HOMES WITH 4 BEDROOMS SOLD PRICES IN KANATA TODAY

Source OREB

Invalid Listing ID

Source: Our Ottawa Real Estate board

REPORT: Feb 16 2021

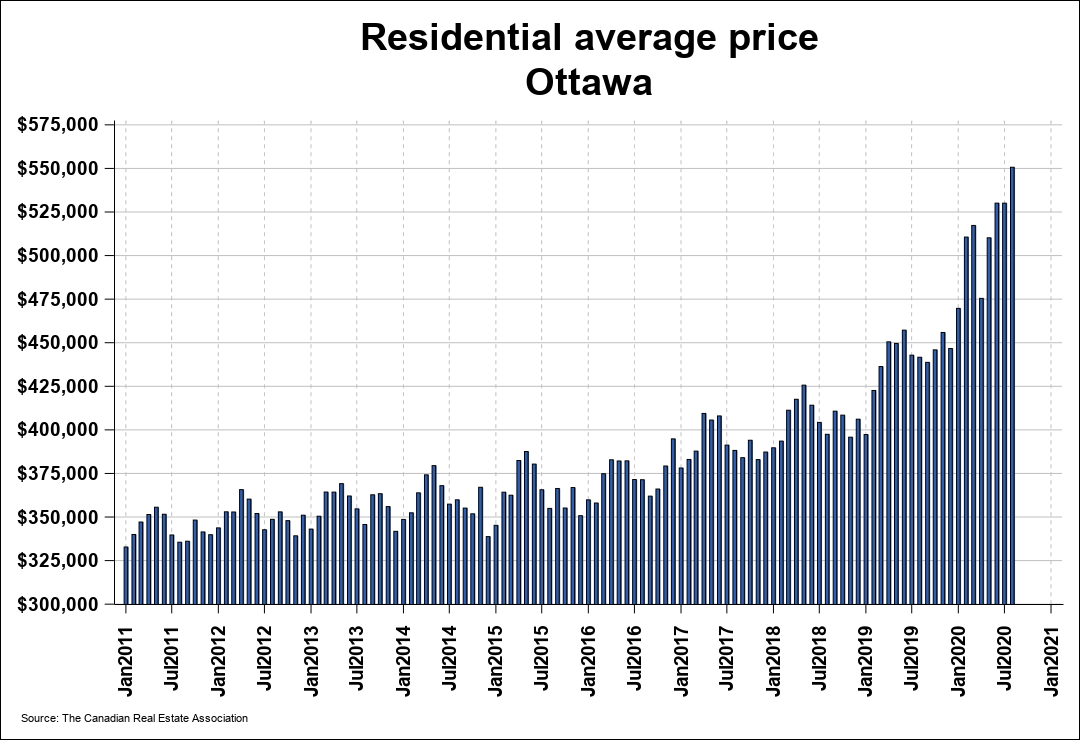

My information and research is based on the CREA and OREB stats and charts for this month.

OTTAWA, February 3, 2021 – Members of the Ottawa Real Estate Board sold 964 residential properties in January through the Board’s Multiple Listing Service® System, compared with 778 in January 2020, an increase of 24 per cent. January’s sales included 674 in the residential-property class, up 21 per cent from a year ago, and 290 in the condominium-property category, an increase of 31 per cent from January 2020. The five-year average for total unit sales in January is 786.

“Pent-up Buyer demand fueled the exceptional number of sales that took place in January even as the mid-month lockdown further restricted supply. Earlier in the month, listing activity increased, likely driven by those Sellers waiting until after the holiday season to put their properties on the market.

However, once the Stay-at-Home Order was announced, Sellers pulled back (rightfully so) and the number of properties entering the market declined,” states Ottawa Real Estate Board President Debra Wright.

“Even though inventory is up from last month, it is still down substantially from last year at this time with 43% fewer properties on the market. This inventory shortage coupled with strong demand triggered a brisk pace to the market. We would have certainly seen higher sales numbers if there were more properties available because the demand is definitely there.”

January’s average sale price for a condominium-class property was $380,336, an increase of 13 per cent from last year, while the average sale price of a residential-class property was $677,197, an increase of 31 per cent from a year ago. Compared to December, the average price for residential-class properties has increased by 12 per cent, and the average price for condominium-class units is 7 per cent higher.* range, while last year at this time, there were only 16 transactions. Sustained price movements are better reflected during the mid to latter part of the year, where trends begin to emerge, and comparisons can be drawn,” advises Wright. “This leads me into my next point – market activity has curtailed, there is no question about that, with January resale numbers lower than what we saw in December. But the effects of this second lockdown will not be entirely measurable until the coming months, dependent on when the mandated Stay- at-Home Order is retracted. If the lockdown is extended, that could affect the market in the longer term; however, as we saw last year, the market was resilient throughout and is being driven by the needs of Buyers and Sellers,” Wright concludes.

In addition to residential sales, OREB Members assisted clients with renting 333 properties in January 2021 compared with 243 in January 2020.

