LET ME SHOW YOU A “FREE HOME EVALUATION” SIMILAR TO THIS – ESTIMATING THE PROPER VALUE OF A PROPERTY ON IRIS ST. OTTAWA

Example only:

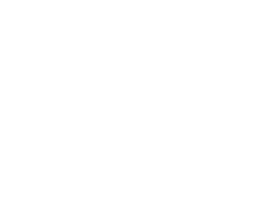

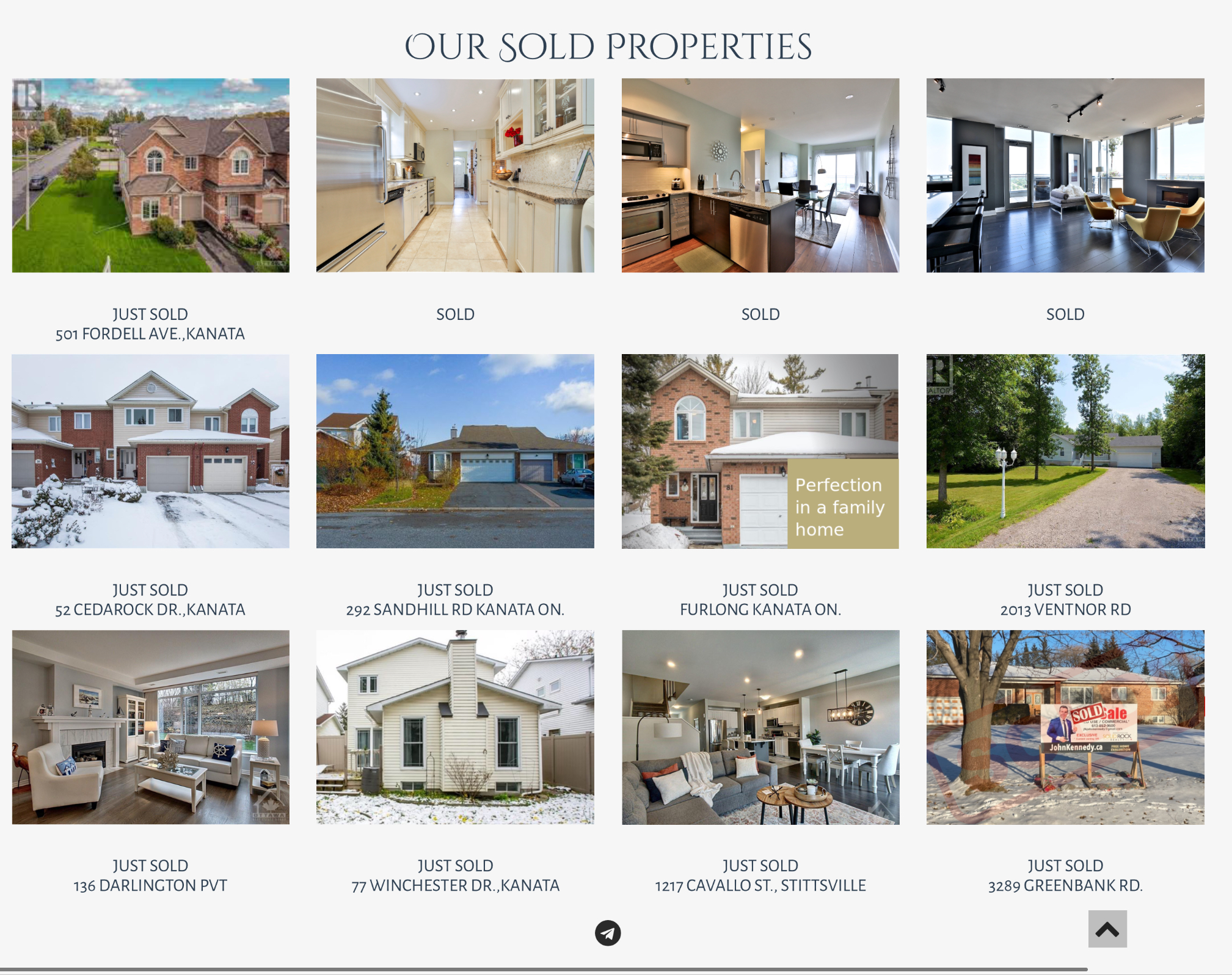

IRIS ST OTTAWA HOME PRICES

HOME PRICES ON IRIS ST. OTTAWA

| Address | Sold Price | Sold Date | Style | Type | BdsAG | Bds | Bths | #Gar |

| 2403 IRIS ST | $557,500 | 2024-05-29 | SEMIDET | BUNGLOW | 3 | 3 | 2 | 0 |

| 2380 IRIS ST | $540,000 | 2024-05-15 | SEMIDET | BUNGLOW | 3 | 3 | 2 | 0 |

| 2419 IRIS ST | $619,000 | 2023-06-16 | SEMIDET | BUNGLOW | 3 | 5 | 2 | 1 |

| 2394 IRIS ST | $562,500 | 2023-04-06 | SEMIDET | BUNGLOW | 3 | 3 | 2 | 0 |

| 2399 IRIS ST | $577,000 | 2022-09-29 | SEMIDET | BUNGLOW | 3 | 3 | 2 | 0 |

| 2411 IRIS ST | $635,000 | 2022-08-24 | SEMIDET | BUNGLOW | 3 | 4 | 2 | 0 |

| 2418 IRIS ST | $690,000 | 2022-06-09 | SEMIDET | BUNGLOW | 3 | 6 | 2 | 0 |

| 2357 IRIS ST | $651,000 | 2022-03-10 | SEMIDET | BUNGLOW | 3 | 3 | 1 | 0 |

| 2434 IRIS ST | $656,100 | 2022-02-02 | SEMIDET | 2STOREY | 3 | 3 | 2 | 0 |

| 2239 IRIS ST | $575,000 | 2021-10-31 | SEMIDET | 2STOREY | 3 | 3 | 2 | 1 |

| 2361 IRIS ST | $575,000 | 2021-08-11 | SEMIDET | BUNGLOW | 3 | 3 | 2 | 0 |

| 2240 IRIS ST | $325,000 | 2019-08-08 | SEMIDET | 2STOREY | 3 | 3 | 1 | 0 |

| 2427 IRIS ST | $239,900 | 2017-10-23 | SEMIDET | BUNGLOW | 3 | 3 | 1 | 0 |

| 2416 IRIS ST | $325,300 | 2016-11-22 | SEMIDET | BUNGLOW | 3 | 3 | 2 | 0 |

