with 933 in January 2022, a decrease of 35%. January’s sales included 460 in the freehold-property class, down 30% from a year ago, and 146 in the condominium-property category, a decrease of 47% from January 2022. The five-year average for total unit sales in January is 819.

“January’s marked slow down in unit sales over 2022 indicates potential home buyers are taking their time,” says OREB President Ken Dekker. “While last month saw the culmination of the succession of interest rate hikes announced by the Bank of Canada, affordability remains a factor. They may be waiting for a shift in listing prices. They’re being cautious in uncertain conditions.”

By the Numbers – Average Prices*:

“Despite the decrease in average prices, the market should not be considered on a downward slide,” says Dekker. “A hyper COVID-19 seller’s market is now leveling out to our current balanced market state.”

“On a positive note, in comparison to December’s figures, January’s average price of freehold properties increased by 3%. The average price of condos did fall by 5% compared to December but condo pricing tends to fluctuate more due to the small data set.”

By the Numbers – Inventory & New Listings:

“Ottawa’s inventory and days on market figures are typical for a balanced market and another sign that buyers are no longer racing to put in an offer,” says Dekker. “The increase in new listings and supply is a boon for home buyers, who now have more selection and the ability to put in conditions at a less frantic pace. REALTORS® are an essential resource in finding the right property for the right buyer. On the other side of the transaction, REALTORS® can help sellers with hyper-local insights about how to sell in their neighbourhood at a time when pricing is key.”

More people are turning to REALTORS® for help renting properties — 509 this month compared to 410 in January 2022, an increase of 24%. “Even with the increase in housing stock, the tighter rental market is another indication that affordability is keeping some potential buyers on the sidelines.”

* OREB cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price will vary from neighbourhood to neighbourhood.

Market Prices Sold and Changes

As we take a closer look at these November 2022 Real Estate prices below and above. We are seeing a 2 storey home selling for less this month. Listing a higher price, but Selling Less. The average price has dropped to (-4.3%) and homes are staying longer on the market.

So let’s look even closer:

Year to date chart: November 2022 to November 2023 prices are UP +8.7% for that same average price on the same home. The way we are seeing things..is that more or less we are entering into a Normal Market +4%to 5% per year increases as per normal before 2015. Everyone at my brokerage thinks, home prices in Ottawa went up too aggressively and now the party is over in Toronto and now in Ottawa!

We don’t think Double digits profit and these aggressive increases per year in the Ottawa Real Estate market is a healthy market.

Lets talk a bit about supply:

New Homes Supply is still very low and will continue to create demand and that means you pay more. See Condos went up 9.3% this month because of affordability and a lack of homes. Over Supply of homes are also not good, and that was the case in the US HOUSING CRASH around 2008 it stalled or crashed most economies including Canada.

Construction and Renovation a difficult permit process.

I would say, we do need to get more homes constructed right now, and building a home should be made much much easier. But it seems today you need a University Degree to deal with the building departments for the Construction of a family home. Apparently my grandfather grade 8 education is no good in our times. With his hand drawings or ruler and pencil wouldn’t work today to get a permit and he constructed 100s of homes as a carpenter, and he had 9 children all educated and fed well. Some people can only afford 1 child. What is wrong with our system in 2022? It simply broken with greed and we are seeing life keeps getting more expensive, harder and more controls placed upon us. It’s impossible building a home or renovation for an apartment in your basement, or building a sons home at the back on your 5 acre land . Our permit system is designed to stop us from building homes. All construction approval is controlled by a few, just like oil.

Conclusion: How about if the city would design 5-10 home models (standard family homes) for you to chose from, free of charge and ready to go, engineered stamped and approved drawings, with all technical drawing stamped for insurance. All designed and Ready for a person to build his/her home on a piece of land. Wouldn’t that be cheaper for the citizen and our kids to build a home? Wouldn’t that ready to go models stop all this red tape, delays, paperwork dance, back and forth approval drawings, months of planning? Just my thoughts on helping people get a home faster! I also think the government should be more involved in the home building for its citizens in 2022 as many developing countries do and since we all now know we have a supply problem.

Did you know: In the last 10 years Builders were only releasing to build a few homes at a time, and selling them in an Auction Sales day Now!! 10 homes for a 100 buyer and you bid. First release Sales day! Prices will continue to climb aggressively if we don’t address these lack of new home supply issues soon. That’s just my thoughts.