* The Board cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price and conditions will vary from neighbourhood to neighbourhood. “I would like to caution those looking at the increase in average prices this month and believing that property values are accelerating at an extreme pace. In January, there was considerable movement in the upper end of the market, which caused a bit of an anomalous outcome in average price percentages. For example, there were 63 sales in the $1M+ price

Invalid Listing ID

CREA DDF® Data

Source: Our Ottawa Real Estate board

REPORT: Feb 16 2021

My information and research is based on the CREA and OREB stats and charts for this month.

OTTAWA, February 3, 2021 – Members of the Ottawa Real Estate Board sold 964 residential properties in January through the Board’s Multiple Listing Service® System, compared with 778 in January 2020, an increase of 24 per cent. January’s sales included 674 in the residential-property class, up 21 per cent from a year ago, and 290 in the condominium-property category, an increase of 31 per cent from January 2020. The five-year average for total unit sales in January is 786.

“Pent-up Buyer demand fueled the exceptional number of sales that took place in January even as the mid-month lockdown further restricted supply. Earlier in the month, listing activity increased, likely driven by those Sellers waiting until after the holiday season to put their properties on the market.

However, once the Stay-at-Home Order was announced, Sellers pulled back (rightfully so) and the number of properties entering the market declined,” states Ottawa Real Estate Board President Debra Wright.

“Even though inventory is up from last month, it is still down substantially from last year at this time with 43% fewer properties on the market. This inventory shortage coupled with strong demand triggered a brisk pace to the market. We would have certainly seen higher sales numbers if there were more properties available because the demand is definitely there.”

January’s average sale price for a condominium-class property was $380,336, an increase of 13 per cent from last year, while the average sale price of a residential-class property was $677,197, an increase of 31 per cent from a year ago. Compared to December, the average price for residential-class properties has increased by 12 per cent, and the average price for condominium-class units is 7 per cent higher.* range, while last year at this time, there were only 16 transactions. Sustained price movements are better reflected during the mid to latter part of the year, where trends begin to emerge, and comparisons can be drawn,” advises Wright. “This leads me into my next point – market activity has curtailed, there is no question about that, with January resale numbers lower than what we saw in December. But the effects of this second lockdown will not be entirely measurable until the coming months, dependent on when the mandated Stay- at-Home Order is retracted. If the lockdown is extended, that could affect the market in the longer term; however, as we saw last year, the market was resilient throughout and is being driven by the needs of Buyers and Sellers,” Wright concludes.

In addition to residential sales, OREB Members assisted clients with renting 333 properties in January 2021 compared with 243 in January 2020.

* The Board cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price and conditions will vary from neighbourhood to neighbourhood. “I would like to caution those looking at the increase in average prices this month and believing that property values are accelerating at an extreme pace. In January, there was considerable movement in the upper end of the market, which caused a bit of an anomalous outcome in average price percentages. For example, there were 63 sales in the $1M+ price

OTTAWA REAL ESTATE NEWS- Here is my report and views of the current real estate market values in Ottawa, Kanata and to Orleans.

Members of the Ottawa Real Estate Board (OREB) sold 1,002 residential properties in December through the Board’s Multiple Listing Service® System, compared with 757 in December 2019, an increase of 32.4 per cent. December’s sales included 710 in the residential property class, up 33.7 per cent from a year ago, and 292 in the condominium property class, an increase of 29.2 per cent from December 2019. The five-year average for total residential unit sales in December is 779.

“At the start of the pandemic, we didn’t know what to expect. We had a momentary stall as did most businesses; however, once real estate was deemed to be an essential service, REALTORS® worked with Buyers and Sellers to ensure safety in the process, and the market picked back up and accelerated past all expectations throughout the remainder of the year.”

The total number of residential and condo units sold throughout 2020 was 18,971, compared with 18,613 in 2019, increasing 2 per cent. Residential property class unit sales went up by 3 per cent, with 14,455 properties exchanging hands last year compared to 14,030 in 2019. Condominium property class sales decreased slightly by 1.5 per cent, with 4,516 units sold in 2020 versus 4,583 in the previous year.

December’s average sale price for a condominium-class property was $355,982, an increase of 14.4 per cent from a year ago, while the average sale price of a residential-class property was $603,880, an increase of 20.6 per cent from December 2019. Year-end figures show an average sale price of $582,267 for residential-class properties and $361,337 for condominium units in 2020. These values represent a 20 per cent and 19 percent increase over 2019, respectively.*

“When analyzing the year-end figures, what clearly stood out was that although the number of units sold was only slightly higher than last year, the Total Sales Volume topped a record-breaking $10 billion compared to $8.2 billion at the end of 2019. This is, in effect, a stark illustration of the increase in Ottawa property values over the course of the year. For example, in 2019, 35% of properties purchased were sold at or below $400K, while in 2020, only 16% of homes were. The market is certainly exhibiting a major shift in terms of availability in lower price ranges,” Wright points out.

