Blog

Category: news

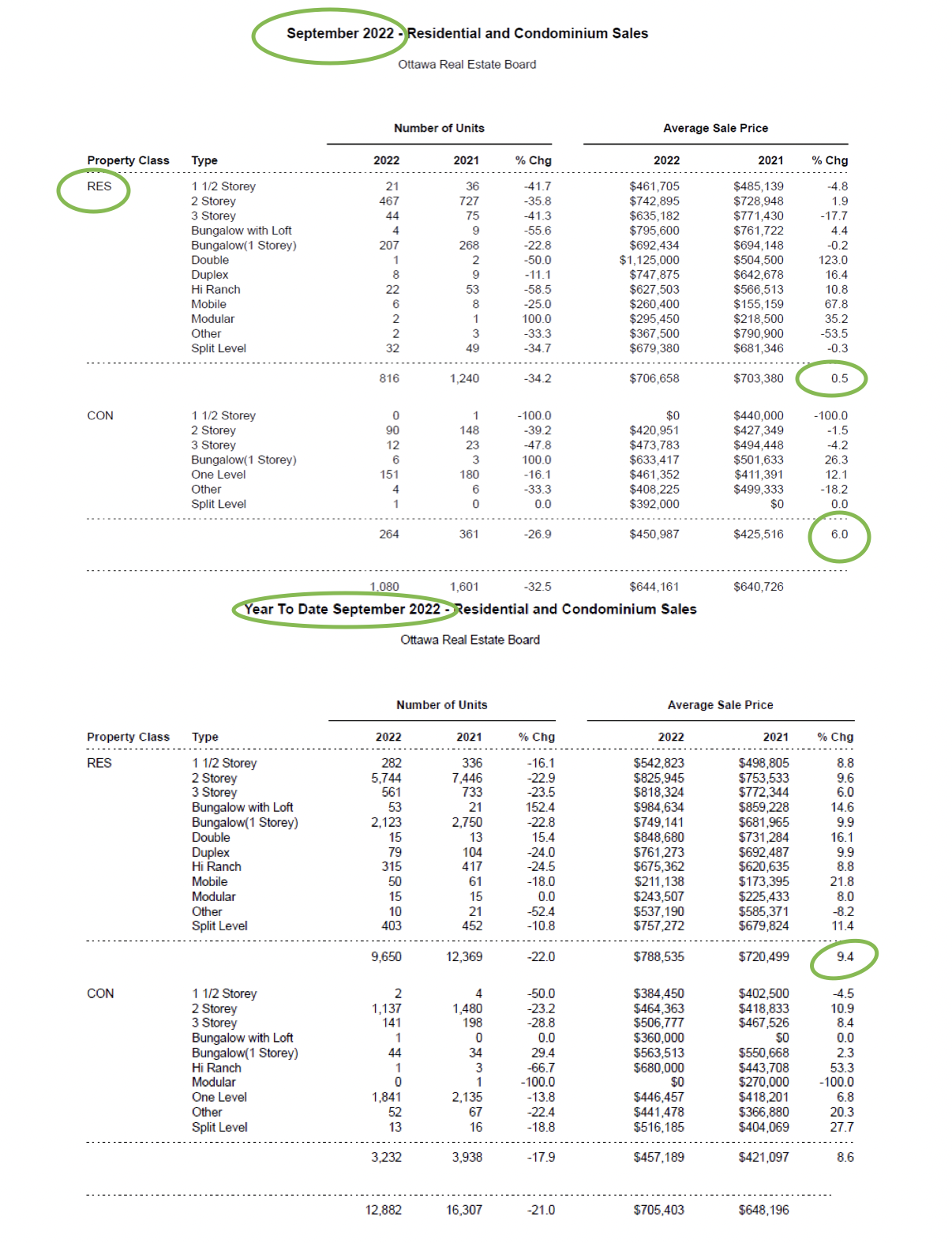

Ottawa Real Estate News 21st October 2022 – Market slows to 0.5% per month.

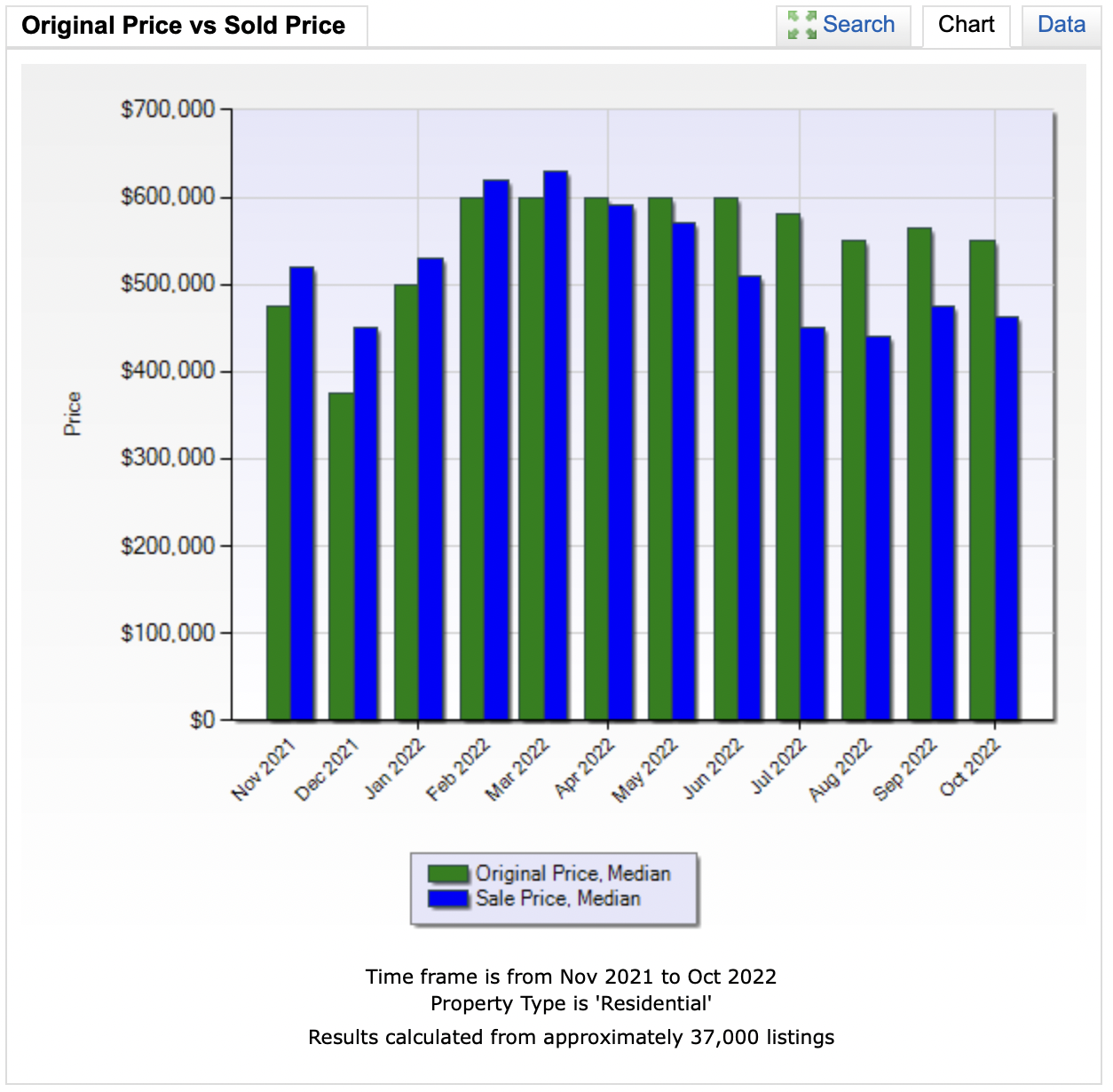

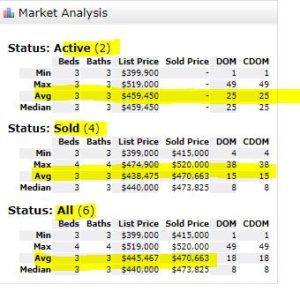

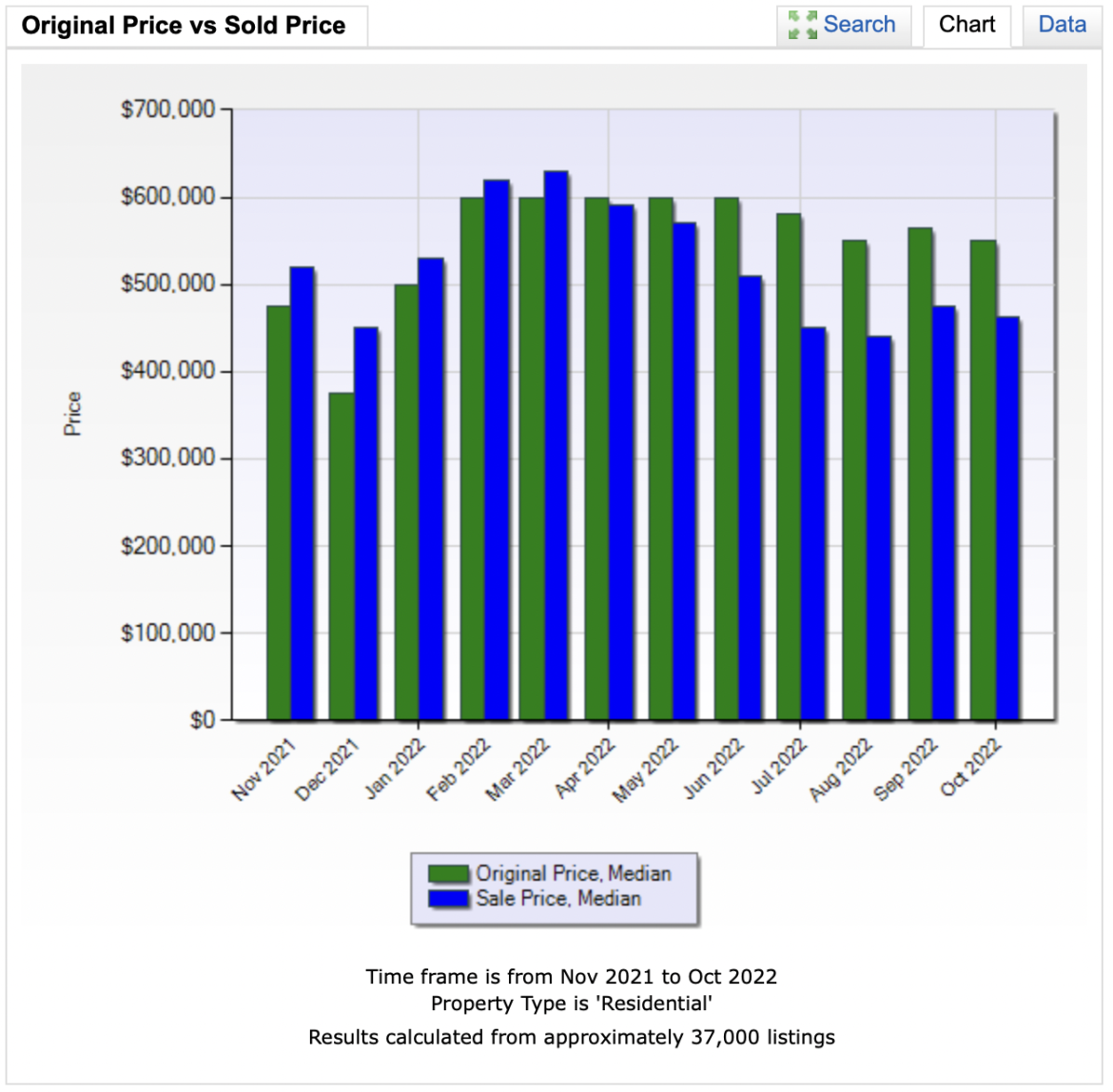

Ottawa Average Home prices was up from Nov 2021 to Oct 2022 by 9.4% more, this past month shows 0.5% increase. Average price $703,000 on a residential freehold property and Condos show $425,000.

