Tag: KANATA REMAX

Ottawa Real Estate Market news Feb 2023 – Kanata Real Estate Market news Feb 2023 – Join our newsletter

February 2023 – Resale Market Starts Slow as Buyers Remain Cautious

February 2, 2023

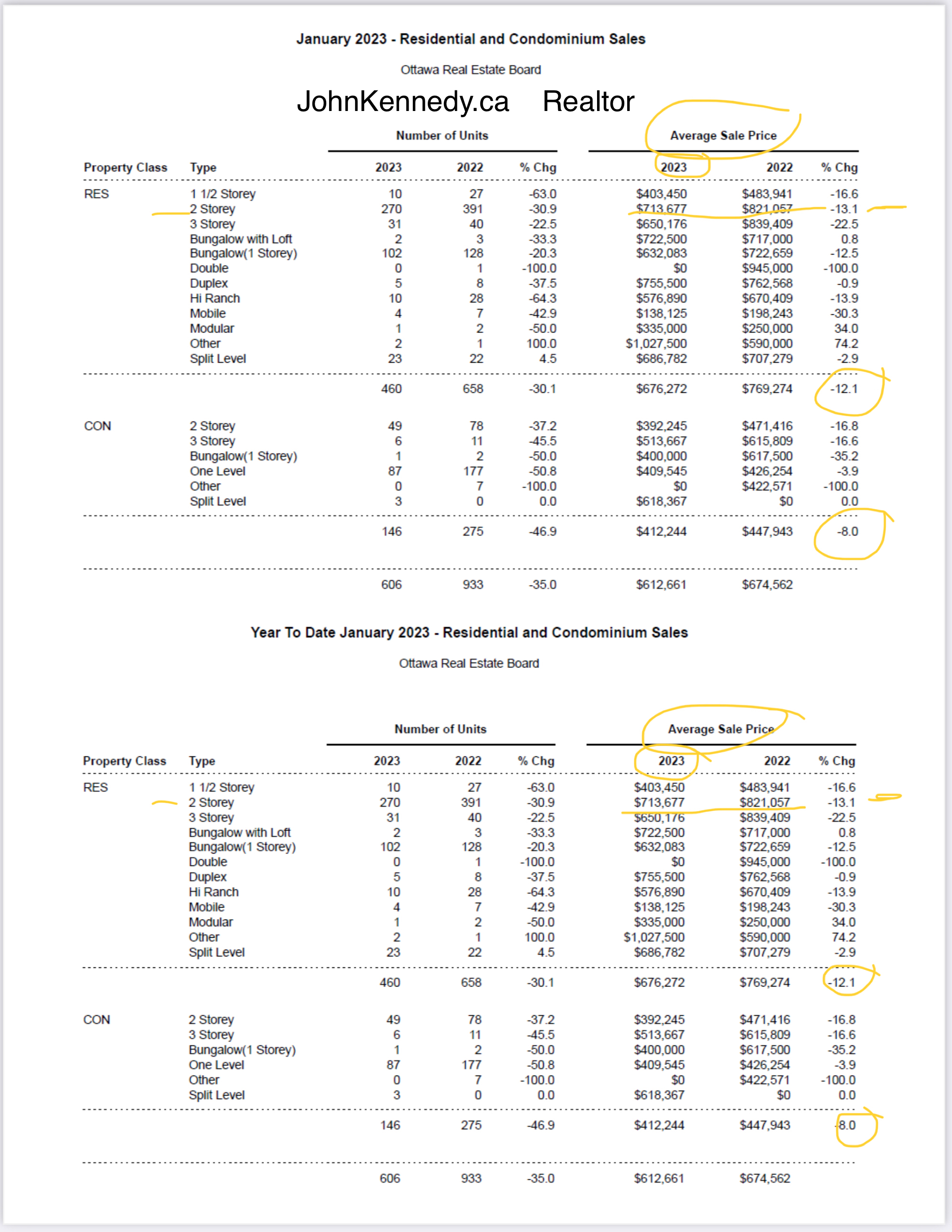

Members of the Ottawa Real Estate Board (OREB) sold 606 residential properties in January through the Board’s Multiple Listing Service® (MLS®) System, compared with 933 in January 2022, a decrease of 35%. January’s sales included 460 in the freehold-property class, down 30% from a year ago, and 146 in the condominium-property category, a decrease of 47% from January 2022. The five-year average for total unit sales in January is 819.

