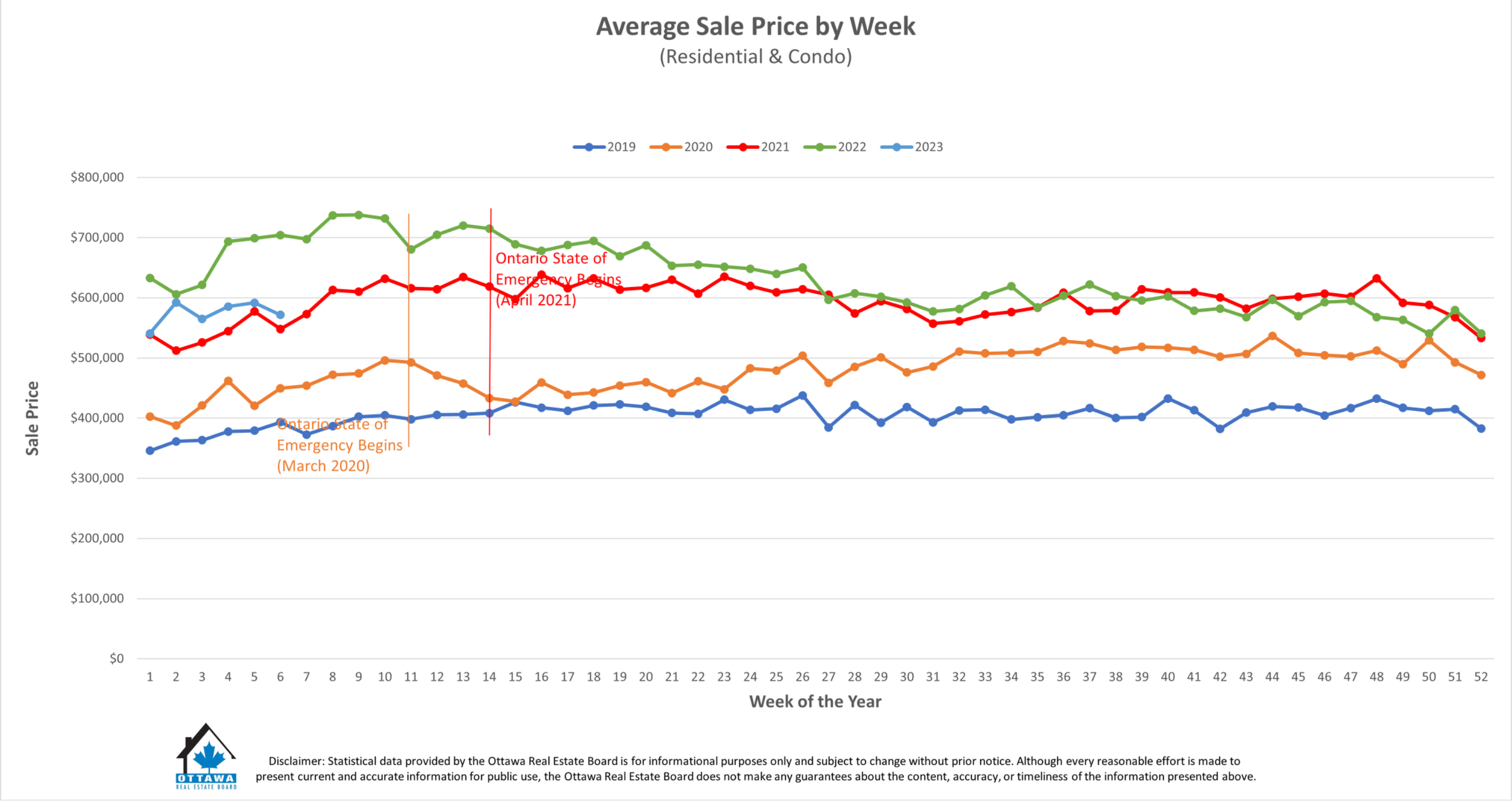

The average price of homes sold in

November 2023 was $633,138, decreasing

0.8% from November 2022.

OTTAWA, December 5, 2023 – The number of

homes sold through the MLS® System of the

Ottawa Real Estate Board totaled 724 units in

November 2023. This was a small reduction of

1.6% from November 2022.

Home sales were 31.8% below the five-year

average and 27.4% below the 10-year average

for the month of November.

On a year-to-date basis, home sales totaled

11,421 units after 11 months of the year. This

was a large decline of 11.7% from the same

period in 2022.

“Sales are performing as expected with the

arrival of colder months, and an uptick in new

and active listings is bringing more choice back

into the market,” says OREB President Ken

Dekker. “While more choice may mean the pace

of buying and selling has slowed, that doesn’t

mean people looking to enter or upgrade in the

market should sit back. Prospective buyers or

those looking to upgrade have an opportunity

to collaborate with their REALTOR® to carefully

explore the market, identify the ideal property,

and negotiate an attractive deal at their

own pace. Sellers will have to manage their

expectations regarding the quantity of offers and

speed of transactions, and their REALTOR® is

the best resource to help them confidently price

and prepare their home for a quality sale.”

By the Numbers – Prices:

The MLS® Home Price Index (HPI) tracks price

trends far more accurately than is possible

using average or median price measures.

•

The overall MLS® HPI composite

benchmark price was $628,900 in

November 2023, a modest gain of 1.4%

from November 2022.

o The benchmark price for single-family

homes was $708,900, up 1.6% on a

year-over-year basis in November.

o By comparison, the benchmark price for

a townhouse/row unit was $492,300,

nearly unchanged, up 0.8% compared

to a year earlier.

o The benchmark apartment price was

$424,300, up 1.2% from year-ago

levels.

•

The average price of homes sold in

November 2023 was $633,138, decreasing

0.8% from November 2022. The more

comprehensive year-to-date average price

was $669,536, a decline of 5.7% from 11

months of 2022.

•

The dollar value of all home sales in

November 2023 was $458.4 million, down

2.4% from the same month in 2022.

OREB cautions that the average sale price

can be useful in establishing trends over

time but should not be used as an indicator

that specific properties have increased or

decreased in value. The calculation of the

average sale price is based on the total dollar

volume of all properties sold. Price will vary from

neighbourhood to neighbourhood.

By the Numbers – Inventory & New Listings

•

The number of new listings saw a minor

increase of 2.7% from November 2022.

There were 1,428 new residential listings

in November 2023. New listings were 8.4%

above the five-year average and 10.4%

above the 10-year average for the month

of November.

•

Active residential listings numbered

2,752 units on the market at the end of

November, a sizable gain of 15.8% from

the end of November 2022. Active listings

haven’t been this high in the month of

November in more than five years.

•

Active listings were 53.9% above the five-

year average and 6.7% below the 10-year

average for the month of November.

•

Months of inventory numbered 3.8 at the

end of November 2023, up from the 3.2

months recorded at the end of November

2022 and above the long-run average

of 3.3 months for this time of year. The

number of months of inventory is the

number of months it would take to sell

current inventories at the current rate of

sales activity.

Sources : OREB -CREA

Join our newsletter and receive the ottawa real estate market news and alerts.