Join my Newsletter to get these market figures and monthly updates sent to you by email.

Free Home Evaluation, Ottawa Homes for Sale – Know your price before you sell.

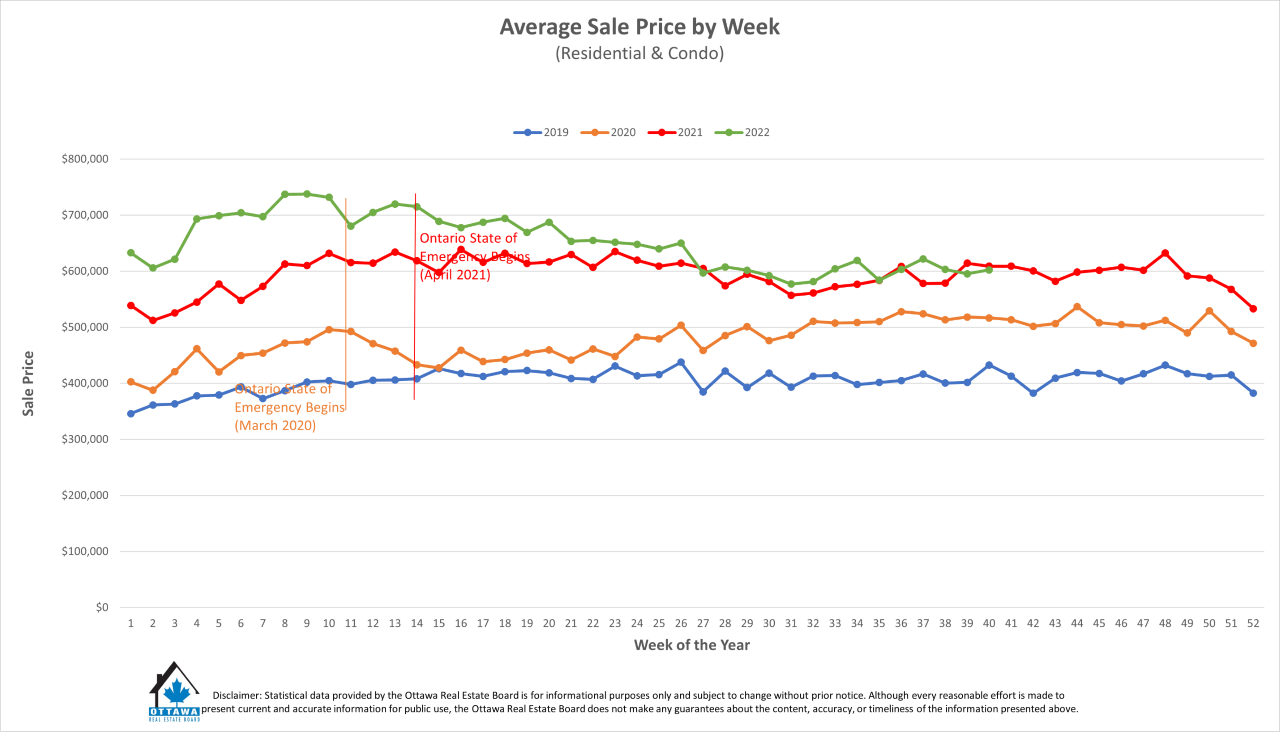

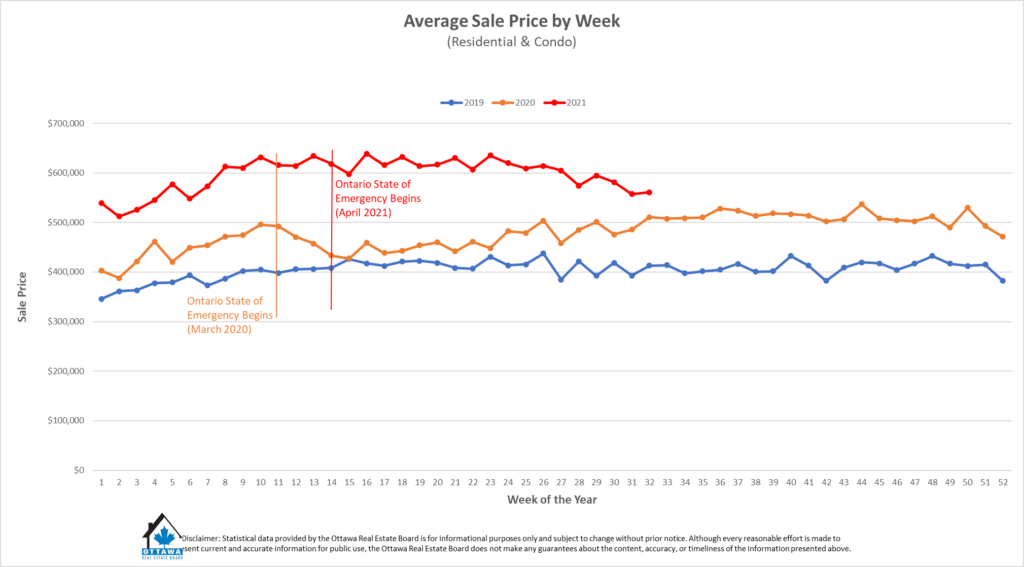

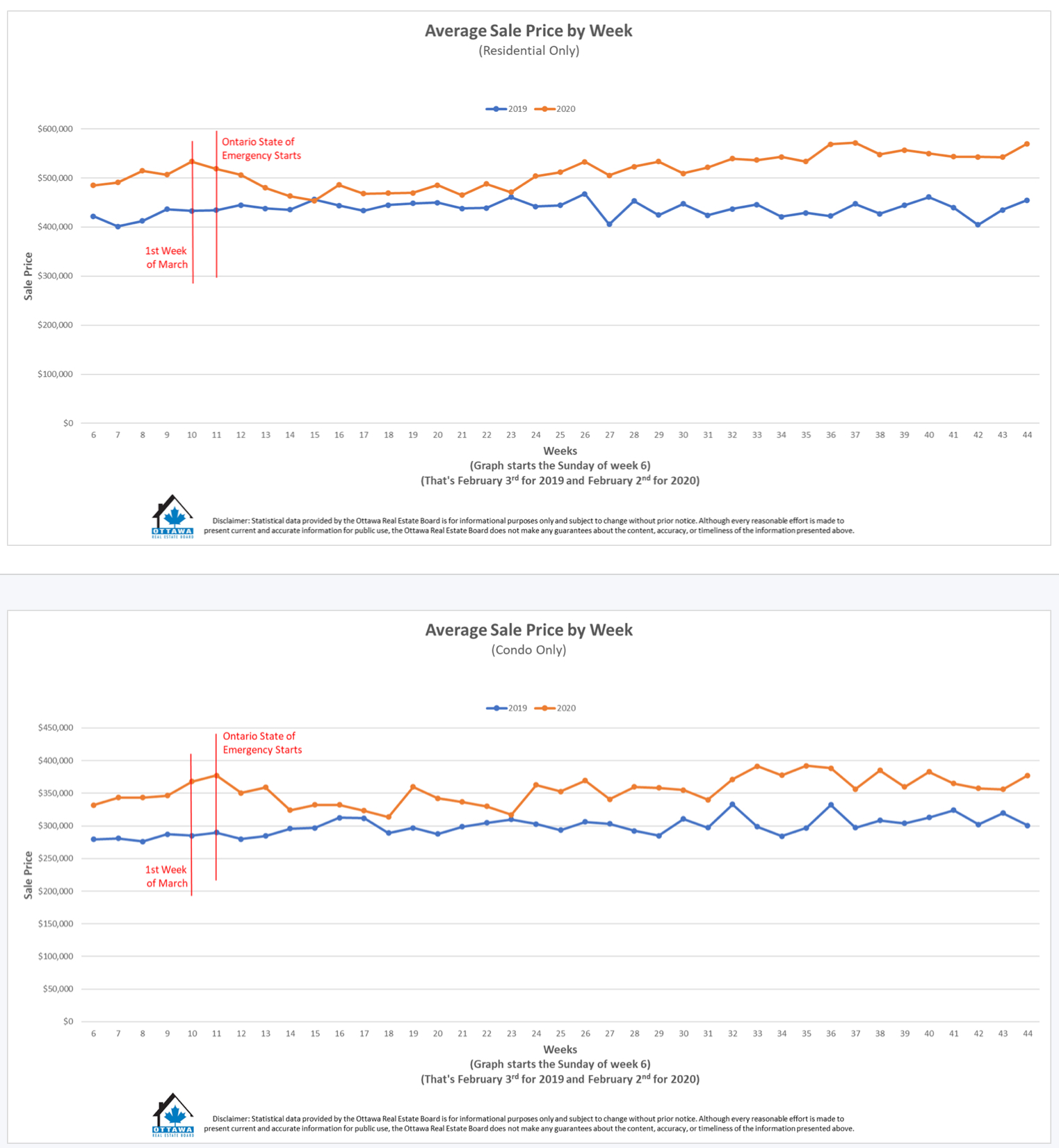

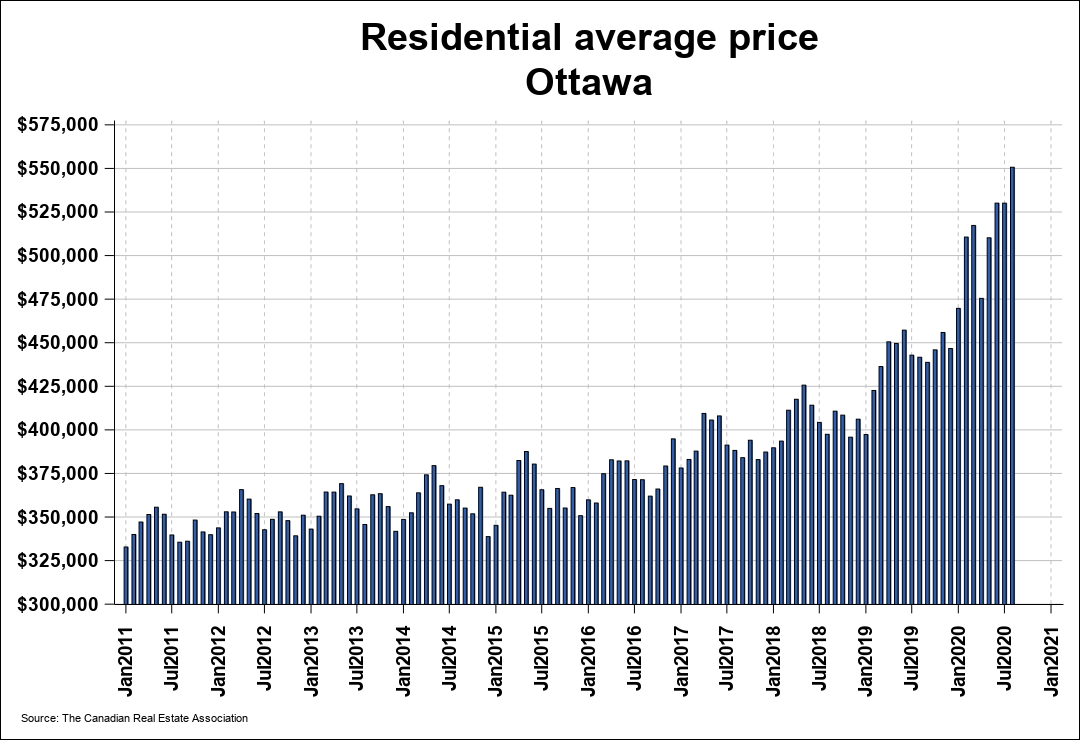

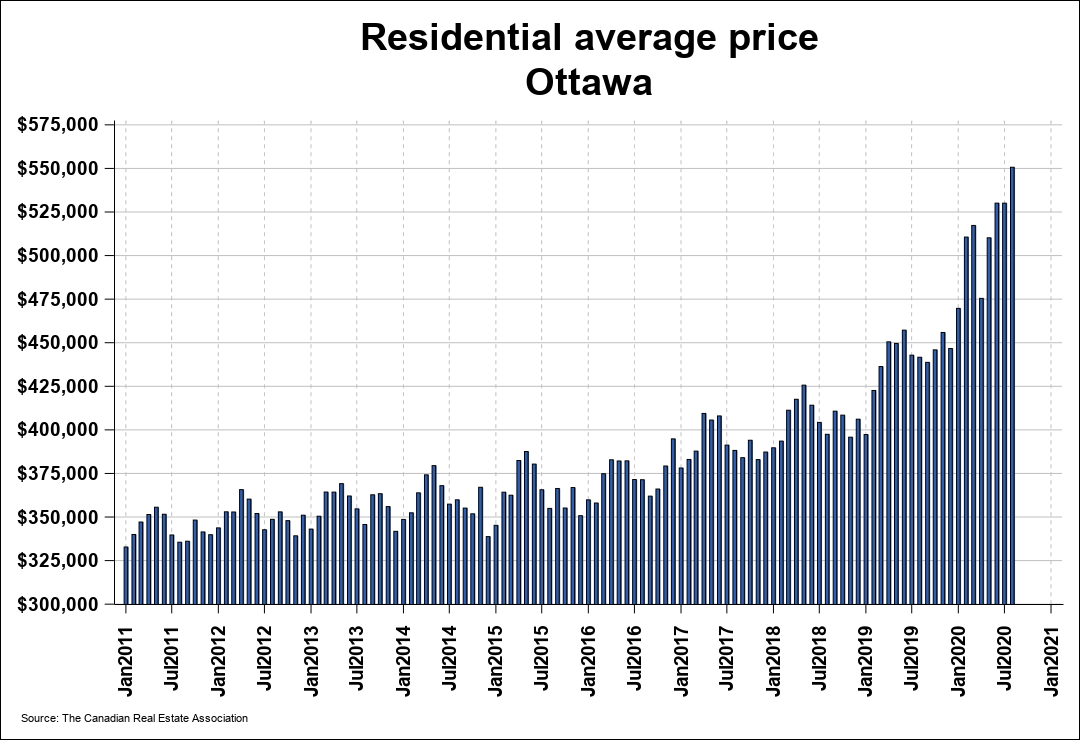

This chart shows the Ottawa area states of sold prices.

Average Prices per week

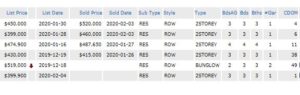

Listed prices vs SOLD Prices

Free Home Evaluation – Ottawa Homes for Sale

Know your price before you sell.

JUST SOLD

#ottawarealestate

#ottawahomeprices

#ottawapricesofhomes

#ottawahomesforsale

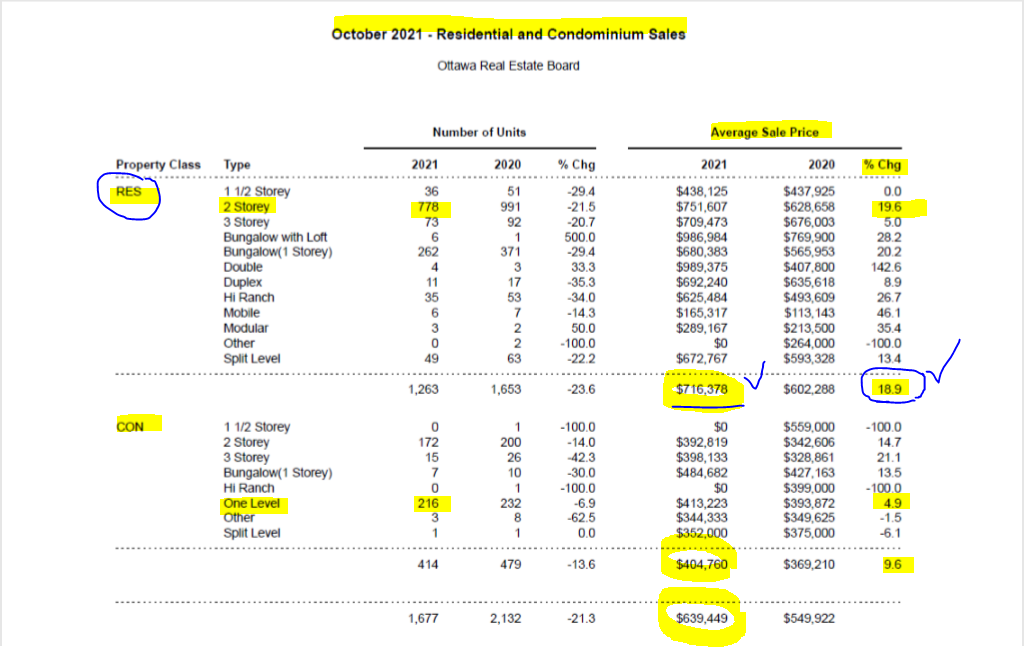

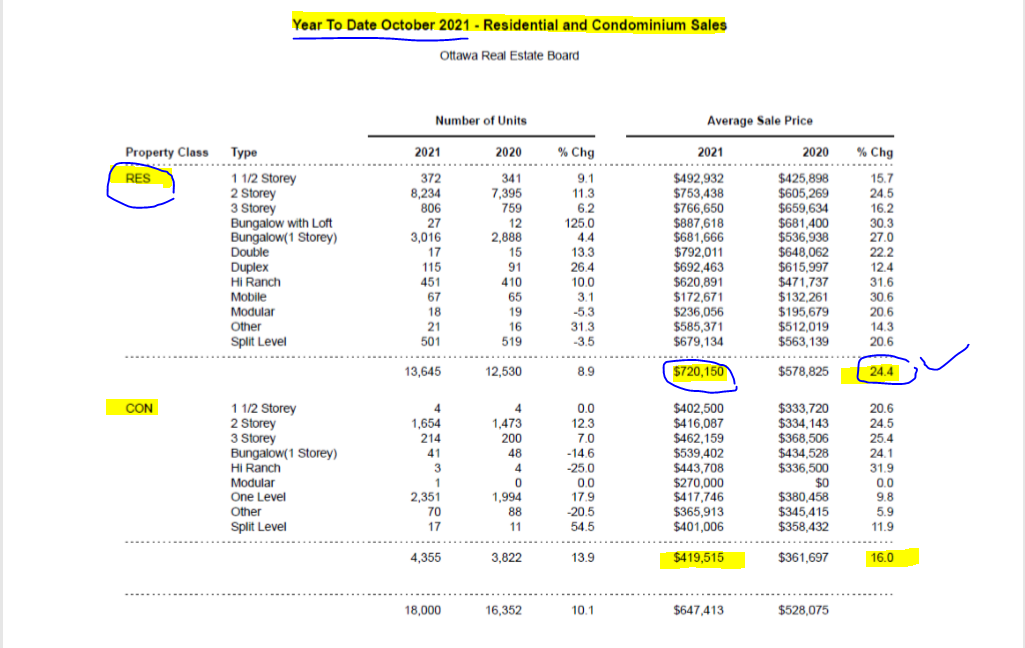

OTTAWA, November 3, 2021 Members of the Ottawa Real Estate Board sold 1,677 residential properties in October through the Board’s Multiple Listing Service® System, compared with 2,132 in October 2020, a decrease of 21 per cent. October’s sales included 1,263 in the residential-property class, down 24 per cent from a year ago, and 414 in the condominium property category, a decrease of 14 per cent from October 2020.

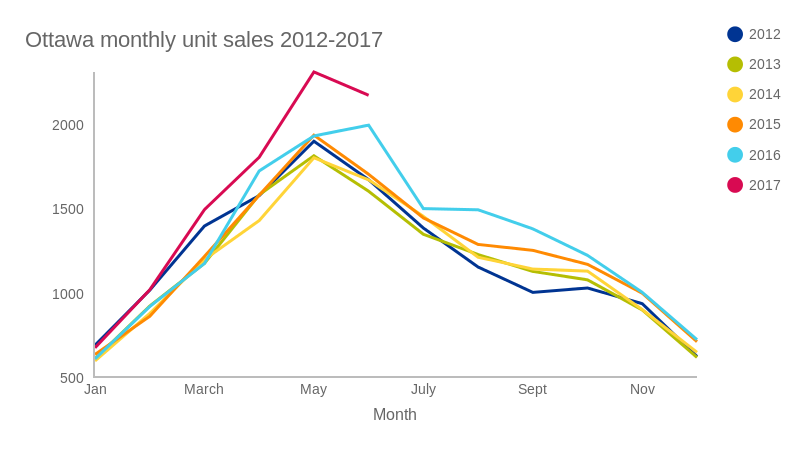

The five-year average for total unit sales in October is 1,605. “October’s resale market was active, busy, and stable – and followed the typical (pre-pandemic) ebb and flow that we commonly see as we enter the fall season,” states Ottawa Real Estate Board President Debra Wright. “The number of transactions increased slightly over September (1,607) as well as the 5-year average. The only reason we see a year-over year decrease in comparison to last October is because 2020’s sales peak had shifted from the spring months to September/ October due to the initial Covid-19 lockdown.”

The average sale price for a condominium-class property in October was $404,760, an increase of 10 per cent from 2020, while the average sale price for a residential