“January’s marked slow down in unit sales over 2022 indicates potential home buyers are taking their time,” says OREB President Ken Dekker. “While last month saw the culmination of the succession of interest rate hikes announced by the Bank of Canada, affordability remains a factor. They may be waiting for a shift in listing prices. They’re being cautious in uncertain conditions.”

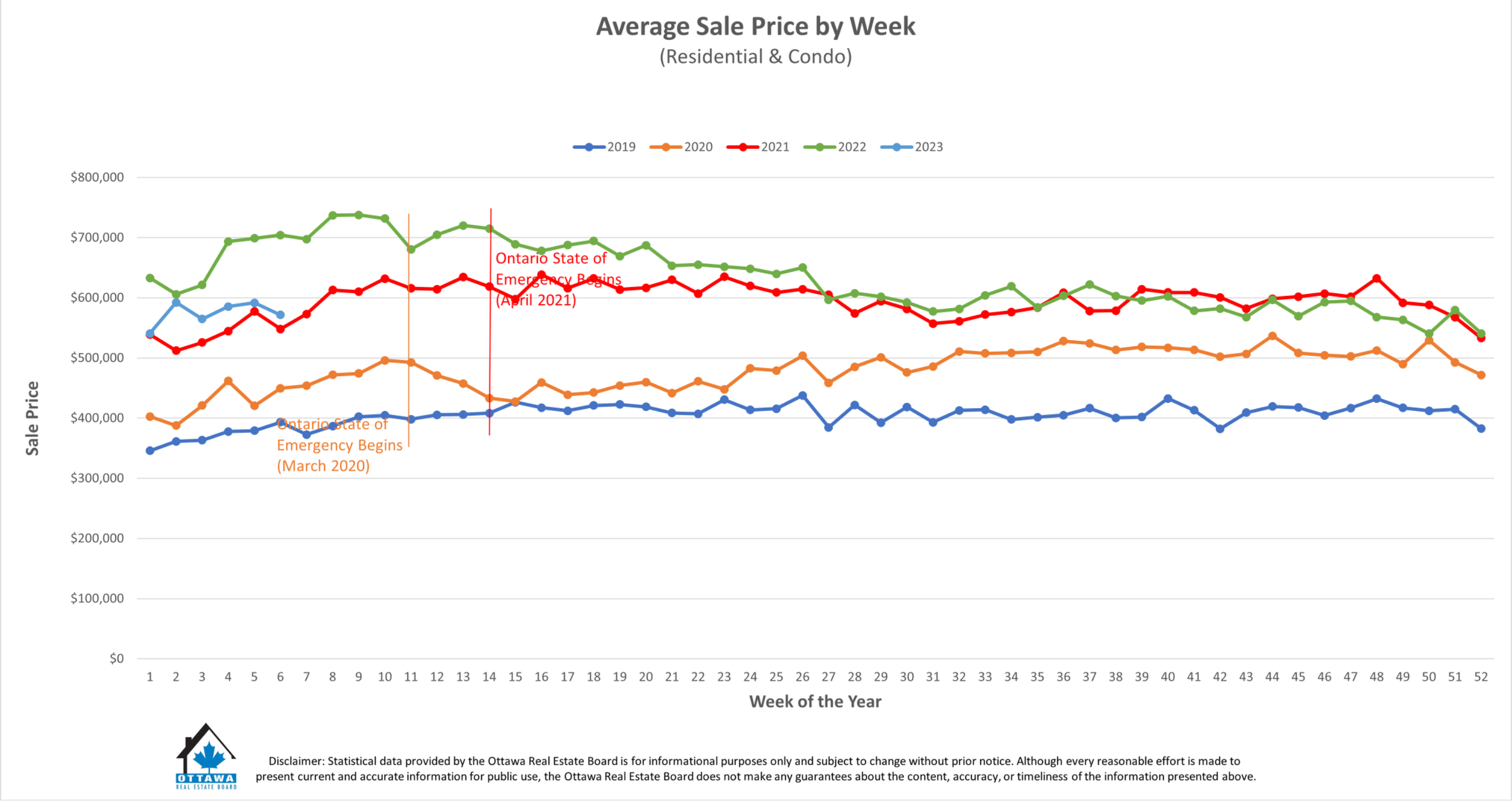

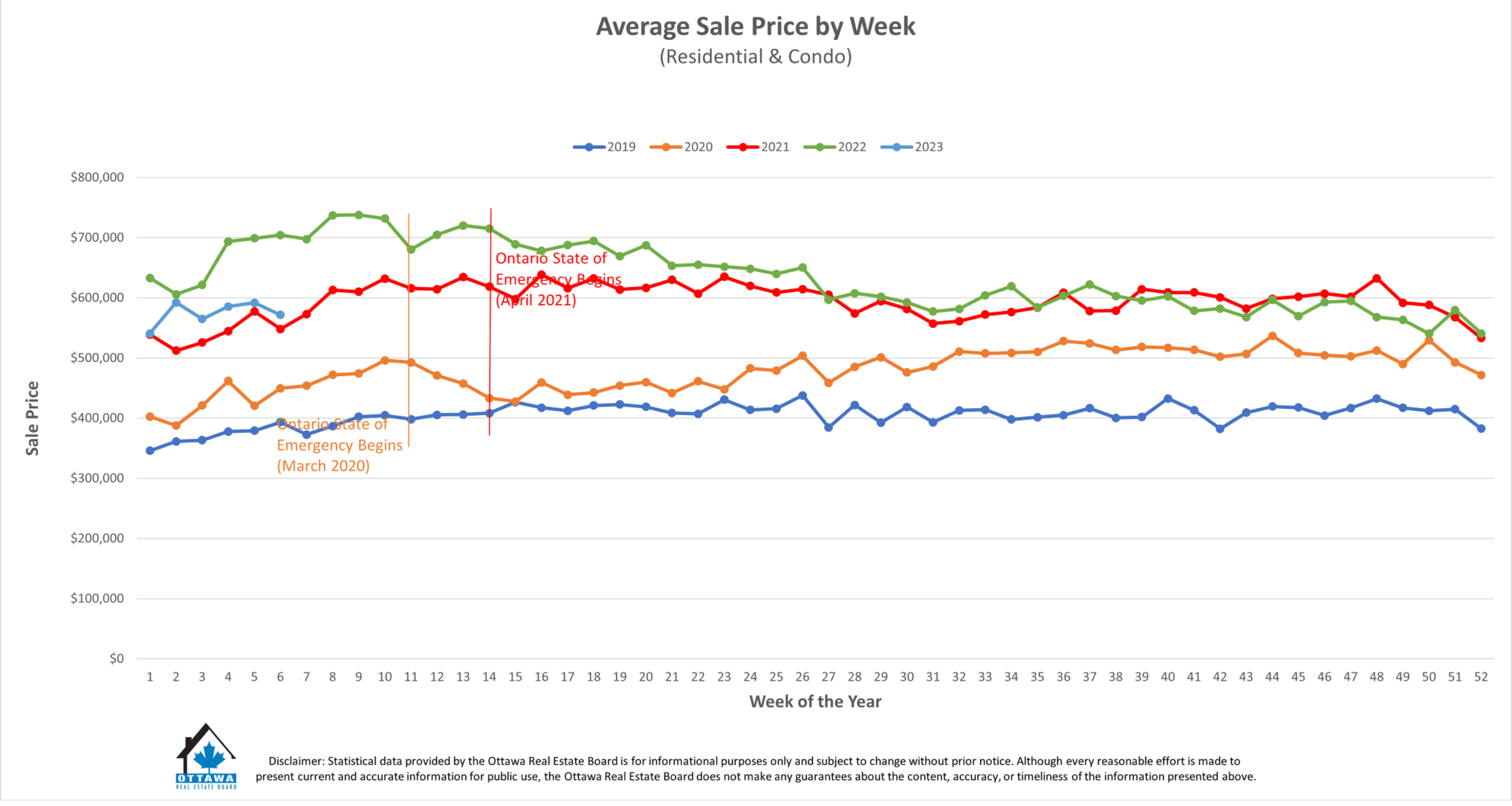

By the Numbers – Average Prices*:

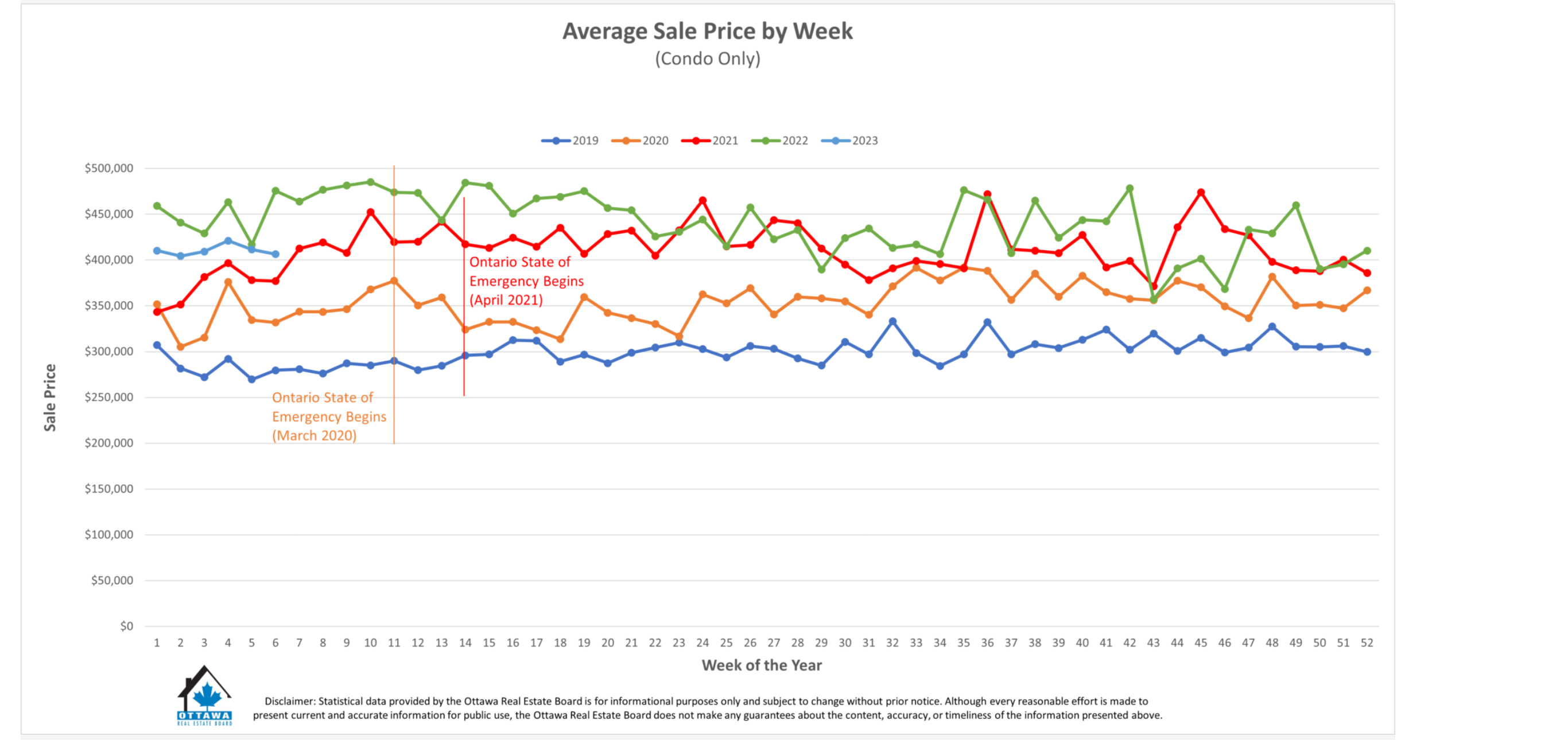

- The average sale price for a condominium-class property in January was $412,244, a decrease of 8% from 2022.

- The average sale price for a freehold-class property was $676,272, decreasing 12% from a year ago.

“Despite the decrease in average prices, the market should not be considered on a downward slide,” says Dekker. “A hyper COVID-19 seller’s market is now leveling out to our current balanced market state.”

“On a positive note, in comparison to December’s figures, January’s average price of freehold properties increased by 3%. The average price of condos did fall by 5% compared to December but condo pricing tends to fluctuate more due to the small data set.”

By the Numbers – Inventory & New Listings:

- Months of Inventory for the freehold-class properties has increased to 3.8 months from 0.9 months in January 2022.

- Months of Inventory for condominium-class properties has increased to 3.8 months from 0.8 months in January 2022.

- January’s new listings (1,324) were 16% higher than 2022 (1,142) and up 89% from December 2022 (699). The 5-year average for new listings in January is 1,233.