“At the end of 2020, average prices increased by 19-20% over this time last year. In 2019, we saw a 9% overall increase for both residential and condo properties compared to 3-5% in 2018 and 3-7% in 2017. These substantive increases in property prices from year to year can be attributed to a variety of factors: the inventory shortage triggering economic supply and demand realities, the multiple-offer phenomena, the record-low mortgage rates increasing purchasing power of Buyers, migration of Buyers from larger markets with high returns to spend, and so forth.”

“I believe that Ottawa is just coming into its own as a national capital city. As such, it is resilient and sheltered in a way that other markets are not – with consistent government and tech sector employment that is particularly conducive to working from home as our current circumstances have required. We may have been privileged with lower price thresholds in previous decades, but perhaps the market is now beginning to reflect the real estate property values of a national capital.”

“Going forward, I fully expect Ottawa’s resale market will continue to be robust in 2021. There are no indicators to suggest that this is an overheated market – it is simply very active, insulated, and strong. One that has only been mildly shaken by a world-wide pandemic,” Wright concludes.

* The Board cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price and conditions will vary from neighbourhood to neighbourhood.

Source:

The Ottawa Real Estate Board

VIDEO

Theses are the sold prices for 4 bedrooms DETACHED HOMES in all Ottawa. Average price shows $736,324. As you can see it’s still selling over the asking price a bit, and is based on the last 160 homes sold in Dec 2020.

DETACHED HOMES

Theses are the sold prices for 3 bedrooms DETACHED HOMES in all Ottawa. Average price shows $521,326. As you can see it’s still selling over the asking price and is based on the last 335 homes sold in Dec 2020

DETACHED HOMES

Theses are the sold prices for 3 bedrooms TOWN HOMES in all Ottawa. Average price shows $534,107. As you can see it’s still selling over the asking price and is based on the last 181 homes sold in Dec 2020

TOWNHOMES SOLD PRICES, not in condo property management.

Theses are the sold prices for 3 bedrooms TOWN HOMES with Condominium management in all Ottawa. Average price shows $344,665. As you can see it’s still selling over the asking price and is based on the last 81 homes sold in Dec 2020

TOWNHOMES SOLD PRICES, WITH CONDOMINIUM property management

Source : Ottawa Real Estate Board.

OTTAWA REAL ESTATE NEWS- Here are my reviews of current market values.

OTTAWA, November 4, 2020 – Members of the Ottawa Real Estate Board sold 2,146 residential properties in October through the Board’s Multiple Listing Service® System, compared with 1,604 in October 2019, a year over year increase of 34 per cent. October’s sales included 1,665 in the residential- property class, up 38 per cent from a year ago, and 481 in the condominium- property category, an increase of 22 per cent from October 2019. The five-year average for October unit sales is 1,515.

“We are heading into the colder months, the second wave of the pandemic is upon us, and yet Ottawa’s resale market continues to hold steady,” observes Ottawa Real Estate Board President Deb Burgoyne.

“While the October average price gains, number of sales, and new listings coming onto the market were all down from September, demand persists, and the number of sellers choosing to enter the market remains strong. With 1,937 residential listings and 708 condo units added to the housing stock in October, this is a 48% and 70% respective increase in new listings over last year at this time,” she adds.

October’s average sale price for a condominium-class property was $368,936, an increase of 16 per cent from this time last year, while the average sale price of a residential-class property was $603,253, an increase of 25 percent from a year ago. With year- to-date average sale prices at $579,026 for residential and $361,666 for condominiums, these values represent a 19 per cent percent increase over 2019 for both property classes.*

“The condominium market is on our watchlist. Inventory for condo units increased 15% over last October, while inventory for residential properties is down 46%. This is an inverse relationship compared to the beginning of 2020 when condo supply was depleting much quicker than residential,” reports Burgoyne.“The shift in the condo market occurred around June. There has been a lot of speculation about changing buyer behaviour and preferences due to our pandemic reality with homeowners wanting home offices and gym space, for example. One could extrapolate or conclude that buying preferences may be shifting towards a desire for properties with more square footage than this property type offers. Particularly, due to the sheer number of employees working remotely for the foreseeable future, commute times may continue to be less of an issue.”

“As the chillier weather and upcoming holiday season approaches, it will be interesting to see how the market calibrates. Typically, we start to see a slowdown in home sale activity. Whether that actually transpires is something we can’t predict given the topsy turvy year that is 2020. What I can tell you is that this is not the time to navigate the market on your own; there is too much at stake to venture in without the knowledge and guidance of an experienced REALTOR®,” Burgoyne concludes.

In addition to residential and condominium sales, OREB Members assisted clients with renting 2,829 properties since the beginning of the year compared to 2,334 at this time last year. * The Board cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price and conditions will vary from neighbourhood to neighbourhood.

Source:

The Ottawa Real Estate Board

November 17th 2020

OTTAWA AREA HOME SALES STATS

Try to broaden your current search criteria

November 16th 2020

Try to broaden your current search criteria