class property was $716,378, an increase of 19 per cent from a year ago. With year-to-date average sale prices at $720,150 for residential and $419,515 for condominiums, these values represent a 24 per cent and 16 percent increase over 2020, respectively.*“While the number of units sold followed the traditional trajectory, the lack of supply continues to put upward pressure on prices, which are holding strong and steadily increasing. Although there were 1,960 new listings in October, falling just under the 5-year average (1,974), it’s simply not enough. Inventory remains at a one-month supply for residential properties and 1.2 months for condominiums.

The only way we will find balance in Ottawa’s market is to increase the housing stock exponentially.”“Low inventory and a lack of suitable housing options restrict movement along the housing spectrum. Moveup buyers and downsizers have nowhere to go, so they stay in place, but we need that exchange of properties in the marketplace to free up supply for entry-level homebuyers,” Wright adds. “Additionally, we have noticed a substantial increase in the number of rental transactions through the MLS® System, which could suggest that some of the properties have been purchased or held on to for investment purposes. This active rental market may be another contributing factor as to why there aren’t more properties coming onto the market for sale.”

OREB Members assisted clients with renting 4,012 properties since the beginning of the year compared to 2,829 at this time last year. * The Board cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price and conditions will vary from neighbourhood to neighbourhood.

SOURCE” OREB

Join our Newsletter and get this Ottawa Real Estate News report sent to you monthly.

OTTAWA HOMES FOR SALE

KANATA HOMES FOR SALE

OTTAWA HOME PRICES

OTTAWA HOMES SOLD PRICES

OTTAWA HOME LISTINGS

OTTAWA AGENTS

OTTAWA PROPERTIES FOR SALE

OTTAWA CONDOS FOR SALE

OTTAWA CONDO SOLD PRICSE

The Market- knowing when to sell.