“Ottawa’s inventory and days on market figures are typical for a balanced market and another sign that buyers are no longer racing to put in an offer,” says Dekker. “The increase in new listings and supply is a boon for home buyers, who now have more selection and the ability to put in conditions at a less frantic pace. REALTORS® are an essential resource in finding the right property for the right buyer. On the other side of the transaction, REALTORS® can help sellers with hyper-local insights about how to sell in their neighbourhood at a time when pricing is key.”

More people are turning to REALTORS® for help renting properties — 509 this month compared to 410 in January 2022, an increase of 24%. “Even with the increase in housing stock, the tighter rental market is another indication that affordability is keeping some potential buyers on the sidelines.”

* OREB cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price will vary from neighbourhood to neighbourhood.

Market Prices Sold and Changes

2022 AWARD WINNER FOR SALES AND CUSTOMER SATISFACTION

Thank you for your trust and referrals!

KANATA HOMES FOR SALE – OTTAWA HOMES FOR SALE. – MARKET REPORT JAN 26TH 2021

Kanata Homes for Sale – Ottawa Home prices –

Listen to our full market video report for January 26th 2021 – Kanata Home Prices – Ottawa Home prices update.

VIDEO

HOMES FOR SALE IN KANATA

HOMES FOR SALE IN OTTAWA

RECEIVE THESE POST IN YOUR EMAIL

OTTAWA – KANATA – REAL ESTATE UPDATES, PRICES SOLD, AVERAGE PRICE ON YOUR STREET, AND LOTS MORE

JOIN MY NEWSLETTER

and

FACEBOOK PAGE

KANATA HOMES FOR SALE

KANATA HOME PRICES

KANATA HOME REPORTS

KANATA HOME PRICES FOR 2021

KANATA TOWNHOMES

KANATA DETACHED HOMES PRICES

KANATA REAL ESTATE MARKET PRICES

2021 KANATA HOME PRICES

OTTAWA HOMES FOR SALE

OTTAWA HOME PRICES

OTTAWA HOME REPORTS

OTTAWA HOME PRICES FOR 2021

OTTAWA TOWNHOMES

OTTAWA DETACHED HOMES PRICES

OTTAWA REAL ESTATE MARKET PRICES

2021 OTTAWA HOME PRICES

KANATA HOMES FOR SALE – MARKET REPORT JAN 26TH 2021

Kanata Homes for Sale, listen to our full market report for January 26th 2021 – Kanata Home Prices

HOMES FOR SALE IN KANATA

HOMES FOR SALE IN OTTAWA

KANATA HOMES FOR SALE

KANATA HOME PRICES

KANATA HOME REPORTS

KANATA HOME PRICES FOR 2021

KANATA TOWNHOMES

KANATA DETACHED HOMES PRICES

KANATA REAL ESTATE MARKET PRICES

2021 KANAT HOME PRICES

Ottawa’s Resale Market Tracks Upward into Fall – Ottawa Real Estate News – Ottawa homes for sale – 20 Oct 2020

OTTAWA, October 5, 2020

An increase of 28 per cent from a year ago!

Members of the Ottawa Real Estate Board sold 2,329 residential properties in September through the Board’s Multiple Listing Service® System, compared with 1,547 in September 2019, a year over year increase of 51 per cent. September’s sales included 1,759 in the residential property class, up 58 per cent from a year ago, and 570 in the condominium property category, an increase of 31 per cent from September 2019. The five-year average for September unit sales is 1,602. “The sheer volume of transactions in September, compared to a year ago, confirms the Ottawa resale market is continuing on its upward trajectory,” states Ottawa Real Estate Board President Deb Burgoyne. “The resale market in 2020, especially since the outset of the pandemic, has certainly not followed the usual spring and fall cycles we typically experience. This year has had its own distinct ebb and flow, and whether this momentum in our market will continue is difficult to predict.” “However, the continued increase in new listings and demand remaining strong allows us to be cautiously optimistic. September saw 2,165 residential properties and 744 condominiums enter the market. This is an increase of 32% and 45% respectively over last year at this time, and over 400 more new listings than came on the market in August,” adds Burgoyne.

September’s average sale price for a condominium-class property was $373,565, an increase of 21 per cent from this time last year, while the average sale price of a residential class property was $622,557, an increase of 28 per cent from a year ago. With year to date average sale prices at $575,506 for residential and $360,550 for condominiums,

these values represent a 19 per cent and 20 percent increase over 2019, respectively. * “While average prices in September hit an all-time high, the movement at the higher end of the market is

also likely driving this figure higher. September’s median prices, which is calculated removing the extreme upper and lower prices, do show more moderate price gains coming in at $570,000 for residential properties and $350,000 for condominiums,” Burgoyne acknowledges.