Have a super month and remember investing in a property is always a good investment. Ask your parents what they paid for a home and see the future prices unfold.

Let me help you to Build family Wealth in Real Estate. Join me one evening and let me show you where to invest in Real Estate for a wealthier family future.

Contact me anytime,

John

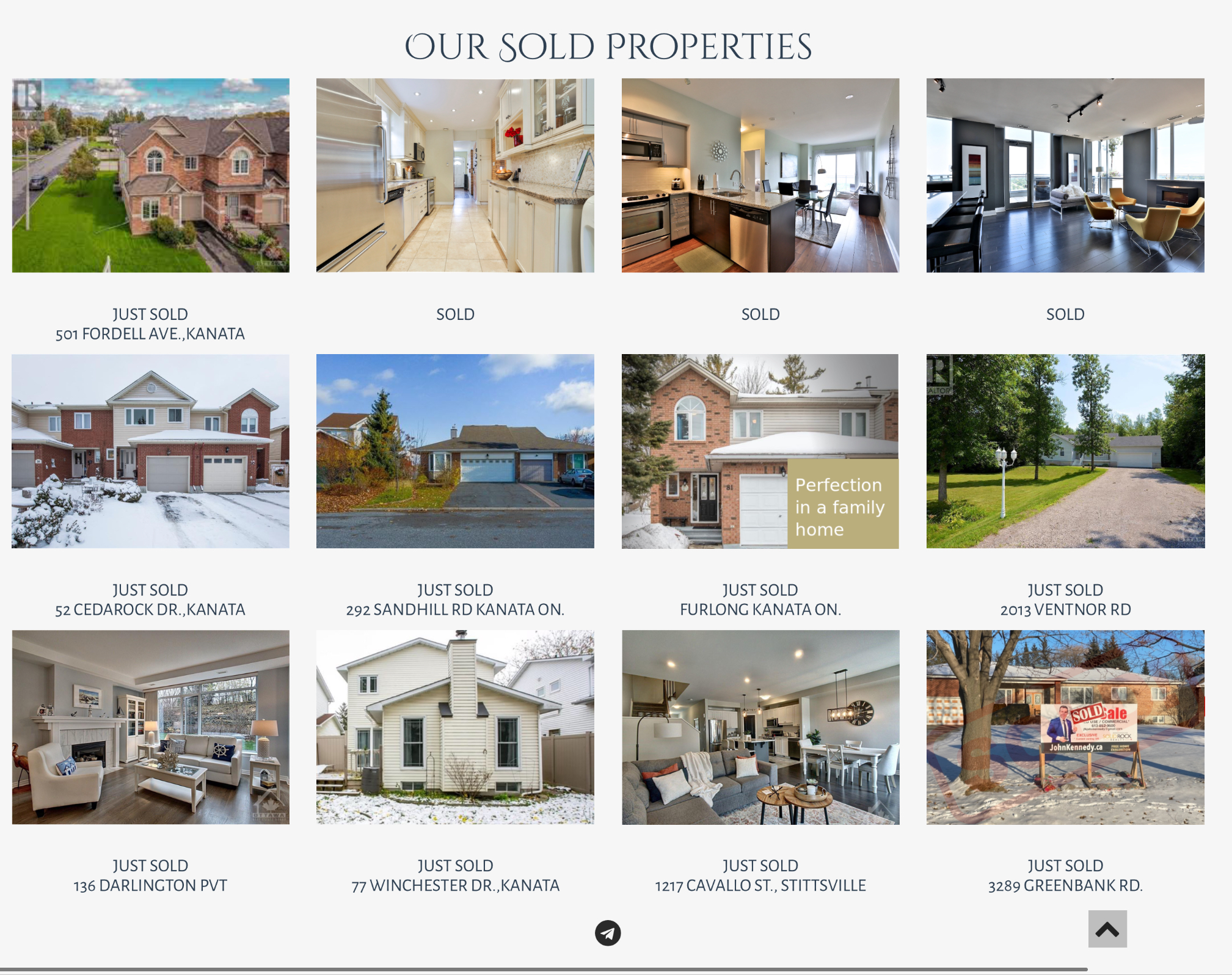

Just Sold

#barrhavenhomesforsale

#kanatahomesforsale

#ottawahomesforsale

#2022homepricesottawa

September 6, 2022, Update from the Ottawa Real Estate Board.