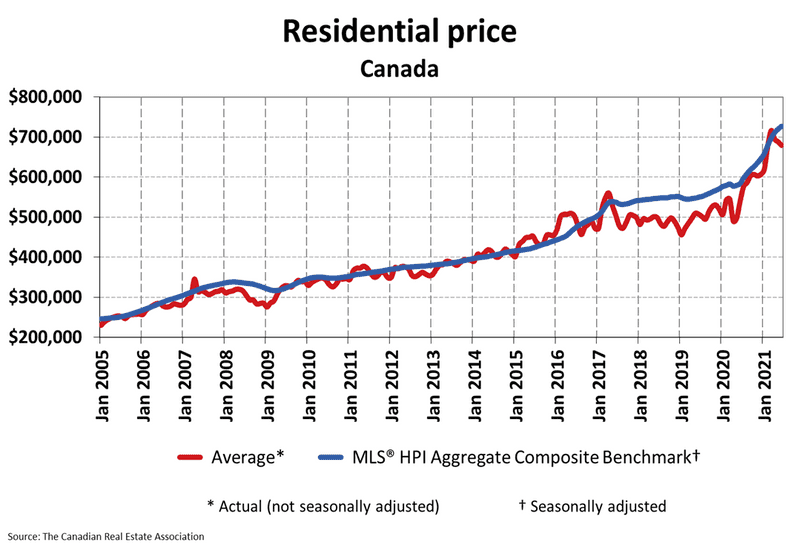

The Canadian Real Estate Market – Prices are still up.

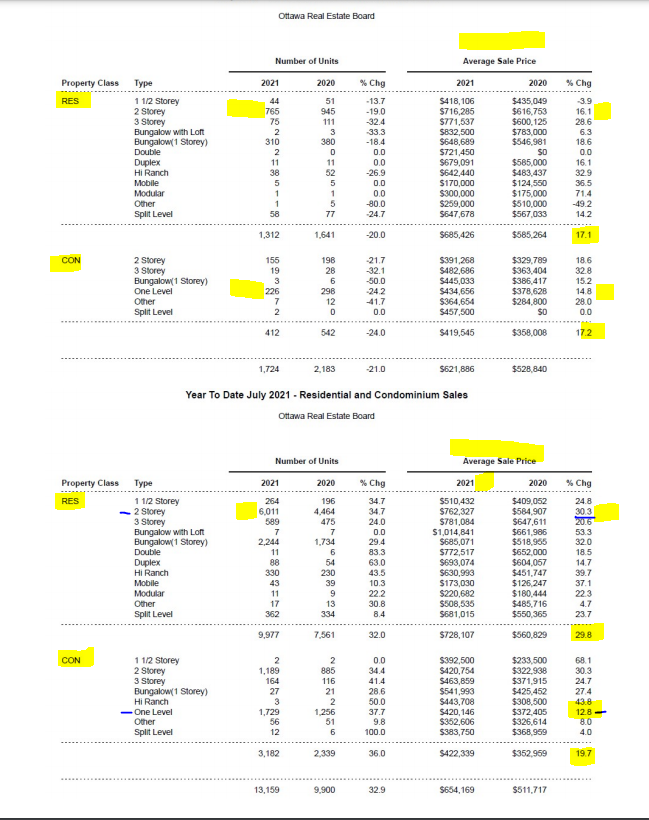

OTTAWA, August 5, 2021 – Members of the Ottawa Real Estate Board sold 1,724 residential properties in July through the Board’s Multiple Listing Service® System, compared with 2,183 in July 2020, a decrease of 21 per cent. July’s sales included 1,312 in the residential-property class, down 20 per cent from a year ago, and 412 in the condominium-property category, a decrease of 24 per cent from July 2020. The five-year average for total unit sales in July is 1,775. “July’s unit sales followed the traditional cycle of the spring and summer markets, which tend to peak around April or May and then slow down as Buyers and Sellers turn their attention to their vacations and other outdoor recreational activities,” states Ottawa Real Estate Board President Debra Wright. “This year’s figure is closer to 2019’s (1,838 sales) and just shy of the 5-year average, with the slight decline in transactions perhaps due to the combination of summer and the reopening of the economy last month. Certainly, the marked decrease from last year’s July sales is due to the spring 2020 lockdown, which had shifted the 2020 resale market’s peak to the summer and fall months,” she adds. July’s average sale price for a condominiumclass property was $419,545, an increase of 17 per cent from last year, while the average sale price for a residentialclass property was $685,426, also an increase of 17 per cent from a year ago. With year-to-date average sale prices at $728,107 for residential and $422,339 for condominiums, these values represent a 30 per cent and 20 percent increase over 2020, respectively.* “Following the same trend as sales, the month-to-month average prices decreased marginally by 4-6% compared to June; however, this minor dip is consistent to what typically happens during the summer months. Overall, average prices have increased considerably from 2020, and year-to-date values are holding steady. Still, Sellers will need to keep in mind that the multiple offer frenzy experienced previously is no longer the norm, and they may need to have more realistic expectations when positioning their homes and settling on a listing price with their REALTORS®.” “We are seeing the housing stock increasing with residential inventory up 19% and condominium supply 23% higher than 2020. Although there were 700 fewer listings than in June, the number of properties that entered the market in July is over the fiveyear average by approximately 114 units. Along with the price stabilizations, we hope this may indicate that Ottawa’s resale market is moving towards a more balanced state, which would be good for everyone,” suggests Wright. “Established in 1921, on July 9th, the Ottawa Real Estate Board commemorated 100 years of helping our neighbours, friends, and fellow residents buy and sell their homes, cottages and investment properties. Over the past century, our Board has advocated for affordable and attainable homes, as well as a range of housing options for seniors, first-time homebuyers and everyone in between. We pledge to continue this endeavour for our future clients in the years to come. On behalf of the Ottawa Real Estate Board and our 3,500 REALTOR® Members, I would like to extend my heartfelt gratitude to all of you who have put your trust in us to help you make your real estate dreams come true. We hope to continue to serve our communities for the next 100 years and beyond.” OREB Members also assisted clients with renting 2,706 properties since the beginning of the year compared to 1,883 at this time last year. * OREB cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price will vary from neighborhoods’.

Call me today for a FREE MARKET EVALUATION OF YOUR PROPERTY.

Lets look at the Kanata Real Estate market details. A full recap of the market : Kanata and Ottawa.