“Of course, the fundamentals of supply and demand remain at play, and our inventory shortage will continue to put Sellers in a position to capitalize on the current market. Additionally, the

dynamics of purchasing behaviour is shifting as Buyers become more tolerant of the condition of a property or its location, for example.” “But, we can’t exhale just yet. At the end of the day, REALTORS® represent both Buyers and Sellers, so a balanced market would be a welcomed relief for everyone. We would like to see both sides get over the finish line with a feeling of elation,

and that they have had a positive experience in their homeownership journey,” Burgoyne expresses. In addition to residential and condominium sales, OREB Members assisted clients with renting 2,536 properties since the beginning of the year compared to 2,117 at this time last year. * The Board cautions that the average sale price can be useful in establishing trends over time

but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all

properties sold. Price and conditions will vary from neighbourhood to neighbourhood.

HOMES FOR SALE IN KANATA

HOMES FOR SALE IN STITTSVILLE

HOMES FOR SALE IN OTTAWA

HOMES FOR SALE IN ORLEANS

Temperatures Cool, but Not Ottawa’s Resale Market September 3, 2020- JOHN KENNEDY

Ottawa Real Estate News Releases

Temperatures Cool, but Not Ottawa’s Resale Market

September 3, 2020

Members of the Ottawa Real Estate Board sold 2,017 residential properties in August through the Board’s Multiple Listing Service® System, compared with 1,725 in August 2019, a year over year increase of 17 per cent. August’s sales included 1,576 in the residential-property class, up 22 per cent from a year ago, and 441 in the condominium-property category, an increase of 2 per cent from August 2019. The five-year average for August unit sales is 1,668.

“August’s resale numbers were undoubtedly driven by the considerable increase in new listings that came onto the market in both July and August,” states Ottawa Real Estate Board President Deb Burgoyne. “There were at least 300 more residential and 175 more condo listings added to inventory than we saw last year at this time. In fact, we have not seen new listing numbers like this since August 2015,” she adds.

“The question that comes to mind is: what is propelling these new listings? Well, there are several contributing factors; there are Sellers that are ready to capitalize on their investments, there are those who may be moving into new builds or further out of the city, and let’s not forget boomers who are downsizing or perhaps moving into rentals.”

“Whatever their motivations, if the rate at which properties are coming onto the market can be sustained, it will surely bring some much-needed balance. For some time, as inventory comes on the market, it is quickly being absorbed. If this increased listing trend continues, at some point, the housing stock may finally build to a point that demand is going to be somewhat satiated,” Burgoyne proposes.

August’s average sale price for a condominium-class property was $383,640, an increase of 24 per cent from this time last year, while the average sale price of a residential-class property was $592,548, an increase of 22 per cent from a year ago. With year to date average sale prices at $566,291 for residential and $357,779 for condominiums, these values represent a 17 per cent and 19 percent increase over 2019, respectively. *

“A culmination of factors has been playing into the price increases in Ottawa’s resale market. Certainly, multiple offers are a dominant element. The reason that we have so many offers highlights the number of active buyers in the market – due to a variety of dynamics, such as record low mortgage rates, recently announced decreased debt/equity thresholds, migrating buyers coming from larger markets who may have received high returns on their home sales, etc. When you add these to the already pent-up demand from our local residents, it has created a perfect storm, so to speak.”

“This is an extremely challenging market for many, especially those on the buying side. Many are experiencing what we call ‘buyer burnout’, having placed many offers without success. We perceive a change in buyers behaviour regarding expectations, that were perhaps, until recently ‘hyped’, or a product of watching a myriad of home improvement shows and/or visiting new builder model homes. Our current reality is perhaps making some buyers more pragmatic and compromising on what they accept, whether it’s a home’s condition, age, or location,” Burgoyne suggests.

“What we need to be cognizant of is that Ottawa is a capital city and a growing city, that until now has been well-insulated when it comes to resale prices. If you look at other larger cities, they have gone through this already. We are just in the early stages, with no end in sight at this point. I suspect that prices are not going to come down, nor is activity going to slow down in the near future. Whether you are on the buying or selling side of a transaction, this is not the kind of market to navigate without guidance. An experienced REALTOR® will ensure Buyers are making strategic offers, and Sellers are not leaving money on the table.”