| 2411 IRIS ST | $312,000 | 2016-11-10 | SEMIDET | BUNGLOW | 2 | 2 | 2 | 0 |

| 2382 IRIS ST | $303,000 | 2016-01-21 | SEMIDET | BUNGLOW | 3 | 4 | 2 | 1 |

| 2422 IRIS ST | $302,000 | 2014-07-20 | SEMIDET | BUNGLOW | 3 | 3 | 2 | 0 |

| 2400 IRIS ST | $282,500 | 2011-12-11 | SEMIDET | BUNGLOW | 3 | 3 | 2 | 0 |

| 2238 IRIS ST | $290,000 | 2011-10-03 | SEMIDET | 2STOREY | 3 | 4 | 2 | 0 |

| 2396 IRIS ST | $284,000 | 2011-09-14 | SEMIDET | BUNGLOW | 3 | 4 | 2 | 0 |

| 2247 IRIS ST | $320,000 | 2011-06-10 | SEMIDET | 2STOREY | 3 | 3 | 2 | 1 |

| 2412 IRIS ST | $272,000 | 2010-07-26 | SEMIDET | BUNGLOW | 3 | 4 | 2 | 0 |

| 2413 IRIS ST | $269,000 | 2009-10-02 | SEMIDET | BUNGLOW | 3 | 5 | 2 | 0 |

| 2419 IRIS ST | $264,300 | 2009-06-15 | SEMIDET | BUNGLOW | 3 | 5 | 2 | 1 |

| 2397 IRIS ST | $190,000 | 2009-02-18 | SEMIDET | BUNGLOW | 2 | 2 | 1 | 0 |

| 2415 IRIS ST | $227,500 | 2008-11-11 | SEMIDET | BUNGLOW | 3 | 3 | 1 | 0 |

| 2393 IRIS ST | $245,000 | 2008-06-04 | SEMIDET | BUNGLOW | 3 | 3 | 2 | 0 |

| 2421 IRIS ST | $213,000 | 2007-03-21 | SEMIDET | BUNGLOW | 3 | 3 | 1 | 0 |

| 2419 IRIS ST | $205,000 | 2006-11-26 | SEMIDET | BUNGLOW | 3 | 3 | 2 |

REQUEST A FREE HOME EVALUATION OF IRIS ST. OTTAWA

HOMES FOR SALE ON IRIST ST. OTTAWA –

2380 IRIS ST, OTTAWA, ONTARIO, K2C-1C6

IRIS ST, OTTAWA, ONTARIO, K2C-1C6

IRIS ST, OTTAWA, HOMES FOR SALE

K2C HOMES FOR SALE

OTTAWA HOME GUIDES

THINKING OF BUYING A HOME ON IRIS ST. OTTAWA?