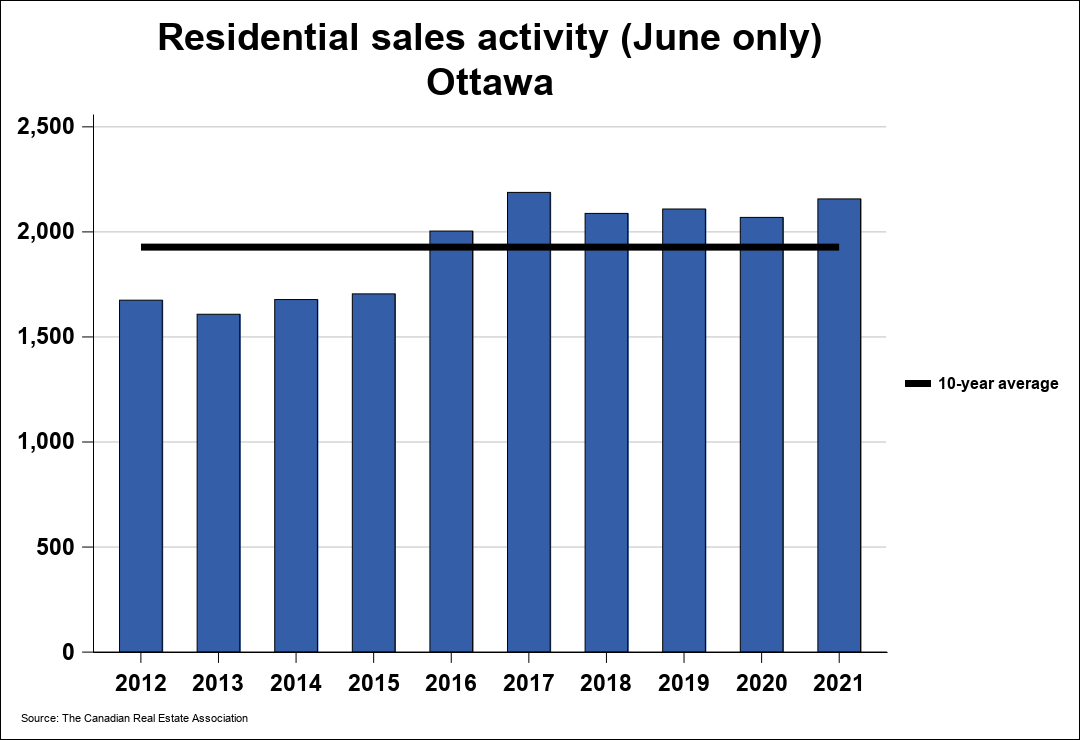

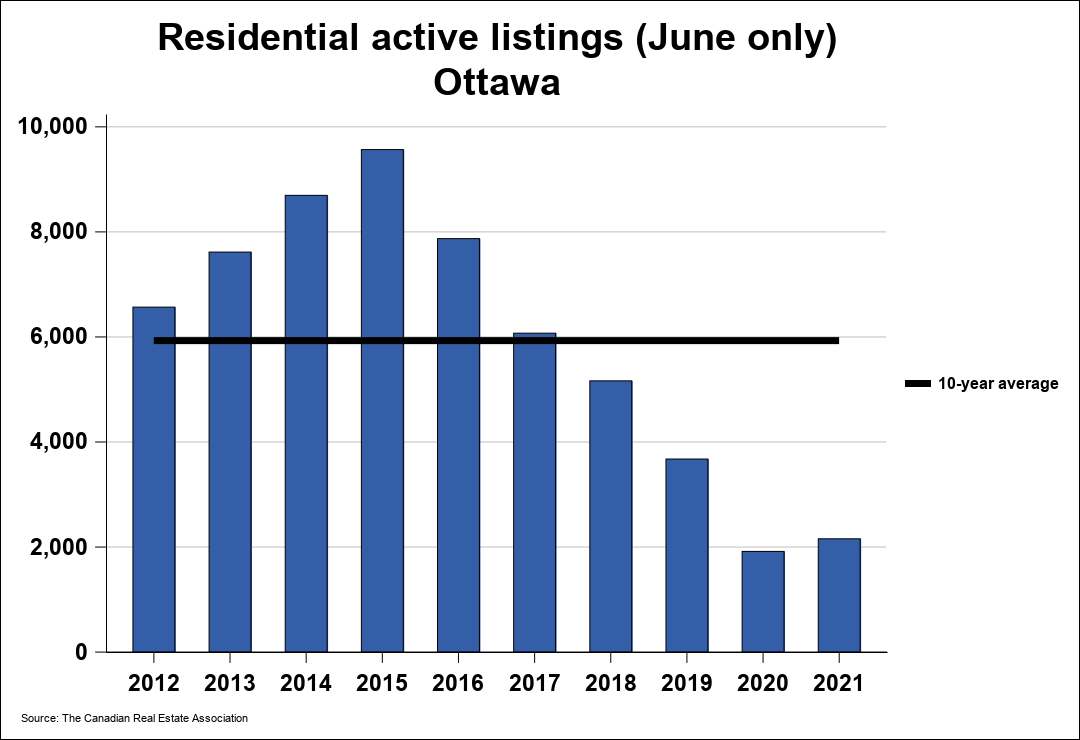

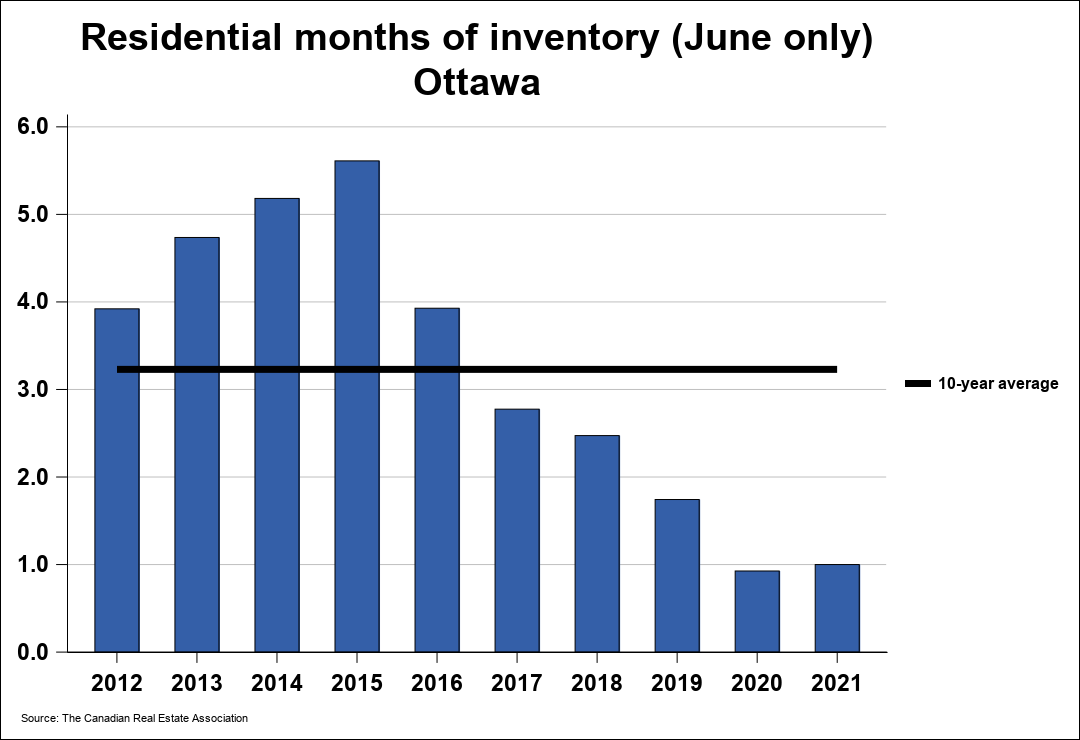

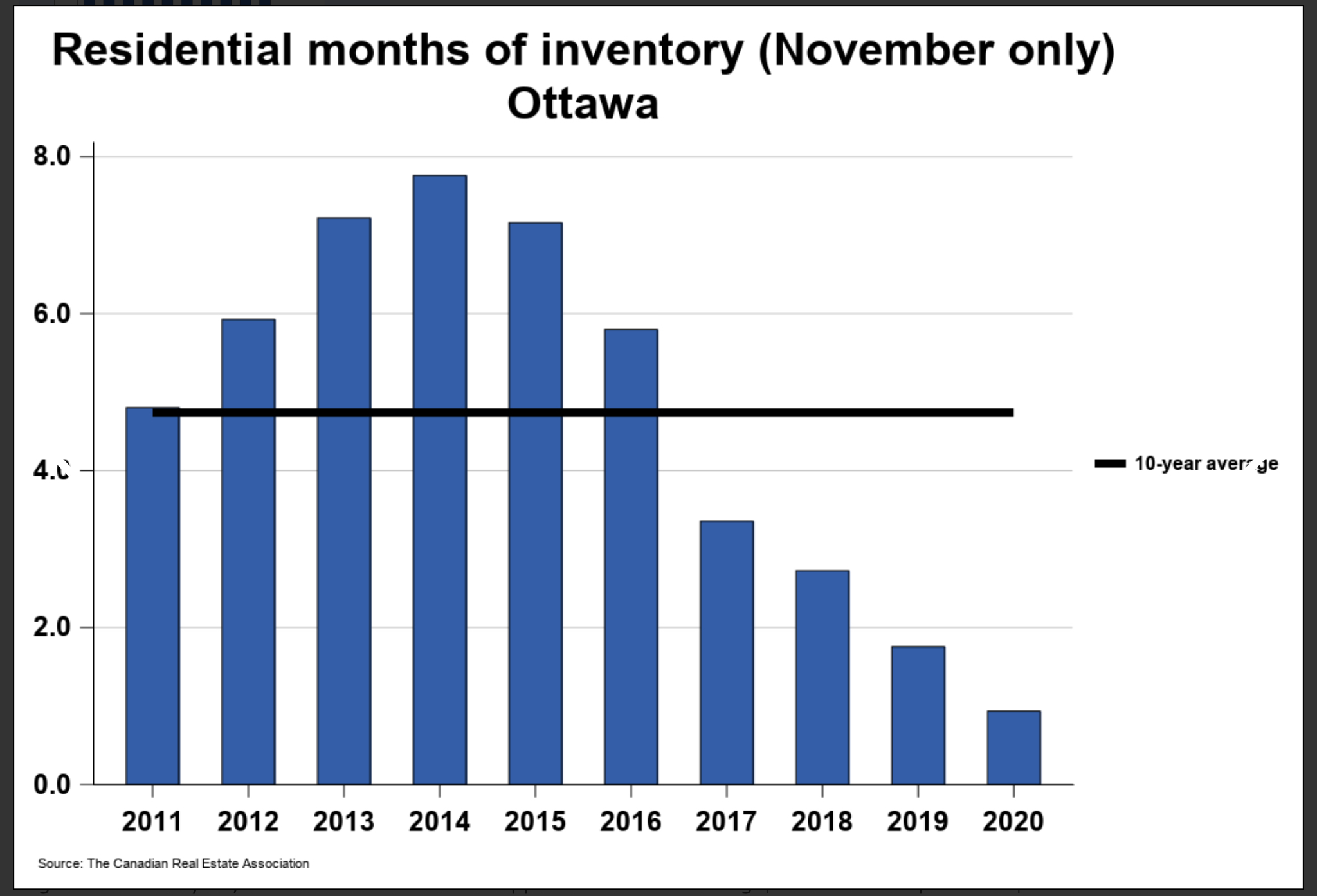

Prices up +20.6% —-Is it’s a bubble? Lets look at the inventory levels to understand why this is happening.

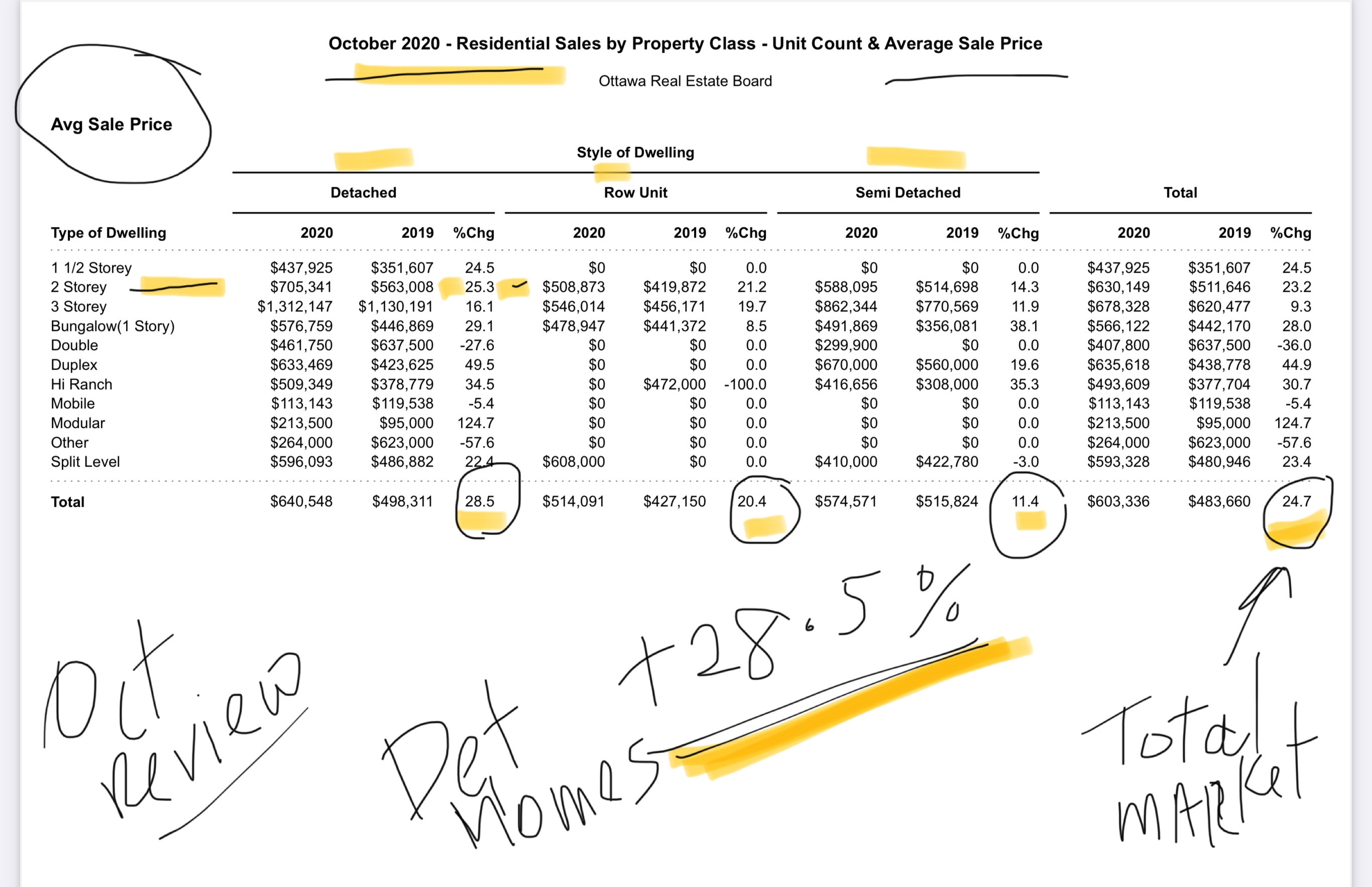

Ottawa’s Resale Market Thrives in December 2020 Despite Pandemic” +32.4% increase in units sold and +14.9% increase in price for a 2 storey home. Overall, Residential prices went up a +20.6% increase from November 2020.

OTTAWA REAL ESTATE NEWS- Here is my report and views of the current real estate market values in Ottawa, Kanata and to Orleans.

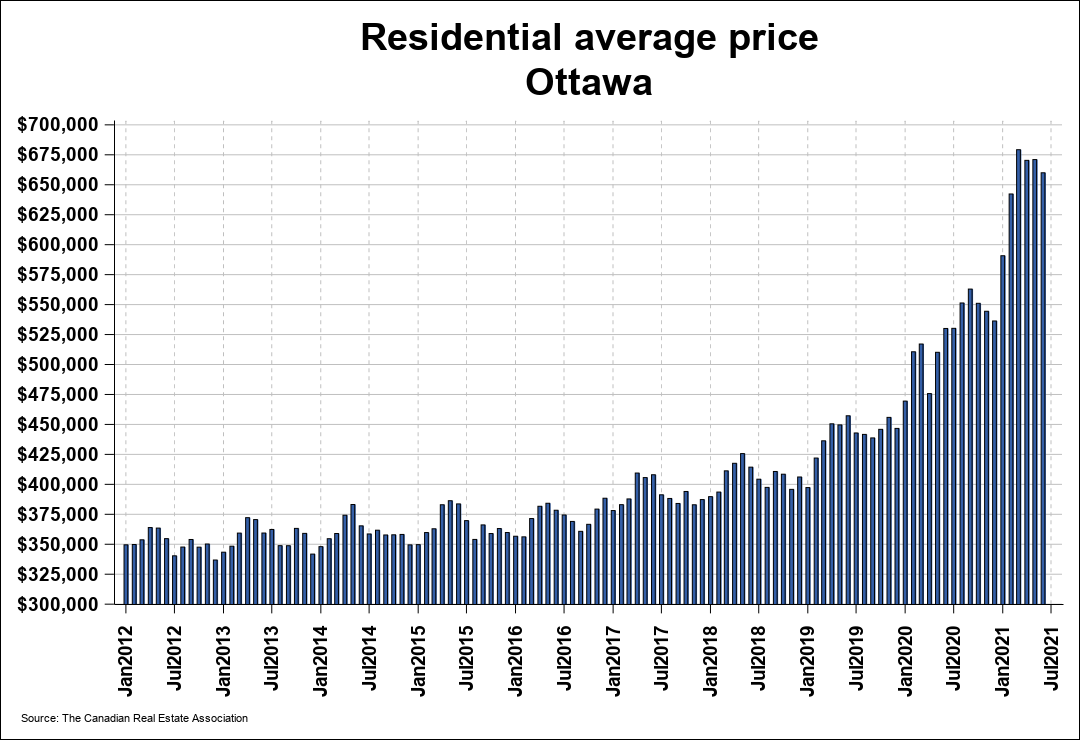

You may ask..why is the market so high? The simple answer is. We have low inventory! It’s been dropping since 2015 as you can see on this chart from CREA.