In addition to residential and condominium sales, OREB Members assisted clients with renting 2,232 properties since the beginning of the year compared to 1,906 at this time last year.

* The Board cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price and conditions will vary from neighbourhood to neighbourhood.

Ottawa homes for sale

Ottawa property pricing

Ottawa property average prices

Ottawa home pricing

Ottawa condo pricing

Ottawa condo prices

Ottawa condo agents

Kanata home prices

Kanata homes for sale

20 PERCENT UP – OTTAWA HOME PRICES NEWS 10 TH MARCH 2020 – OTTAWA AND KANATA HOMES FOR SALE

2020 February’s Resale Market Back in Overdrive

20 % UP OVER LAST YEAR – FEBRUARY BOARD REAL ESTATE REPORT.

OTTAWA HOME PRICES NEWS 10 TH MARCH 2020

OTTAWA AND KANATA HOMES FOR SALE

FREE HOME EVALUATION 10 MARCH 2020

KANATA HOMES FOR SALE –

OTTAWA HOMES FOR SALE

KANATA REAL ESTATE

OTTAWA REAL ESTATE

10 MARCH 2020

KANATA HOME PRICING –

OTTAWA HOME PRICING

10 MARCH 2020

KANATA MARCH 2020 SALE PRICES

OTTAWA MARCH 2020 SALE PRICES

10 MARCH 2020

KANATA REAL ESTATE AGENT

OTTAWA REAL ESTATE AGENT

10 MARCH 2020

KANATA CENTURY 21,

OTTAWA CENTURY 21,

10 MARCH 2020

KANATA BRIDLEWOOD HOME PRICES

10 MARCH 2020

KANATA BRIDLEWOOD HOMES FOR SALE

10 MARCH 2020

KANATA MLS – KANATA STREET SOLD PRICES

10 MARCH 2020

KANATA HOMES FOR SALE – JUST LISTED 81 FURLONG CRES KANATA – KANATA REAL ESTATE NEWS MARCH 4TH 2020

FREEHOLD END UNIT ON POPULAR CRESCENT IN BRIDLEWOOD. BEAUTIFUL YARD WITH TREES AND DECK – EXTRA LARGE BRIGHT MASTERBDR WITH FULL ENSUITE BATH AND WALKIN CLOSET – 2 ADDITIONAL BEDROOMS WITH SEPRT 4 PC BATH ON 2 ND LEVEL AND 1 BEDRM IN BMT – LARGE KITCHEN WITH EAT-IN AND DINING AREAS – NEW HARDWOOD FLOORING ON MAIN FLOOR – WELL MAINTAINED – WOOD FIRE PLACE – SKYLIGHT ON UPPERFL – GARAGE ACCESS IN HOME – APRX 4 PARKING SPOTS – INCLUDES: STOVE, FRIDGE, DISHWASHER, WASHER AND DRYER – NO PETS, NO SMOKERS HERE! – MUST SEE SHOWS 10+

FREE HOME EVALUATION

OTTAWA REAL ESTATE NEWS 6 MARCH 2020

FREE HOME EVALUATION 6 MARCH 2020

KANATA HOMES FOR SALE –

OTTAWA HOMES FOR SALE

KANATA REAL ESTATE

OTTAWA REAL ESTATE

6 MARCH 2020

KANATA HOME PRICING –

OTTAWA HOME PRICING

6 MARCH 2020

KANATA MARCH 2020 SALE PRICES

OTTAWA MARCH 2020 SALE PRICES

6 MARCH 2020

KANATA REAL ESTATE AGENT

OTTAWA REAL ESTATE AGENT

6 MARCH 2020

KANATA CENTURY 21,

OTTAWA CENTURY 21,

6 MARCH 2020

KANATA BRIDLEWOOD HOME PRICES

6 MARCH 2020

KANATA BRIDLEWOOD HOMES FOR SALE

6 MARCH 2020

KANATA MLS – KANATA STREET SOLD PRICES

6 MARCH 2020

January Resales Lose Momentum – OTTAWA REAL ESTATE SALE REPORT – MARCH 3-3-2020 NEWS – KANATA HOMES FOR SALE

AVERAGE PRICE UP 19.3% – NOW IS GREAT TIME TO SELL.