September 6, 2022

Members of the Ottawa Real Estate Board sold 1,137 residential properties in August through the Board’s Multiple Listing Service® System, compared with 1,565 in August 2021, a decrease of 27 per cent. August’s sales included 850 in the residential-property class, down 27 per cent from a year ago, and 287 in the condominium-property category, a decrease of 28 per cent from August 2021. The five-year average for total unit sales in August is 1,603.

“August is a traditionally slower month in Ottawa’s resale market ebb and flow cycle due to summer vacations. Compounding the slowdown in market activity, Buyers are uncertain about their purchasing power given impending additional interest rate hikes,” states Ottawa Real Estate Board President Penny Torontow.

“The lightning speed at which homes were selling at the start of 2022 is a thing of the past, evidenced by Days on Market (DOMs) inching closer to that 30-day mark. We have also observed a return to standard financing and inspection conditions and fewer multiple offer scenarios,” she adds.

Additional figures:

“Prices are still rising slightly in some areas, albeit lower single-digit percentage increases, bringing back the moderate price-growth stability that is characteristic of the Ottawa resale market. What happened to prices in 2020 and 2021 was unusual. We are moving towards a balanced market state, where Buyers have choices and Sellers need to ensure they are pricing their properties accurately,” Torontow advises.

“The informed market knowledge and insight of a licensed REALTOR® is critical to both Buyers and Sellers navigating market shifts. Sellers will want to closely explore with their REALTOR® the best time and price to list their home to optimize a property’s days on market. Buyers can use the extra time to work with their REALTOR® on due diligence and finding a dream home that meets their needs within their financial parameters.”

REALTORS® also help with finding rentals and vetting potential tenants. Since the beginning of the year, OREB Members have assisted clients with renting 4,172 properties compared to 3,182 last year at this time.

* OREB cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price will vary from neighbourhood to neighbourhood.

source OREB.

OTTAWA AVERAGE PRICES FROM SEPTEMBER 2022

OTTAWA AVERAGE PRICES FROM SEPTEMBER 2022

The Members of the Ottawa Real Estate Board sold 936 residential properties in January through the Board’s Multiple Listing Service® System, compared with 963 in January 2021, a decrease of 3 per cent. January’s sales included 661 in the residential-property class, down 2 per cent from a year ago, and 275 in the condominium-property category, a decrease of 5 per cent from January 2021. The five-year average for total unit sales in January is 840.

“January’s sales, almost identical to 2021’s, were very strong for a traditionally slower month, especially given the frigid temperatures and increased government Covid-19 restrictions we experienced,” states Ottawa Real Estate Board President Penny Torontow. “This increased activity compared to previous years is not solely a pandemic phenomenon. Yes, the pandemic has accelerated market activity in some ways, but pent-up Buyer demand due to the housing supply shortage has been an ongoing fundamental issue for the Ottawa resale market for well over 5 years now – and the price increases will continue to reflect that until the housing stock grows.”

The average sale price for a condominium-class property in January was $447,943, an increase of 18 per cent from 2021, while the average sale price for a residential-class property was $771,739, increasing 14 per cent from a year ago.*

“Average prices continue to rise steadily with the lack of inventory pushing prices to levels previously unseen. We only need to observe the number of homes now selling over $1M for a clear demonstration. In 2020, they represented 3% of residential sales, in 2021, they held 9% of the market’s resales, and now in 2022, that number reflects close to 14% of detached home sales.”

“Meanwhile, the residential-class properties selling within the $650-$900K range represent 47% of all of January’s residential unit sales. In 2021, it was 33%. But we must keep in mind, average prices statistics amalgamate data from the entire city, so while in some areas the increases would be less, other pockets of Ottawa may see more,” advises Torontow.

“The condo market is also flourishing both in number of sales and prices. Possibly due to the fact that residential units may be out of reach for some Buyers, they are finding themselves more open to this option and are actually able to find a condominium-class property within their budget.”

“Bad weather, pandemic lockdowns, it doesn’t matter – Ottawa remains a fast-moving, active, and robust market. So, if you are thinking of selling your property, there has never been a better time. Contact a REALTOR® who can explain the various factors that will help you get the best price for your home today.” In addition to residential sales, OREB Members assisted clients with renting 410 properties in January 2022 compared to 333 in 2021.

* OREB cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price will vary from neighbourhood to neighbourhood.

source OREB.

OTTAWA AVERAGE PRICES FROM JAN 2012 TO FEB 2022

OTTAWA AVERAGE PRICES FROM JAN 2012 TO FEB 2022