RECEIVE THESE POST IN YOUR EMAIL

OTTAWA – KANATA – REAL ESTATE UPDATES, PRICES SOLD, AVERAGE PRICE ON YOUR STREET, AND LOTS MORE

JOIN MY NEWSLETTER

and

FACEBOOK PAGE

RECEIVE ALL NEW LISTINGS ALERT

AND HELP BUYING A HOME

Ottawa’s REAL ESTATE Resale Market News and updates January 13th 2021.

Members of the Ottawa Real Estate Board (OREB) sold 1,002 residential properties in December through the Board’s Multiple Listing Service® System, compared with 757 in December 2019, an increase of 32.4 per cent. December’s sales included 710 in the residential property class, up 33.7 per cent from a year ago, and 292 in the condominium property class, an increase of 29.2 per cent from December 2019. The five-year average for total residential unit sales in December is 779.

“At the start of the pandemic, we didn’t know what to expect. We had a momentary stall as did most businesses; however, once real estate was deemed to be an essential service, REALTORS® worked with Buyers and Sellers to ensure safety in the process, and the market picked back up and accelerated past all expectations throughout the remainder of the year.”

The total number of residential and condo units sold throughout 2020 was 18,971, compared with 18,613 in 2019, increasing 2 per cent. Residential property class unit sales went up by 3 per cent, with 14,455 properties exchanging hands last year compared to 14,030 in 2019. Condominium property class sales decreased slightly by 1.5 per cent, with 4,516 units sold in 2020 versus 4,583 in the previous year.

December’s average sale price for a condominium-class property was $355,982, an increase of 14.4 per cent from a year ago, while the average sale price of a residential-class property was $603,880, an increase of 20.6 per cent from December 2019. Year-end figures show an average sale price of $582,267 for residential-class properties and $361,337 for condominium units in 2020. These values represent a 20 per cent and 19 percent increase over 2019, respectively.*

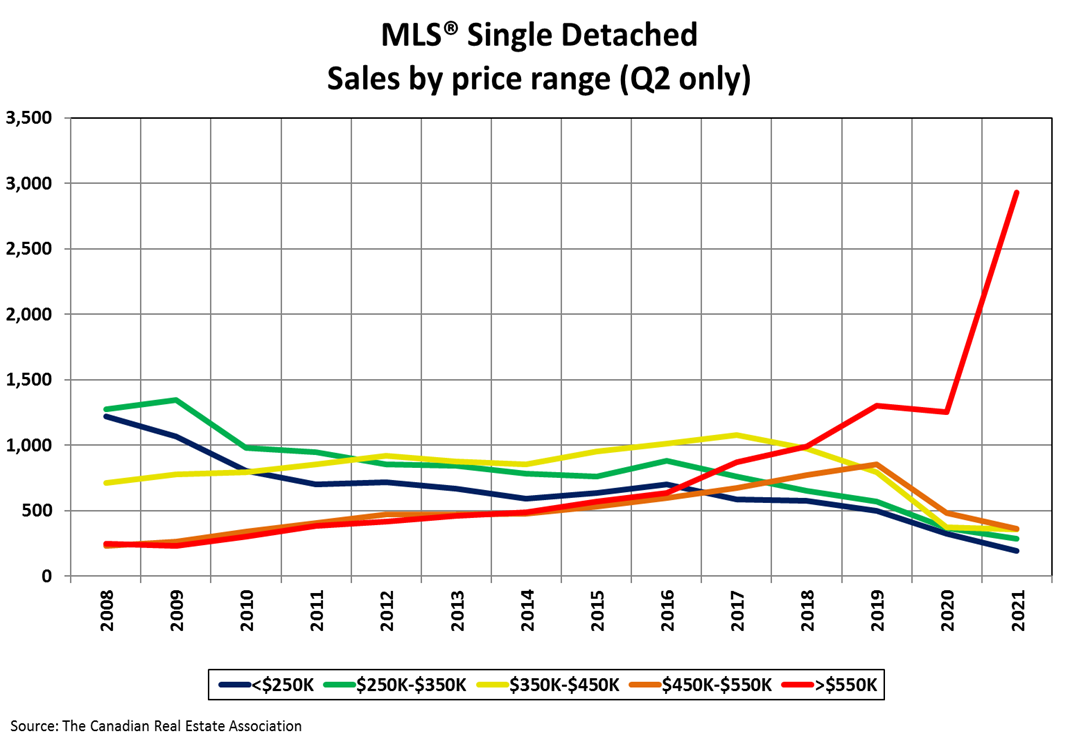

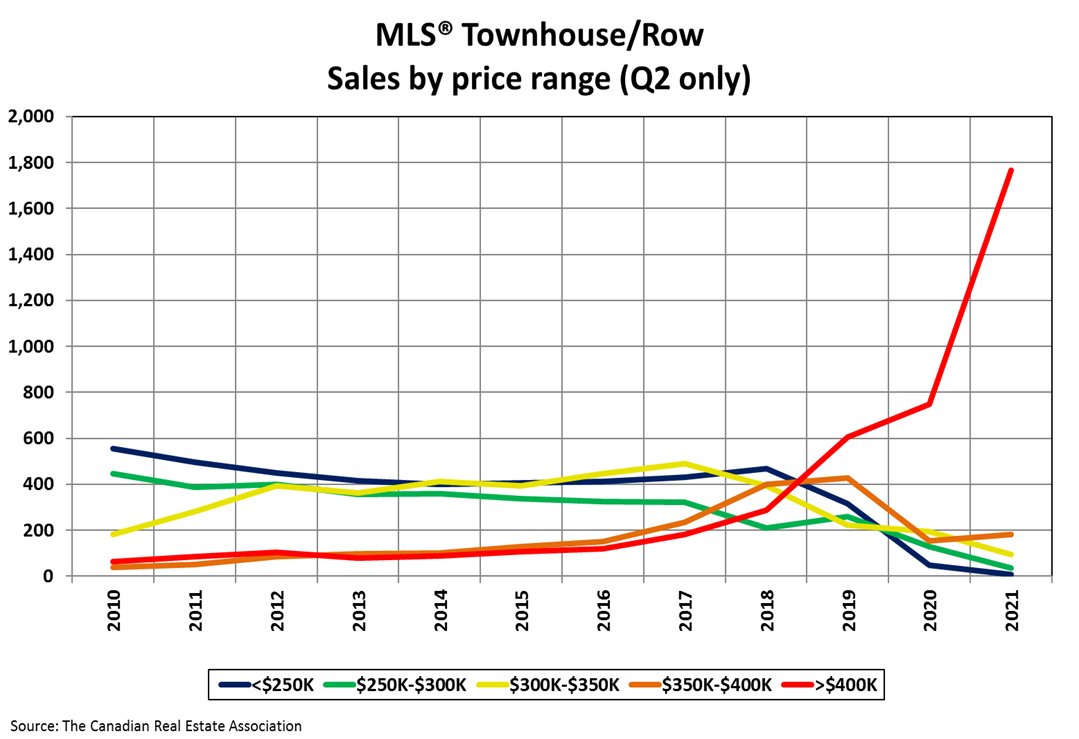

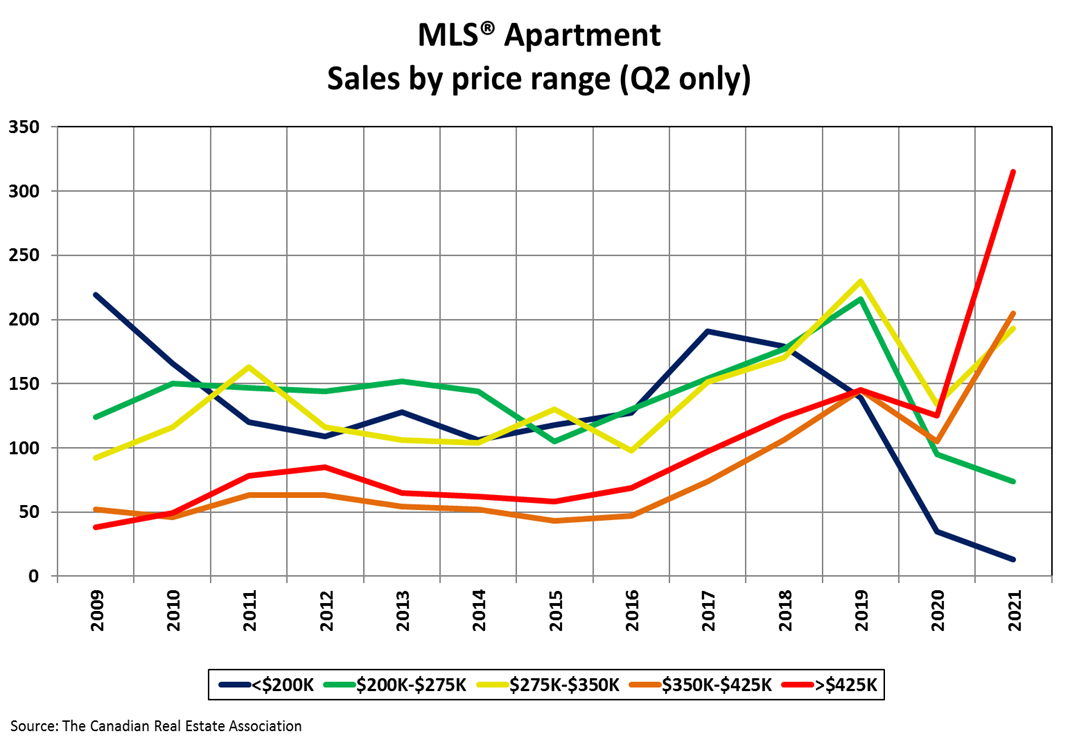

“When analyzing the year-end figures, what clearly stood out was that although the number of units sold was only slightly higher than last year, the Total Sales Volume topped a record-breaking $10 billion compared to $8.2 billion at the end of 2019. This is, in effect, a stark illustration of the increase in Ottawa property values over the course of the year. For example, in 2019, 35% of properties purchased were sold at or below $400K, while in 2020, only 16% of homes were. The market is certainly exhibiting a major shift in terms of availability in lower price ranges,” Wright points out.

“At the end of 2020, average prices increased by 19-20% over this time last year. In 2019, we saw a 9% overall increase for both residential and condo properties compared to 3-5% in 2018 and 3-7% in 2017. These substantive increases in property prices from year to year can be attributed to a variety of factors: the inventory shortage triggering economic supply and demand realities, the multiple-offer phenomena, the record-low mortgage rates increasing purchasing power of Buyers, migration of Buyers from larger markets with high returns to spend, and so forth.”