RECEIVE A FREE HOME EVALUATION

OTTAWA, February 5, 2020 – Members of the Ottawa Real Estate Board sold 780 residential properties in January

through the Board’s Multiple Listing Service® System, compared with 817 in January 2019, a decrease of 4.5 per

cent. January’s sales included 558 in the residential-property class, down 8.4 per cent from a year ago, and 222 in

the condominium-property category, an increase of 6.7 per cent from January 2019. The five-year average for January

unit sales is 713. “2020 is off to a slower start as the shortage of inventory is now impacting market momentum,” states Ottawa Real Estate Board’s President Deborah Burgoyne. “Although we have higher sales than the five-year average, due to increased condo sales, the persistent supply challenges seem to have finally caught up with us. Furthermore, the number of new listings that came on the market in January (1,082) is well below the average (1,651).” “We don’t expect this trajectory to change anytime in the foreseeable future,” Burgoyne acknowledges. “The

supply chain needs to be buffered at all points along the continuum from first-time and move-up buyers, to downsizing

boomers as well as renters. They are all interconnected links in the housing chain.” January’s average sale price for a

condominium-class property was $338,077, an increase of 19.1 per cent from last year while the average sale price of a residential-class property was $516,229, an increase of 19.3 per cent from a year ago. Compared to last

month, however, the average price for residential-class properties increased by a modest 3.2 per cent and the average price for condominium-class units was 8.8 per cent higher.* The Board’s Housing Price Index (HPI), which is another data point of price trends based on the specific housing stock in neighbourhoods, indicates that the overall benchmark price for Ottawa has increased by approximately 13.75% from last year. The most active price range in the

condominium market was $200,000 to $349,999, accounting for 55 per cent of the units sold while $400,000 to $549,999 represented the most prevalent price point in the residential market, accounting for 40 per cent of January’s

Transactions. “The fact is Ottawa’s market has always been steadily increasing at a reasonable pace and is sustainable. If buyers are waiting for prices to decline, based on historical trends, it’s not likely,” Burgoyne cautions. “Although supply may pick up eventually—if you need to get into the market, don’t wait. It’s a challenging market for everyone. Hire a trusted professional to ensure you are protected and well informed in your home buying or selling transaction.” In addition to residential sales, OREB Members assisted clients with renting 243 properties in January 2020 compared with 169 in January 2019. * The Board cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price and conditions will vary from neighbourhood to neighbourhood.

SEE FULL REPORTS ON IMAGES – CLICK ON THEM

FREE HOME EVALUATION 3 MARCH 2020

KANATA HOMES FOR SALE –

OTTAWA HOMES FOR SALE

KANATA REAL ESTATE

OTTAWA REAL ESTATE

3 MARCH 2020

KANATA HOME PRICING –

OTTAWA HOME PRICING

3 MARCH 2020

KANATA MARCH 2020 SALE PRICES

OTTAWA MARCH 2020 SALE PRICES

3 MARCH 2020

KANATA REAL ESTATE AGENT

OTTAWA REAL ESTATE AGENT

3 MARCH 2020

KANATA CENTURY 21,

OTTAWA CENTURY 21,

3 MARCH 2020

KANATA BRIDLEWOOD HOME PRICES

3 MARCH 2020

KANATA BRIDLEWOOD HOMES FOR SALE

3 MARCH 2020

KANATA MLS – KANATA STREET SOLD PRICES

3 MARCH 2020

KANATA HOMES FOR SALE – JUST LISTED 56 GRAND CEDAR CRT- FEB 7 2020

Fantastic Bungalow End Unit in wonderful Amberwood Village.

This beautiful home has been tastefully updated and well cared for. Hardwood and ceramic on the main floor. The eat in kitchen is well appointed and includes the appliances. The main floor features a beautiful sunroom to enjoy your morning coffee. The specious Master has a walk in closet with 2 additional closets and a 4 piece ensuite with an air tub. The spacious living / dining room has a wonderful gas fireplace. Incredible storage in this fabulous bungalow. The 2nd bedroom / den is conveniently located beside the 3 pce bathroom. Main floor laundry is here as well. Head to the lower level to the games / recreation room with another gas fireplace to enjoy. A powder room located down here as well. There is a large workshop / utility room and plenty of storage. Come out and see this wonderful home and make Amberwood your community! Open house Feb. 9th 2-4. No offers will be considered before February 13th @ 6p.m.