“I believe that Ottawa is just coming into its own as a national capital city. As such, it is resilient and sheltered in a way that other markets are not – with consistent government and tech sector employment that is particularly conducive to working from home as our current circumstances have required. We may have been privileged with lower price thresholds in previous decades, but perhaps the market is now beginning to reflect the real estate property values of a national capital.”

“Going forward, I fully expect Ottawa’s resale market will continue to be robust in 2021. There are no indicators to suggest that this is an overheated market – it is simply very active, insulated, and strong. One that has only been mildly shaken by a world-wide pandemic,” Wright concludes.

* The Board cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price and conditions will vary from neighbourhood to neighbourhood.

Source:

The Ottawa Real Estate Board

HOMES FOR SALE IN OTTAWA

FREE HOME EVALUATION 13 Jan 2021

KANATA HOMES FOR SALE

KANATA HOME PRICES

KANATA HOME REPORTS

KANATA HOME PRICES FOR 2021

KANATA TOWNHOMES

KANATA DETACHED HOMES PRICES

KANATA REAL ESTATE MARKET PRICES

2021 KANATA HOME PRICES

OTTAWA HOMES FOR SALE 13 Jan 2021

OTTAWA REAL ESTATE 13 Jan 2021

OTTAWA HOME PRICING 13 Jan 2021

OTTAWA SALE PRICES 13 Jan 2021

OTTAWA REAL ESTATE AGENT 13 Jan 2021

OTTAWA HOME NEWS , 13 Jan 2021

OTTAWA BRIDLEWOOD HOME PRICES 13 Jan 2021

OTTAWA HOMES FOR SALE 13 Jan 2021

OTTAWA MLS NEWS 13 Jan 2021

OTTAWA STREET SOLD PRICES 13 Jan 2021

Ottawa’s Resale Market Thrives in December 2020 Despite Pandemic” +32.4% increase in units sold and +14.9% increase in price for a 2 storey home. Overall, Residential prices went up a +20.6% increase from November 2020.

OTTAWA REAL ESTATE NEWS- Here is my report and views of the current real estate market values in Ottawa, Kanata and to Orleans.

You may ask..why is the market so high? The simple answer is. We have low inventory! It’s been dropping since 2015 as you can see on this chart from CREA.

RECEIVE THESE POST IN YOUR EMAIL

OTTAWA – KANATA – REAL ESTATE UPDATES, PRICES SOLD, AVERAGE PRICE ON YOUR STREET, AND LOTS MORE

JOIN MY NEWSLETTER

and

FACEBOOK PAGE

RECEIVE ALL NEW LISTINGS ALERT

AND HELP BUYING A HOME

Ottawa’s REAL ESTATE Resale Market News and updates January 13th 2021.

Members of the Ottawa Real Estate Board (OREB) sold 1,002 residential properties in December through the Board’s Multiple Listing Service® System, compared with 757 in December 2019, an increase of 32.4 per cent. December’s sales included 710 in the residential property class, up 33.7 per cent from a year ago, and 292 in the condominium property class, an increase of 29.2 per cent from December 2019. The five-year average for total residential unit sales in December is 779.

“At the start of the pandemic, we didn’t know what to expect. We had a momentary stall as did most businesses; however, once real estate was deemed to be an essential service, REALTORS® worked with Buyers and Sellers to ensure safety in the process, and the market picked back up and accelerated past all expectations throughout the remainder of the year.”

The total number of residential and condo units sold throughout 2020 was 18,971, compared with 18,613 in 2019, increasing 2 per cent. Residential property class unit sales went up by 3 per cent, with 14,455 properties exchanging hands last year compared to 14,030 in 2019. Condominium property class sales decreased slightly by 1.5 per cent, with 4,516 units sold in 2020 versus 4,583 in the previous year.

December’s average sale price for a condominium-class property was $355,982, an increase of 14.4 per cent from a year ago, while the average sale price of a residential-class property was $603,880, an increase of 20.6 per cent from December 2019. Year-end figures show an average sale price of $582,267 for residential-class properties and $361,337 for condominium units in 2020. These values represent a 20 per cent and 19 percent increase over 2019, respectively.*

“When analyzing the year-end figures, what clearly stood out was that although the number of units sold was only slightly higher than last year, the Total Sales Volume topped a record-breaking $10 billion compared to $8.2 billion at the end of 2019. This is, in effect, a stark illustration of the increase in Ottawa property values over the course of the year. For example, in 2019, 35% of properties purchased were sold at or below $400K, while in 2020, only 16% of homes were. The market is certainly exhibiting a major shift in terms of availability in lower price ranges,” Wright points out.

“At the end of 2020, average prices increased by 19-20% over this time last year. In 2019, we saw a 9% overall increase for both residential and condo properties compared to 3-5% in 2018 and 3-7% in 2017. These substantive increases in property prices from year to year can be attributed to a variety of factors: the inventory shortage triggering economic supply and demand realities, the multiple-offer phenomena, the record-low mortgage rates increasing purchasing power of Buyers, migration of Buyers from larger markets with high returns to spend, and so forth.”

“I believe that Ottawa is just coming into its own as a national capital city. As such, it is resilient and sheltered in a way that other markets are not – with consistent government and tech sector employment that is particularly conducive to working from home as our current circumstances have required. We may have been privileged with lower price thresholds in previous decades, but perhaps the market is now beginning to reflect the real estate property values of a national capital.”

“Going forward, I fully expect Ottawa’s resale market will continue to be robust in 2021. There are no indicators to suggest that this is an overheated market – it is simply very active, insulated, and strong. One that has only been mildly shaken by a world-wide pandemic,” Wright concludes.

* The Board cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price and conditions will vary from neighbourhood to neighbourhood.

Source:

The Ottawa Real Estate Board

HOMES FOR SALE IN OTTAWA

FREE HOME EVALUATION 13 Jan 2021

OTTAWA HOMES FOR SALE 13 Jan 2021

OTTAWA REAL ESTATE 13 Jan 2021

OTTAWA HOME PRICING 13 Jan 2021

OTTAWA SALE PRICES 13 Jan 2021

OTTAWA REAL ESTATE AGENT 13 Jan 2021

OTTAWA HOME NEWS , 13 Jan 2021

OTTAWA BRIDLEWOOD HOME PRICES 13 Jan 2021

OTTAWA HOMES FOR SALE 13 Jan 2021

OTTAWA MLS NEWS 13 Jan 2021

OTTAWA STREET SOLD PRICES 13 Jan 2021

Ottawa’s Resale Market “Steady as She Goes”

OTTAWA REAL ESTATE NEWS- Here are my views of the current market values.

Ottawa’s REAL ESTATE Resale Market News and updates Nov 24th 2020

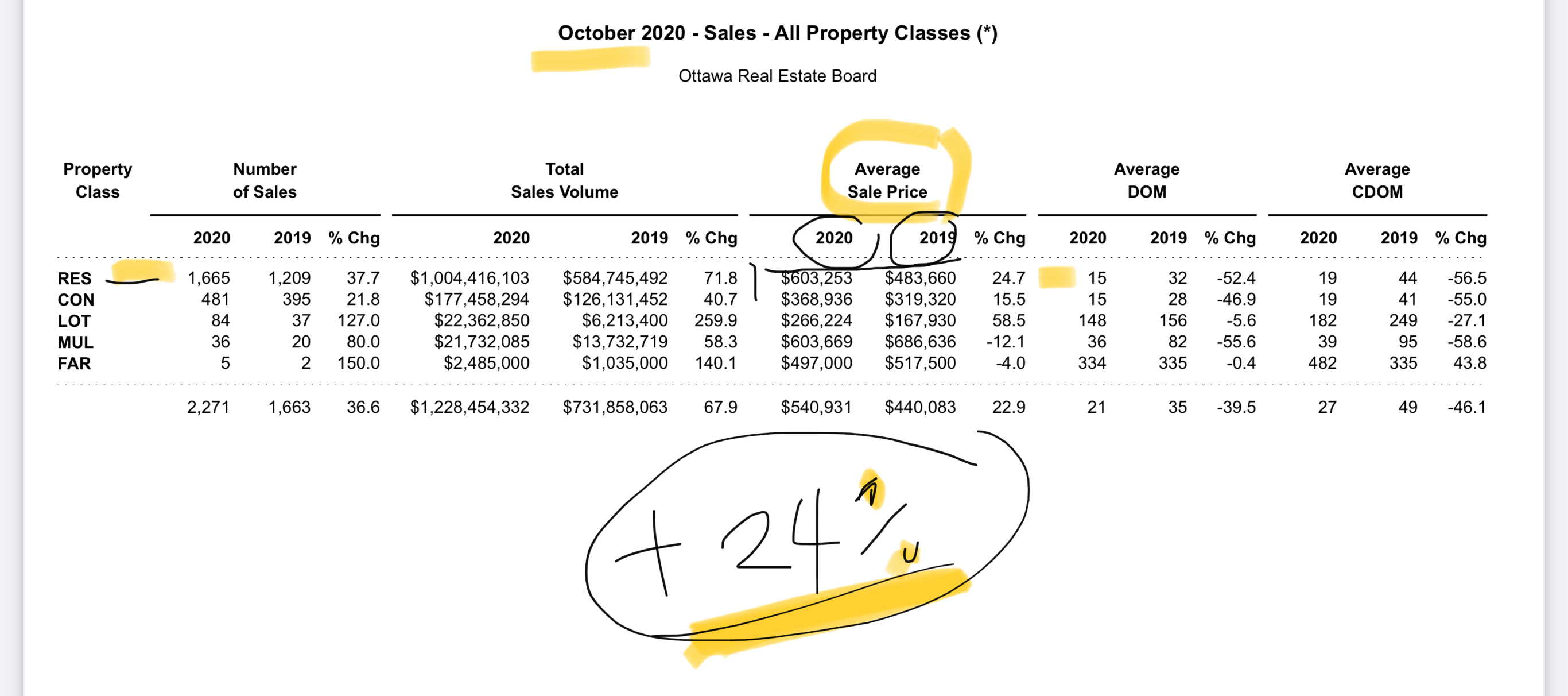

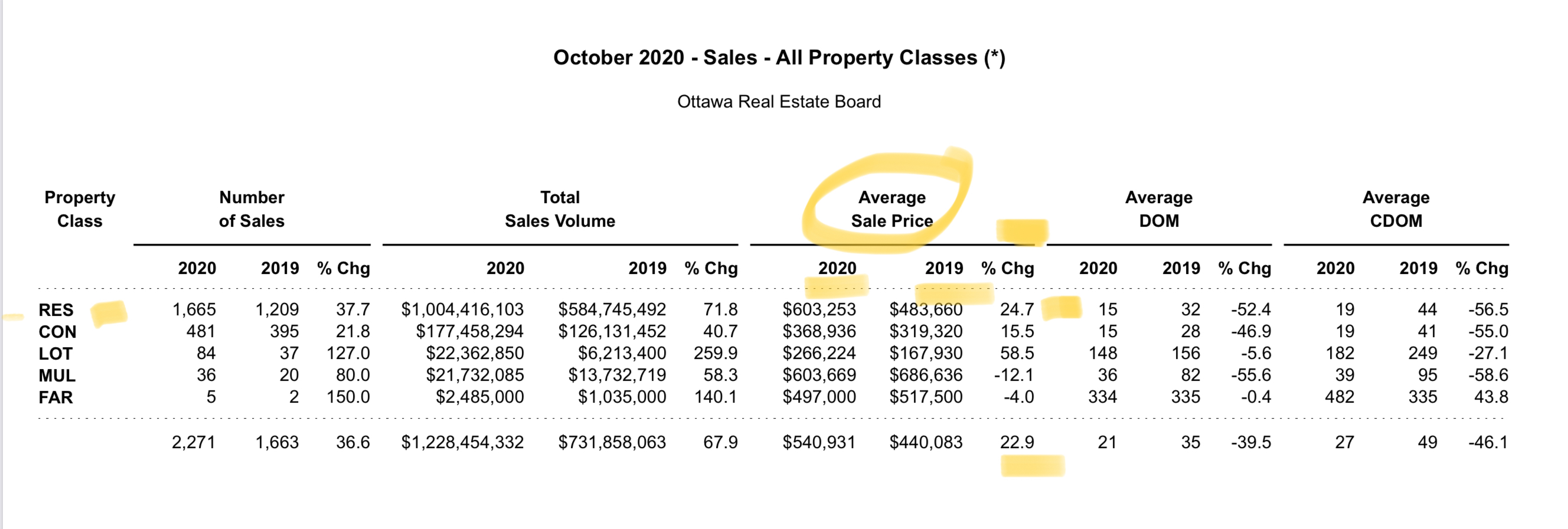

OTTAWA, November 4, 2020 – Members of the Ottawa Real Estate Board sold 2,146 residential properties in October through the Board’s Multiple Listing Service® System, compared with 1,604 in October 2019, a year over year increase of 34 per cent. October’s sales included 1,665 in the residential- property class, up 38 per cent from a year ago, and 481 in the condominium- property category, an increase of 22 per cent from October 2019. The five-year average for October unit sales is 1,515.

“We are heading into the colder months, the second wave of the pandemic is upon us, and yet Ottawa’s resale market continues to hold steady,” observes Ottawa Real Estate Board President Deb Burgoyne.

“While the October average price gains, number of sales, and new listings coming onto the market were all down from September, demand persists, and the number of sellers choosing to enter the market remains strong. With 1,937 residential listings and 708 condo units added to the housing stock in October, this is a 48% and 70% respective increase in new listings over last year at this time,” she adds.

October’s average sale price for a condominium-class property was $368,936, an increase of 16 per cent from this time last year, while the average sale price of a residential-class property was $603,253, an increase of 25 percent from a year ago. With year- to-date average sale prices at $579,026 for residential and $361,666 for condominiums, these values represent a 19 per cent percent increase over 2019 for both property classes.*

“The condominium market is on our watchlist. Inventory for condo units increased 15% over last October, while inventory for residential properties is down 46%. This is an inverse relationship compared to the beginning of 2020 when condo supply was depleting much quicker than residential,” reports Burgoyne.“The shift in the condo market occurred around June. There has been a lot of speculation about changing buyer behaviour and preferences due to our pandemic reality with homeowners wanting home offices and gym space, for example. One could extrapolate or conclude that buying preferences may be shifting towards a desire for properties with more square footage than this property type offers. Particularly, due to the sheer number of employees working remotely for the foreseeable future, commute times may continue to be less of an issue.”

“As the chillier weather and upcoming holiday season approaches, it will be interesting to see how the market calibrates. Typically, we start to see a slowdown in home sale activity. Whether that actually transpires is something we can’t predict given the topsy turvy year that is 2020. What I can tell you is that this is not the time to navigate the market on your own; there is too much at stake to venture in without the knowledge and guidance of an experienced REALTOR®,” Burgoyne concludes.

In addition to residential and condominium sales, OREB Members assisted clients with renting 2,829 properties since the beginning of the year compared to 2,334 at this time last year. * The Board cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price and conditions will vary from neighbourhood to neighbourhood.

Source:

The Ottawa Real Estate Board

FREE HOME EVALUATION 24 NOV 2020

OTTAWA HOMES FOR SALE

OTTAWA

REAL ESTATE 24 NOV 2020

OTTAWA

HOME PRICING 24 NOV 2020

OTTAWA

NOV 2020 SALE PRICES 24 NOV 2020

OTTAWA

REAL ESTATE AGENT 24 NOV 2020

OTTAWA

HOME NEWS ,24 NOV 2020

OTTAWA

BRIDLEWOOD HOME PRICES 24 NOV 2020

OTTAWA

BRIDLEWOOD HOMES FOR SALE 24 NOV 2020

OTTAWA

MLS –

OTTAWA

STREET SOLD PRICES 24 NOV 2020

Ottawa’s Resale Market “Steady as She Goes”

OTTAWA REAL ESTATE NEWS- Here are my reviews of current market values.

Ottawa’s REAL ESTATE Resale Market News and updates Nov 24th 2020

OTTAWA, November 4, 2020 – Members of the Ottawa Real Estate Board sold 2,146 residential properties in October through the Board’s Multiple Listing Service® System, compared with 1,604 in October 2019, a year over year increase of 34 per cent. October’s sales included 1,665 in the residential- property class, up 38 per cent from a year ago, and 481 in the condominium- property category, an increase of 22 per cent from October 2019. The five-year average for October unit sales is 1,515.

“We are heading into the colder months, the second wave of the pandemic is upon us, and yet Ottawa’s resale market continues to hold steady,” observes Ottawa Real Estate Board President Deb Burgoyne.

“While the October average price gains, number of sales, and new listings coming onto the market were all down from September, demand persists, and the number of sellers choosing to enter the market remains strong. With 1,937 residential listings and 708 condo units added to the housing stock in October, this is a 48% and 70% respective increase in new listings over last year at this time,” she adds.

October’s average sale price for a condominium-class property was $368,936, an increase of 16 per cent from this time last year, while the average sale price of a residential-class property was $603,253, an increase of 25 percent from a year ago. With year- to-date average sale prices at $579,026 for residential and $361,666 for condominiums, these values represent a 19 per cent percent increase over 2019 for both property classes.*

“The condominium market is on our watchlist. Inventory for condo units increased 15% over last October, while inventory for residential properties is down 46%. This is an inverse relationship compared to the beginning of 2020 when condo supply was depleting much quicker than residential,” reports Burgoyne.“The shift in the condo market occurred around June. There has been a lot of speculation about changing buyer behaviour and preferences due to our pandemic reality with homeowners wanting home offices and gym space, for example. One could extrapolate or conclude that buying preferences may be shifting towards a desire for properties with more square footage than this property type offers. Particularly, due to the sheer number of employees working remotely for the foreseeable future, commute times may continue to be less of an issue.”

“As the chillier weather and upcoming holiday season approaches, it will be interesting to see how the market calibrates. Typically, we start to see a slowdown in home sale activity. Whether that actually transpires is something we can’t predict given the topsy turvy year that is 2020. What I can tell you is that this is not the time to navigate the market on your own; there is too much at stake to venture in without the knowledge and guidance of an experienced REALTOR®,” Burgoyne concludes.

In addition to residential and condominium sales, OREB Members assisted clients with renting 2,829 properties since the beginning of the year compared to 2,334 at this time last year. * The Board cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price and conditions will vary from neighbourhood to neighbourhood.

Source:

The Ottawa Real Estate Board

FREE HOME EVALUATION 24 NOV 2020

KANATA HOMES FOR SALE

KANATA REAL ESTATE 24 NOV 2020

KANATA HOME PRICING 24 NOV 2020

KANATA NOV 2020 SALE PRICES 24 NOV 2020

KANATA REAL ESTATE AGENT 24 NOV 2020

KANATA HOME NEWS ,24 NOV 2020

KANATA BRIDLEWOOD HOME PRICES 24 NOV 2020

KANATA BRIDLEWOOD HOMES FOR SALE 24 NOV 2020

KANATA MLS – KANATA STREET SOLD PRICES 24 NOV 2020

OTTAWA, October 5, 2020

An increase of 28 per cent from a year ago!

Members of the Ottawa Real Estate Board sold 2,329 residential properties in September through the Board’s Multiple Listing Service® System, compared with 1,547 in September 2019, a year over year increase of 51 per cent. September’s sales included 1,759 in the residential property class, up 58 per cent from a year ago, and 570 in the condominium property category, an increase of 31 per cent from September 2019. The five-year average for September unit sales is 1,602. “The sheer volume of transactions in September, compared to a year ago, confirms the Ottawa resale market is continuing on its upward trajectory,” states Ottawa Real Estate Board President Deb Burgoyne. “The resale market in 2020, especially since the outset of the pandemic, has certainly not followed the usual spring and fall cycles we typically experience. This year has had its own distinct ebb and flow, and whether this momentum in our market will continue is difficult to predict.” “However, the continued increase in new listings and demand remaining strong allows us to be cautiously optimistic. September saw 2,165 residential properties and 744 condominiums enter the market. This is an increase of 32% and 45% respectively over last year at this time, and over 400 more new listings than came on the market in August,” adds Burgoyne.

September’s average sale price for a condominium-class property was $373,565, an increase of 21 per cent from this time last year, while the average sale price of a residential class property was $622,557, an increase of 28 per cent from a year ago. With year to date average sale prices at $575,506 for residential and $360,550 for condominiums,

these values represent a 19 per cent and 20 percent increase over 2019, respectively. * “While average prices in September hit an all-time high, the movement at the higher end of the market is

also likely driving this figure higher. September’s median prices, which is calculated removing the extreme upper and lower prices, do show more moderate price gains coming in at $570,000 for residential properties and $350,000 for condominiums,” Burgoyne acknowledges.

“Of course, the fundamentals of supply and demand remain at play, and our inventory shortage will continue to put Sellers in a position to capitalize on the current market. Additionally, the

dynamics of purchasing behaviour is shifting as Buyers become more tolerant of the condition of a property or its location, for example.” “But, we can’t exhale just yet. At the end of the day, REALTORS® represent both Buyers and Sellers, so a balanced market would be a welcomed relief for everyone. We would like to see both sides get over the finish line with a feeling of elation,

and that they have had a positive experience in their homeownership journey,” Burgoyne expresses. In addition to residential and condominium sales, OREB Members assisted clients with renting 2,536 properties since the beginning of the year compared to 2,117 at this time last year. * The Board cautions that the average sale price can be useful in establishing trends over time

but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all

properties sold. Price and conditions will vary from neighbourhood to neighbourhood.

HOMES FOR SALE IN KANATA

HOMES FOR SALE IN STITTSVILLE

HOMES FOR SALE IN OTTAWA

HOMES FOR SALE IN ORLEANS

JUST SOLD IN BRIDLEWOOD KANATA

52 CEDAROCK DR

TOP PRICE SOLD ON THE STREET UP TO 5 FEB 2020.

Stunning Town-home on quiet street with all newer High-end interior finishes. Interior Designer Owner – 3 bedrooms, 3 bathrooms. Master bedroom with walkin closet, 3 pc en-suite – Hardwood throughout the home on all levels – Large widows – Well illuminated natural lighting – Kitchen facing south allowing for natural sun light. Marble counter tops, Stainless steel appliances included – Media family room, big screen projector size – This home is a 10++ show piece. Extremely well upgraded. The backyard offers an stunning full size Deck with existing furniture and BBQ included and a fountain stone designed pond. Including Washer and dryer, 3 Parking – Great neighborhood for families, Walk to school, Quite street. A MUST SEE! *Assoc/POTL fee $100 yearly, covers roadway maintenance.

BRIDLEWOOD KANATA HOME PRICES 5TH FEB 2020

FREE HOME EVALUATION 5 FEB 2020

KANATA HOMES FOR SALE

KANATA REAL ESTATE 5 FEB 2020

KANATA HOME PRICING 5 FEB 2020

KANATA FEB 2020 SALE PRICES 5 FEB 2020

KANATA REAL ESTATE AGENT 5 FEB 2020

KANATA CENTURY 21 5 FEB 2020

KANATA BRIDLEWOOD HOME PRICES 5 FEB 2020.

KANATA BRIDLEWOOD HOMES FOR SALE 5 FEB 2020.

KANATA MLS – KANATA STREET SOLD PRICES 5 FEB 2020.